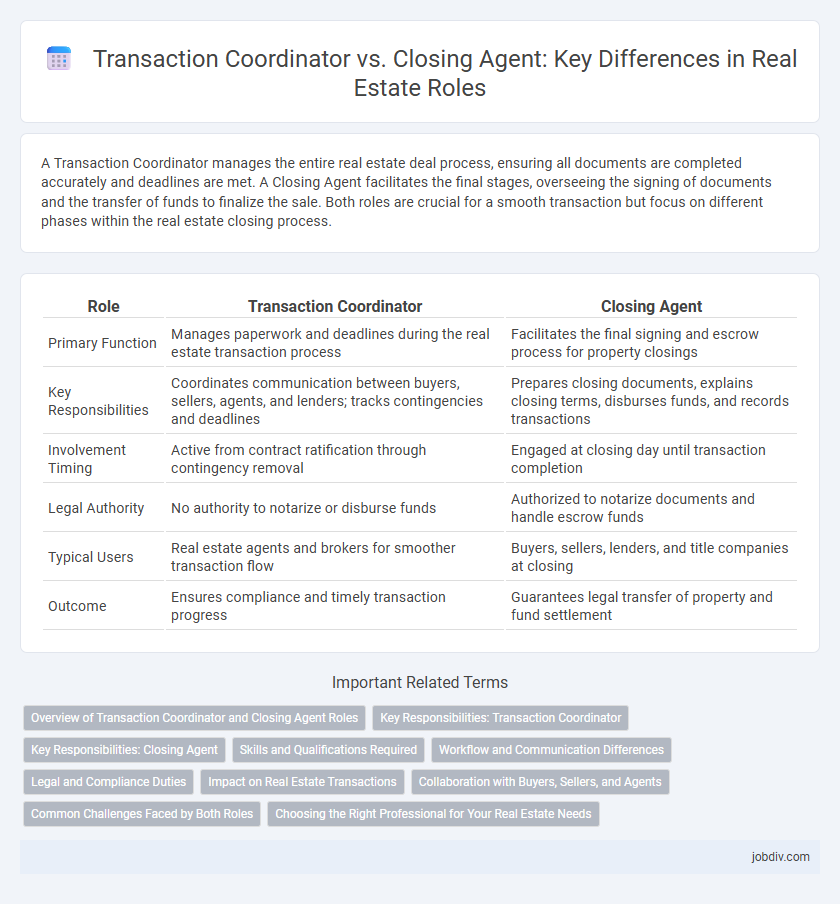

A Transaction Coordinator manages the entire real estate deal process, ensuring all documents are completed accurately and deadlines are met. A Closing Agent facilitates the final stages, overseeing the signing of documents and the transfer of funds to finalize the sale. Both roles are crucial for a smooth transaction but focus on different phases within the real estate closing process.

Table of Comparison

| Role | Transaction Coordinator | Closing Agent |

|---|---|---|

| Primary Function | Manages paperwork and deadlines during the real estate transaction process | Facilitates the final signing and escrow process for property closings |

| Key Responsibilities | Coordinates communication between buyers, sellers, agents, and lenders; tracks contingencies and deadlines | Prepares closing documents, explains closing terms, disburses funds, and records transactions |

| Involvement Timing | Active from contract ratification through contingency removal | Engaged at closing day until transaction completion |

| Legal Authority | No authority to notarize or disburse funds | Authorized to notarize documents and handle escrow funds |

| Typical Users | Real estate agents and brokers for smoother transaction flow | Buyers, sellers, lenders, and title companies at closing |

| Outcome | Ensures compliance and timely transaction progress | Guarantees legal transfer of property and fund settlement |

Overview of Transaction Coordinator and Closing Agent Roles

Transaction coordinators manage the administrative tasks throughout the real estate process, ensuring all documents are completed accurately and deadlines are met to facilitate smooth communication between buyers, sellers, agents, and lenders. Closing agents, often title company representatives or attorneys, handle the final steps of a real estate transaction by overseeing the signing of documents, disbursing funds, and recording the property deed to legally transfer ownership. Both roles are essential for coordinating the complexities of real estate deals and ensuring compliance with legal and contractual obligations.

Key Responsibilities: Transaction Coordinator

A Transaction Coordinator manages all administrative tasks throughout the real estate process, including document collection, appointment scheduling, and communication between buyers, sellers, and agents to ensure deadlines are met. They track contract contingencies, coordinate inspections, and maintain the transaction timeline to guarantee a smooth progression from contract to closing. Their role is essential for reducing errors, improving efficiency, and supporting agents by handling paperwork and follow-ups in residential or commercial real estate deals.

Key Responsibilities: Closing Agent

Closing agents manage the final steps of real estate transactions, ensuring all documents are accurately prepared and signed. They coordinate with buyers, sellers, lenders, and title companies to verify the transfer of funds and property ownership. Their role includes conducting title searches, preparing closing statements, and facilitating the official recording of the deed.

Skills and Qualifications Required

Transaction Coordinators require strong organizational skills, attention to detail, and proficiency in real estate software to manage contract timelines, documentation, and communication between parties. Closing Agents must possess in-depth knowledge of title insurance, escrow processes, and legal regulations, along with excellent negotiation and problem-solving abilities to ensure a smooth property transfer. Both roles demand effective communication skills and a thorough understanding of real estate transactions to minimize errors and delays.

Workflow and Communication Differences

Transaction Coordinators manage the administrative workflow throughout the real estate process, ensuring all documentation is accurately prepared and deadlines met, which streamlines communication between agents, buyers, and lenders. Closing Agents focus on the final stage, coordinating the closing meeting, managing escrow funds, and facilitating the signing of legal documents, acting as the primary point of contact for title companies and lenders. The key difference lies in their communication scope: Transaction Coordinators handle ongoing updates and compliance, while Closing Agents oversee final transaction execution and resolution.

Legal and Compliance Duties

Transaction coordinators manage contract deadlines, ensure document accuracy, and facilitate communication between parties to maintain compliance with real estate regulations. Closing agents oversee the legal execution of closing documents, verify the transfer of property titles, and handle escrow accounts to ensure adherence to state and federal laws. Both roles require a thorough understanding of real estate contracts and local compliance requirements to prevent legal disputes and ensure smooth transaction closings.

Impact on Real Estate Transactions

A Transaction Coordinator streamlines the administrative tasks throughout the real estate process, ensuring all documents are completed and deadlines met, which accelerates transaction efficiency and reduces errors. A Closing Agent handles the final stages by overseeing title searches, coordinating between parties, and facilitating the official property transfer, directly impacting the closing timeline and legal compliance. Both roles are critical in minimizing delays and enhancing the overall smoothness of real estate transactions.

Collaboration with Buyers, Sellers, and Agents

Transaction coordinators streamline communication between buyers, sellers, and agents by managing paperwork and deadlines to ensure a smooth real estate process. Closing agents handle the final steps, coordinating funds and legal documents to complete property transfers efficiently. Both roles require seamless collaboration to align all parties and prevent delays during transactions.

Common Challenges Faced by Both Roles

Transaction coordinators and closing agents both face common challenges such as managing tight deadlines to ensure a smooth property transfer, coordinating communication between multiple parties including buyers, sellers, lenders, and real estate agents, and handling complex documentation with accuracy to prevent delays or legal issues. Both roles require meticulous attention to detail and advanced organizational skills to effectively track contract contingencies, inspections, and financial transactions. Failure to address these challenges can result in transaction disputes or financial penalties for clients and agencies.

Choosing the Right Professional for Your Real Estate Needs

Selecting the right professional for your real estate transaction depends on understanding the distinct roles of a transaction coordinator and a closing agent. A transaction coordinator manages the administrative tasks, contract deadlines, and communication throughout the escrow process, ensuring a seamless workflow between buyers, sellers, and agents. In contrast, a closing agent handles the finalization of the sale, including document signing, funds distribution, and recording the deed, making their expertise critical for a successful property transfer.

Transaction Coordinator vs Closing Agent Infographic

jobdiv.com

jobdiv.com