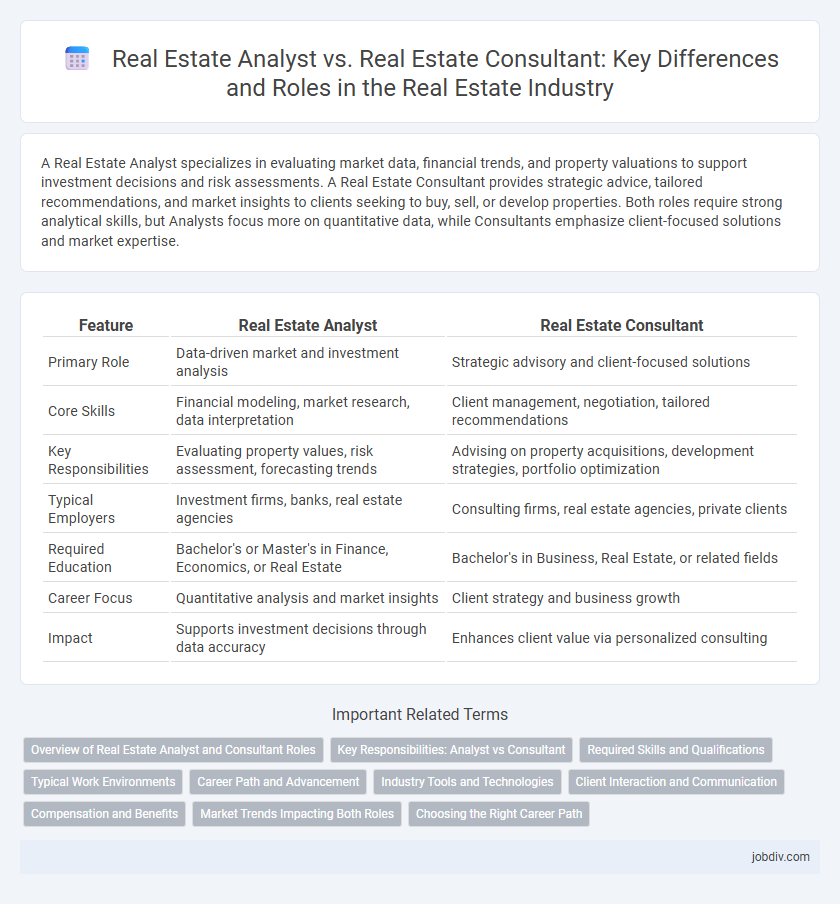

A Real Estate Analyst specializes in evaluating market data, financial trends, and property valuations to support investment decisions and risk assessments. A Real Estate Consultant provides strategic advice, tailored recommendations, and market insights to clients seeking to buy, sell, or develop properties. Both roles require strong analytical skills, but Analysts focus more on quantitative data, while Consultants emphasize client-focused solutions and market expertise.

Table of Comparison

| Feature | Real Estate Analyst | Real Estate Consultant |

|---|---|---|

| Primary Role | Data-driven market and investment analysis | Strategic advisory and client-focused solutions |

| Core Skills | Financial modeling, market research, data interpretation | Client management, negotiation, tailored recommendations |

| Key Responsibilities | Evaluating property values, risk assessment, forecasting trends | Advising on property acquisitions, development strategies, portfolio optimization |

| Typical Employers | Investment firms, banks, real estate agencies | Consulting firms, real estate agencies, private clients |

| Required Education | Bachelor's or Master's in Finance, Economics, or Real Estate | Bachelor's in Business, Real Estate, or related fields |

| Career Focus | Quantitative analysis and market insights | Client strategy and business growth |

| Impact | Supports investment decisions through data accuracy | Enhances client value via personalized consulting |

Overview of Real Estate Analyst and Consultant Roles

A Real Estate Analyst evaluates market trends, financial data, and property values to provide investment insights and risk assessments. A Real Estate Consultant offers strategic advice to clients, focusing on property acquisition, development, and portfolio management based on market research and client goals. Both roles require deep knowledge of real estate markets, but Analysts emphasize data analysis while Consultants prioritize client-focused decision-making.

Key Responsibilities: Analyst vs Consultant

Real Estate Analysts focus on evaluating market trends, conducting financial modeling, and performing investment analysis to guide property acquisitions and portfolio management. Real Estate Consultants provide strategic advice to clients on property development, market positioning, and risk assessment, often tailoring solutions based on client objectives. While Analysts emphasize quantitative data and forecasting, Consultants prioritize client-centric strategies and actionable recommendations.

Required Skills and Qualifications

Real Estate Analysts require strong analytical skills, proficiency in financial modeling, and expertise in market research to evaluate property investments and forecast trends. Real Estate Consultants need excellent communication, negotiation abilities, and a deep understanding of client needs to provide tailored advice and strategic planning. Both roles typically demand a background in finance, economics, or real estate, along with relevant certifications such as CFA, CCIM, or real estate licenses.

Typical Work Environments

Real estate analysts typically work in corporate offices, investment firms, or government agencies where they analyze market trends, property values, and financial data. Real estate consultants often operate within consulting firms or independently, engaging directly with clients to provide strategic advice on property investments and development projects. Both roles require collaboration with realtors, developers, and financial institutions, but analysts focus more on data-driven environments while consultants emphasize client-facing, project-based settings.

Career Path and Advancement

Real estate analysts typically focus on market data, financial modeling, and investment viability, building expertise that can lead to senior analyst or portfolio management roles. Real estate consultants provide strategic advice on property development, acquisitions, and market positioning, often advancing to senior advisory or executive roles within firms. Career advancement for analysts leans toward quantitative and research-driven positions, while consultants progress through relationship management and strategic planning leadership.

Industry Tools and Technologies

Real estate analysts primarily utilize advanced data analytics software such as ARGUS, CoStar, and Excel-based financial modeling tools to evaluate market trends and property valuations. Real estate consultants rely on customer relationship management (CRM) platforms, geographic information systems (GIS), and presentation tools like Power BI to deliver strategic advisory services and investment recommendations. Both roles increasingly integrate artificial intelligence and big data technologies to enhance decision-making accuracy and client insights.

Client Interaction and Communication

Real estate analysts primarily focus on data interpretation and market trends, providing clients with detailed reports and investment insights based on quantitative analysis. In contrast, real estate consultants engage more directly with clients, offering personalized advice, addressing client concerns, and facilitating strategic decision-making processes. Effective communication skills are essential for consultants to tailor recommendations, while analysts emphasize clear presentation of complex data to support client understanding.

Compensation and Benefits

Real estate analysts typically earn base salaries ranging from $60,000 to $90,000 annually, with bonuses linked to project performance, while real estate consultants often command higher fees or commissions based on client engagements, sometimes exceeding $100,000 per year. Analysts benefit from structured employment packages including health insurance, retirement plans, and paid time off common in corporate settings. Consultants enjoy flexible compensation tied to successful deals and may receive profit sharing or equity stakes in development projects, offering potential for substantial financial growth.

Market Trends Impacting Both Roles

Real estate analysts use data-driven models to forecast market trends such as housing price fluctuations, rental yield variations, and economic indicators impacting property values, which directly influence investment decisions and portfolio management. Real estate consultants interpret these market trends to provide strategic advice on property acquisitions, development potential, and risk mitigation tailored to client goals. Both roles require in-depth knowledge of supply-demand dynamics, interest rate shifts, and regulatory changes affecting real estate markets to guide stakeholders effectively.

Choosing the Right Career Path

Real Estate Analysts specialize in market data analysis, financial modeling, and investment forecasting, making them ideal for careers centered on analytics and strategic decision-making. Real Estate Consultants provide expert advice on property development, market trends, and client investment strategies, suited for professionals who excel in client interaction and customized solutions. Selecting the right career path depends on whether you prefer quantitative analysis and research or advisory roles focused on personalized real estate guidance.

Real Estate Analyst vs Real Estate Consultant Infographic

jobdiv.com

jobdiv.com