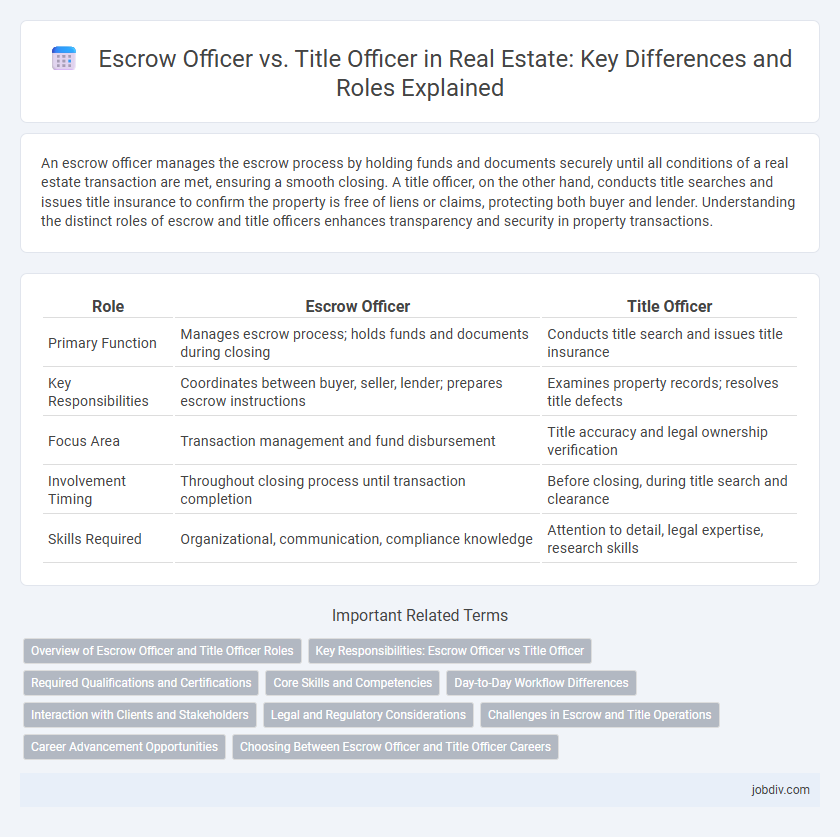

An escrow officer manages the escrow process by holding funds and documents securely until all conditions of a real estate transaction are met, ensuring a smooth closing. A title officer, on the other hand, conducts title searches and issues title insurance to confirm the property is free of liens or claims, protecting both buyer and lender. Understanding the distinct roles of escrow and title officers enhances transparency and security in property transactions.

Table of Comparison

| Role | Escrow Officer | Title Officer |

|---|---|---|

| Primary Function | Manages escrow process; holds funds and documents during closing | Conducts title search and issues title insurance |

| Key Responsibilities | Coordinates between buyer, seller, lender; prepares escrow instructions | Examines property records; resolves title defects |

| Focus Area | Transaction management and fund disbursement | Title accuracy and legal ownership verification |

| Involvement Timing | Throughout closing process until transaction completion | Before closing, during title search and clearance |

| Skills Required | Organizational, communication, compliance knowledge | Attention to detail, legal expertise, research skills |

Overview of Escrow Officer and Title Officer Roles

Escrow officers manage the escrow process by holding and disbursing funds, ensuring all contract terms are met before closing a real estate transaction. Title officers conduct thorough title searches, resolve title issues, and guarantee clear ownership through title insurance policies. Both roles are essential in safeguarding buyer and seller interests and facilitating smooth property transfers.

Key Responsibilities: Escrow Officer vs Title Officer

Escrow officers manage the escrow process by holding and disbursing funds, ensuring all contractual obligations are met before closing the transaction, and coordinating communication between buyers, sellers, and lenders. Title officers conduct title searches, examine public records to confirm property ownership, resolve title issues, and prepare title insurance policies to protect against potential claims. Both roles are critical in real estate transactions, with escrow officers focusing on fund management and transaction coordination, while title officers specialize in verifying property titles and mitigating legal risks.

Required Qualifications and Certifications

Escrow officers typically require a high school diploma or equivalent, with many holding certifications such as the National Escrow Association's Certified Escrow Officer (CEO) credential to demonstrate expertise in managing escrow accounts and transaction compliance. Title officers often possess a background in real estate, law, or finance, with certifications like the American Land Title Association's Title Insurance and Settlement Practices Certification validating their proficiency in title searches, risk assessment, and issuing title insurance policies. Both roles benefit from strong knowledge of local real estate laws, regulatory requirements, and advanced training to ensure accurate and legally compliant closings.

Core Skills and Competencies

Escrow Officers excel in transaction management, ensuring compliance, coordinating funds, and facilitating communication between buyers, sellers, and lenders. Title Officers possess expertise in title searches, resolving liens, and issuing title insurance policies to guarantee clear ownership. Both roles demand strong attention to detail, problem-solving abilities, and thorough knowledge of real estate laws and regulations.

Day-to-Day Workflow Differences

Escrow Officers manage the day-to-day coordination of real estate transactions, ensuring all funds, documents, and contingencies are handled accurately for closing. Title Officers focus on researching property titles, resolving liens or claims, and issuing title insurance policies to guarantee clear ownership. While Escrow Officers facilitate communication among buyers, sellers, and lenders, Title Officers primarily analyze legal records to protect against title defects.

Interaction with Clients and Stakeholders

Escrow officers act as neutral third parties managing funds and documents to ensure smooth real estate transactions, maintaining clear communication with buyers, sellers, lenders, and agents. Title officers specialize in examining property titles, addressing any liens or claims, and collaborating closely with underwriters, attorneys, and clients to verify ownership and resolve title issues. Both roles require effective interaction with multiple stakeholders to guarantee successful closings and protect all parties involved.

Legal and Regulatory Considerations

Escrow officers facilitate the secure transfer of funds and documents according to contract terms, ensuring compliance with state escrow laws and regulations to protect all parties involved. Title officers focus on examining property titles, identifying liens or claims, and ensuring clear ownership through adherence to title insurance requirements and local real estate statutes. Both roles require thorough knowledge of federal regulations such as RESPA and state-specific guidelines to mitigate legal risks and ensure seamless real estate transactions.

Challenges in Escrow and Title Operations

Escrow officers face challenges in coordinating complex document workflows and managing timely fund disbursement to ensure transaction integrity. Title officers must address difficulties in conducting thorough title searches and resolving liens or encumbrances to guarantee clear property ownership. Both roles require meticulous attention to regulatory compliance and communication between multiple parties to prevent delays and legal disputes in real estate transactions.

Career Advancement Opportunities

Escrow officers and title officers both play critical roles in real estate transactions, with escrow officers managing the trust accounts and transaction details while title officers focus on title searches and insurance policies. Career advancement for escrow officers often leads to senior escrow officer positions or escrow manager roles, emphasizing transaction coordination and client relationship management. Title officers can progress to senior title examiner or title operations manager roles, specializing in title risk assessment and policy underwriting, which opens pathways to leadership in title insurance firms.

Choosing Between Escrow Officer and Title Officer Careers

Choosing between an escrow officer and a title officer career depends on your expertise in real estate transactions and risk management. Escrow officers specialize in managing the escrow process and coordinating funds transfer, ensuring all transaction conditions are met. Title officers focus on verifying property ownership, conducting title searches, and resolving title issues to secure clear property titles for buyers and lenders.

Escrow Officer vs Title Officer Infographic

jobdiv.com

jobdiv.com