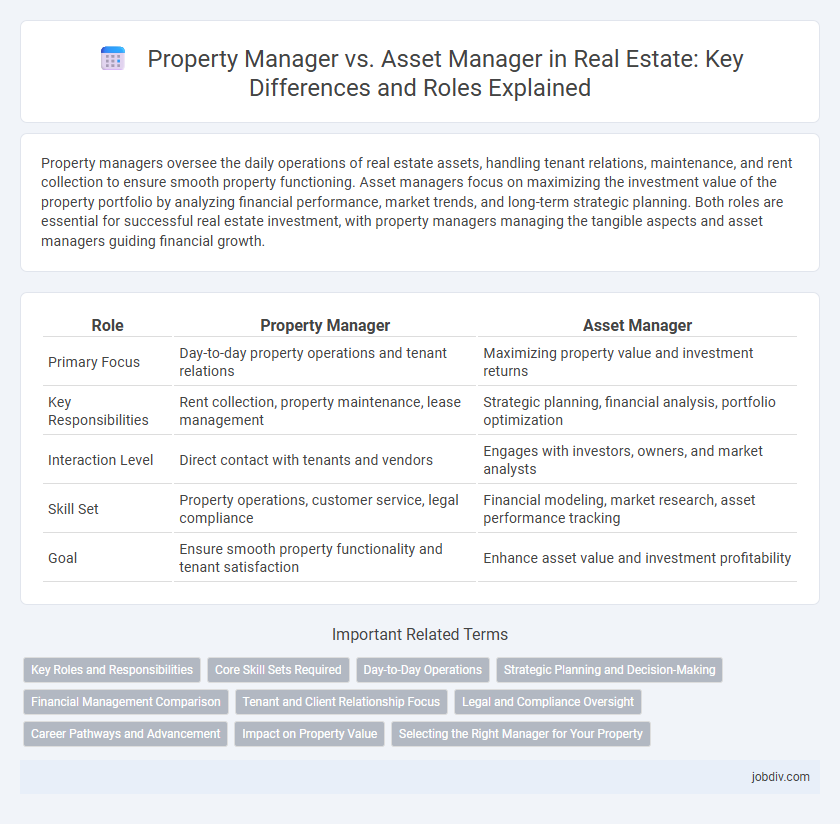

Property managers oversee the daily operations of real estate assets, handling tenant relations, maintenance, and rent collection to ensure smooth property functioning. Asset managers focus on maximizing the investment value of the property portfolio by analyzing financial performance, market trends, and long-term strategic planning. Both roles are essential for successful real estate investment, with property managers managing the tangible aspects and asset managers guiding financial growth.

Table of Comparison

| Role | Property Manager | Asset Manager |

|---|---|---|

| Primary Focus | Day-to-day property operations and tenant relations | Maximizing property value and investment returns |

| Key Responsibilities | Rent collection, property maintenance, lease management | Strategic planning, financial analysis, portfolio optimization |

| Interaction Level | Direct contact with tenants and vendors | Engages with investors, owners, and market analysts |

| Skill Set | Property operations, customer service, legal compliance | Financial modeling, market research, asset performance tracking |

| Goal | Ensure smooth property functionality and tenant satisfaction | Enhance asset value and investment profitability |

Key Roles and Responsibilities

Property managers oversee daily operations of real estate assets, including tenant relations, rent collection, maintenance, and compliance with local laws to ensure smooth property functioning. Asset managers focus on the strategic financial performance of real estate investments by analyzing market trends, managing budgets, and developing long-term value enhancement plans. Both roles collaborate closely to maximize property profitability and maintain asset value throughout the investment lifecycle.

Core Skill Sets Required

Property managers excel in tenant relations, maintenance coordination, and lease administration, ensuring daily operational efficiency of real estate assets. Asset managers focus on financial analysis, market research, and portfolio optimization to maximize property value and investment returns. Proficiency in budgeting, risk assessment, and strategic planning distinguishes asset management from the hands-on, property-level management skills.

Day-to-Day Operations

Property managers handle the daily operations of real estate assets, including tenant relations, maintenance, rent collection, and ensuring compliance with local regulations. Asset managers focus on broader investment strategies, overseeing property performance, financial reporting, and long-term value maximization. Efficient coordination between property managers and asset managers is essential for optimizing both operational stability and investment returns.

Strategic Planning and Decision-Making

Property managers oversee day-to-day operations such as maintenance, tenant relations, and lease management to ensure efficient asset functionality. Asset managers focus on long-term strategic planning, analyzing market trends, financial performance, and investment opportunities to maximize property value and portfolio returns. Strategic decision-making in asset management involves capital allocation and risk assessment, whereas property management decisions prioritize operational efficiency and tenant satisfaction.

Financial Management Comparison

Property managers focus on the day-to-day financial operations of real estate assets, handling rent collection, expense tracking, and budgeting to ensure smooth cash flow. Asset managers oversee the broader financial strategy, analyzing portfolio performance, optimizing asset value, and making investment decisions to maximize long-term returns. Both roles are critical, yet property managers manage operational finance while asset managers drive strategic financial growth.

Tenant and Client Relationship Focus

Property Managers prioritize tenant relations by handling daily operations, rent collection, and maintenance requests to ensure tenant satisfaction and retention. Asset Managers focus on the client relationship by developing long-term investment strategies, optimizing property value, and maximizing financial returns for property owners. Both roles require effective communication, but Property Managers are tenant-centric while Asset Managers are client- and investment-centric.

Legal and Compliance Oversight

Property managers ensure daily operations comply with local housing laws and tenant regulations, handling lease agreements, rent collection, and maintenance requests within established legal frameworks. Asset managers focus on broader legal compliance, overseeing contracts, risk management, and adherence to investment guidelines to protect the property's financial performance and regulatory requirements. Both roles require thorough knowledge of fair housing laws, liability issues, and government mandates to mitigate legal risks and ensure consistent compliance across property portfolios.

Career Pathways and Advancement

Property Manager roles emphasize hands-on operational management of residential or commercial real estate, providing direct tenant relations and maintenance oversight, often serving as a foundational step for career growth. Asset Manager positions require strategic oversight of property portfolios, focusing on financial performance, investment analysis, and long-term value optimization, making this path suitable for professionals aiming for senior roles in real estate investment firms or REITs. Advancement from property management to asset management typically involves acquiring expertise in finance, market analysis, and portfolio management, facilitating career progression toward executive leadership in real estate.

Impact on Property Value

Property managers directly influence property value by maintaining tenant satisfaction, overseeing repairs, and ensuring operational efficiency, which preserves and can enhance rental income streams. Asset managers focus on maximizing long-term property value through strategic financial planning, market analysis, and capital improvements, aligning property performance with investment goals. Effective collaboration between property and asset managers can optimize both immediate operational success and sustained property appreciation.

Selecting the Right Manager for Your Property

Choosing between a property manager and an asset manager depends on your investment goals and the level of oversight required. Property managers handle day-to-day operations, tenant relations, and maintenance, ensuring smooth property functionality. Asset managers focus on financial performance, portfolio optimization, and strategic decision-making to maximize the property's long-term value.

Property Manager vs Asset Manager Infographic

jobdiv.com

jobdiv.com