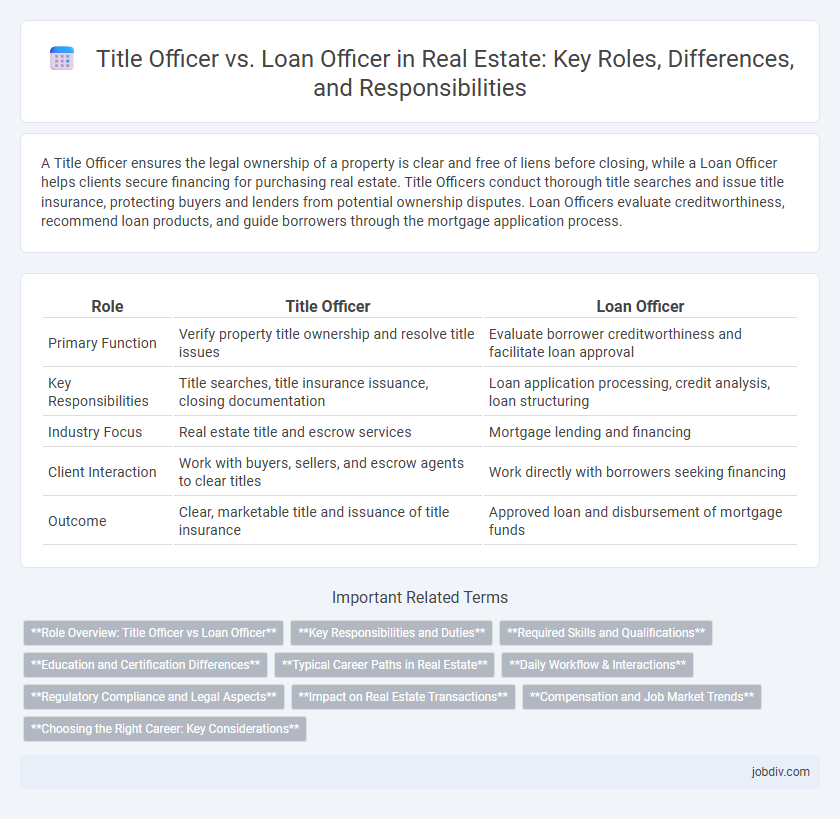

A Title Officer ensures the legal ownership of a property is clear and free of liens before closing, while a Loan Officer helps clients secure financing for purchasing real estate. Title Officers conduct thorough title searches and issue title insurance, protecting buyers and lenders from potential ownership disputes. Loan Officers evaluate creditworthiness, recommend loan products, and guide borrowers through the mortgage application process.

Table of Comparison

| Role | Title Officer | Loan Officer |

|---|---|---|

| Primary Function | Verify property title ownership and resolve title issues | Evaluate borrower creditworthiness and facilitate loan approval |

| Key Responsibilities | Title searches, title insurance issuance, closing documentation | Loan application processing, credit analysis, loan structuring |

| Industry Focus | Real estate title and escrow services | Mortgage lending and financing |

| Client Interaction | Work with buyers, sellers, and escrow agents to clear titles | Work directly with borrowers seeking financing |

| Outcome | Clear, marketable title and issuance of title insurance | Approved loan and disbursement of mortgage funds |

Role Overview: Title Officer vs Loan Officer

Title officers specialize in verifying property titles to ensure they are free of liens or disputes, facilitating clear ownership transfer during real estate transactions. Loan officers evaluate, authorize, or recommend approval of mortgage applications by assessing financial status, creditworthiness, and property value. Both roles are critical in closing real estate deals, with title officers focusing on legal ownership and loan officers managing financing.

Key Responsibilities and Duties

A Title Officer is responsible for verifying property ownership, conducting title searches, and ensuring clear titles free of liens or discrepancies before real estate transactions close. A Loan Officer evaluates borrower creditworthiness, processes mortgage applications, and facilitates loan approvals to secure financing for property purchases. Both roles are essential to the real estate process, with Title Officers safeguarding legal ownership and Loan Officers managing financial underwriting.

Required Skills and Qualifications

Title officers require strong knowledge of property titles, legal documentation, and attention to detail to identify potential title defects or liens. Loan officers need expertise in financial analysis, credit assessment, and regulatory compliance to evaluate borrower eligibility and structure loan agreements. Both roles demand strong communication skills and proficiency in industry-specific software and regulations.

Education and Certification Differences

Title officers typically hold certifications such as Certified Title Examiner (CTE) or Title Insurance Producer licenses, with education focused on property law, title searches, and risk assessment. Loan officers often require a mortgage loan originator (MLO) license, obtained through pre-licensing education, passing the SAFE Act exam, and continuing education to maintain compliance with federal lending regulations. The distinct educational pathways emphasize legal title verification for title officers and financial lending expertise for loan officers.

Typical Career Paths in Real Estate

Title officers typically begin their careers in title companies or real estate law firms, focusing on property ownership verification, title searches, and resolving liens or disputes. Loan officers often start in banks or mortgage companies, specializing in evaluating creditworthiness, processing loan applications, and facilitating mortgage approvals. Both roles offer advancement opportunities in real estate finance and legal compliance, with title officers potentially moving into underwriting or escrow management, while loan officers may advance to senior loan originators or mortgage brokers.

Daily Workflow & Interactions

Title officers conduct daily title searches, verify property ownership, and resolve liens to ensure clear titles for real estate transactions. Loan officers interact directly with borrowers, assess creditworthiness, gather financial documents, and coordinate with underwriters to facilitate mortgage approvals. Both roles require collaboration with real estate agents, attorneys, and lenders but focus on distinct aspects of the transaction process.

Regulatory Compliance and Legal Aspects

Title officers ensure regulatory compliance by verifying property titles are free from liens or legal issues, safeguarding ownership rights during real estate transactions. Loan officers navigate legal aspects by adhering to federal and state lending regulations, ensuring borrowers meet credit standards and documentation requirements. Both roles require thorough knowledge of regulatory frameworks to prevent legal disputes and maintain transaction integrity.

Impact on Real Estate Transactions

Title officers ensure the accuracy and legitimacy of property ownership by conducting thorough title searches and resolving any liens or claims, which protects buyers and sellers during real estate transactions. Loan officers evaluate and approve mortgage applications, directly influencing the buyer's financing options and the transaction's feasibility. Their combined roles streamline the closing process, mitigating risks and securing clear titles alongside approved financing to facilitate successful property transfers.

Compensation and Job Market Trends

Title officers earn an average annual salary of $55,000 to $75,000, influenced by experience and regional demand, while loan officers typically command higher compensation, ranging from $60,000 to $90,000, with commission-based incentives boosting earnings in strong housing markets. Job market trends reveal expanding opportunities for loan officers due to rising mortgage activity and refinancing, whereas title officers face more stable but slower growth linked to property transaction volumes. Both roles benefit from technological advancements streamlining processes, though loan officers see greater volatility correlated with interest rate fluctuations and housing market cycles.

Choosing the Right Career: Key Considerations

Choosing between a title officer and loan officer career involves evaluating key skills and job responsibilities specific to real estate transactions. Title officers focus on verifying property ownership and resolving title issues, requiring attention to legal detail and risk assessment. Loan officers specialize in mortgage financing, demanding strong client interaction and financial knowledge to guide borrowers through loan approval processes.

Title Officer vs Loan Officer Infographic

jobdiv.com

jobdiv.com