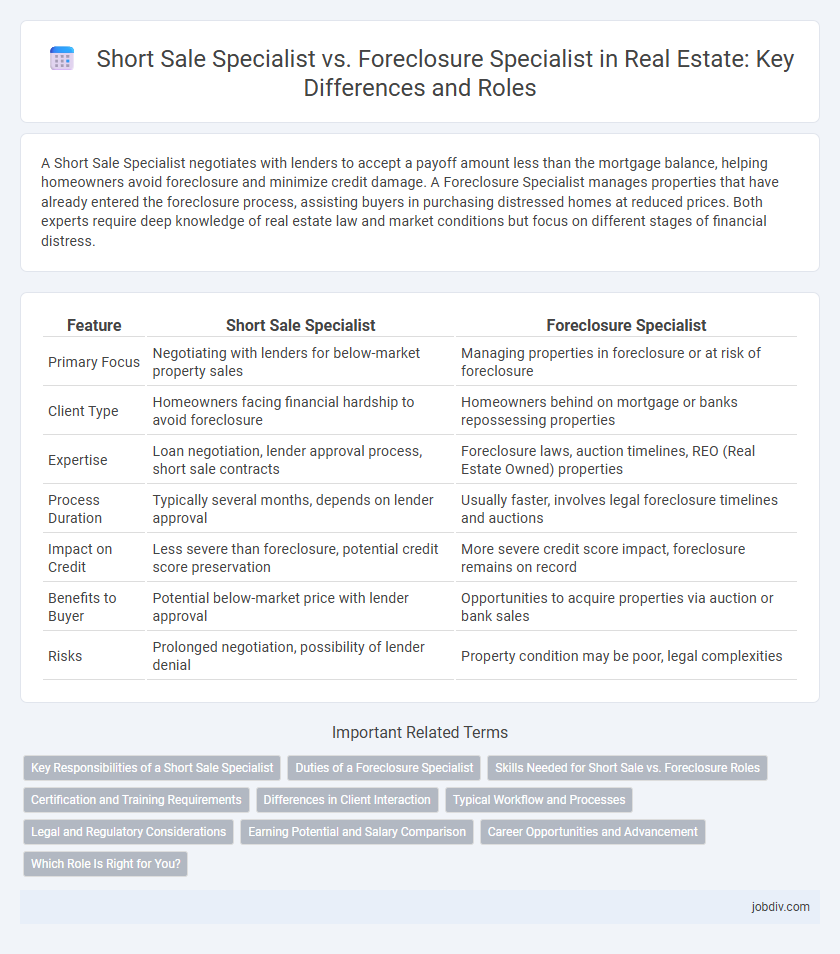

A Short Sale Specialist negotiates with lenders to accept a payoff amount less than the mortgage balance, helping homeowners avoid foreclosure and minimize credit damage. A Foreclosure Specialist manages properties that have already entered the foreclosure process, assisting buyers in purchasing distressed homes at reduced prices. Both experts require deep knowledge of real estate law and market conditions but focus on different stages of financial distress.

Table of Comparison

| Feature | Short Sale Specialist | Foreclosure Specialist |

|---|---|---|

| Primary Focus | Negotiating with lenders for below-market property sales | Managing properties in foreclosure or at risk of foreclosure |

| Client Type | Homeowners facing financial hardship to avoid foreclosure | Homeowners behind on mortgage or banks repossessing properties |

| Expertise | Loan negotiation, lender approval process, short sale contracts | Foreclosure laws, auction timelines, REO (Real Estate Owned) properties |

| Process Duration | Typically several months, depends on lender approval | Usually faster, involves legal foreclosure timelines and auctions |

| Impact on Credit | Less severe than foreclosure, potential credit score preservation | More severe credit score impact, foreclosure remains on record |

| Benefits to Buyer | Potential below-market price with lender approval | Opportunities to acquire properties via auction or bank sales |

| Risks | Prolonged negotiation, possibility of lender denial | Property condition may be poor, legal complexities |

Key Responsibilities of a Short Sale Specialist

A Short Sale Specialist primarily negotiates with lenders to approve sales below the mortgage balance, aiming to prevent foreclosure and minimize financial damage for homeowners. They analyze market conditions, prepare documentation, and communicate with all parties involved to facilitate a smooth transaction. Their expertise in valuation, negotiation skills, and lender criteria is crucial to successfully closing short sales.

Duties of a Foreclosure Specialist

A Foreclosure Specialist manages distressed properties by coordinating with lenders, homeowners, and legal entities to navigate the foreclosure process efficiently. Their duties include assessing property values, negotiating repayment plans, and facilitating the timely sale of foreclosed homes to minimize lender losses. Expertise in foreclosure laws and local market trends ensures these specialists effectively mitigate financial risks while supporting all parties involved.

Skills Needed for Short Sale vs. Foreclosure Roles

Short Sale Specialists require advanced negotiation skills to work effectively with lenders and homeowners to agree on reduced debt payments, along with a deep understanding of loan documentation and real estate contracts. Foreclosure Specialists must be proficient in the foreclosure process, including tracking deadlines, understanding legal procedures, and managing asset disposition through auctions or bank-owned sales. Both roles demand strong communication and problem-solving abilities, but Short Sale Specialists emphasize financial restructuring, while Foreclosure Specialists focus on legal compliance and property management.

Certification and Training Requirements

Short sale specialists typically require certification through organizations like the National Association of Realtors (NAR) or specific courses on short sale negotiation and lender approval processes. Foreclosure specialists often pursue training related to foreclosure laws, loss mitigation, and real estate finance, with certifications available from institutions such as the Distressed Property Institute (DPI). Both roles demand a strong understanding of state and federal regulations, but foreclosure specialists usually need more in-depth knowledge of legal proceedings and foreclosure timelines.

Differences in Client Interaction

Short Sale Specialists prioritize negotiation with lenders and buyers to reduce mortgage debt, often requiring extensive communication to manage complex approval processes and maintain client trust. Foreclosure Specialists primarily guide clients through legal procedures and timeline management, focusing on minimizing credit impact and offering strategic advice during foreclosure proceedings. Client interaction for Short Sale Specialists is typically more collaborative and prolonged, whereas Foreclosure Specialists engage in more directive, time-sensitive counseling.

Typical Workflow and Processes

Short sale specialists coordinate with lenders to negotiate debt repayment terms, requiring detailed financial documentation and patience during lender approval processes. Foreclosure specialists focus on preventing or managing property seizures, working closely with legal teams to navigate court filings, timelines, and potential auction procedures. Both roles demand expertise in communication, negotiation, and understanding of housing market trends to optimize outcomes for clients.

Legal and Regulatory Considerations

Short sale specialists navigate complex lender approval processes and negotiate with lienholders to avoid judicial foreclosure, ensuring compliance with state-specific short sale laws and disclosure requirements. Foreclosure specialists must understand the strict timelines, default notices, and judicial or non-judicial foreclosure procedures dictated by local statutes to protect clients' legal rights. Both roles require thorough knowledge of federal regulations like the Real Estate Settlement Procedures Act (RESPA) and the Dodd-Frank Act to manage risk and maintain adherence to foreclosure rescue and anti-deficiency rules.

Earning Potential and Salary Comparison

Short sale specialists typically earn commissions ranging from 3% to 6% of the property's sale price, with potential bonuses for expedited closings, while foreclosure specialists may receive higher payouts due to dealing with distressed properties priced below market value. Foreclosure agents often work with banks and lenders, earning referral fees or flat rates alongside commissions, which can surpass short sale earnings depending on property volume and market conditions. Real estate professionals in both niches can increase income through expertise in negotiation, market trends, and legal processes related to distressed properties.

Career Opportunities and Advancement

Short sale specialists possess expertise in negotiating with lenders to facilitate property sales below mortgage balance, offering unique career opportunities in distressed property markets and banks. Foreclosure specialists focus on managing the foreclosure process, collaborating with legal agencies and financial institutions, which positions them for advancement in legal firms, asset management companies, and real estate agencies. Both career paths provide strong growth potential due to increasing demand for professionals skilled in navigating complex real estate financial situations.

Which Role Is Right for You?

Choosing between a Short Sale Specialist and a Foreclosure Specialist depends on your expertise and client needs in real estate distress solutions. Short Sale Specialists excel in negotiating with lenders to approve sales below mortgage balances, ideal for clients aiming to avoid foreclosure and minimize credit damage. Foreclosure Specialists focus on navigating the legal process of property seizures, suited for agents working with borrowers facing imminent repossession or investors seeking discounted distressed properties.

Short Sale Specialist vs Foreclosure Specialist Infographic

jobdiv.com

jobdiv.com