Real estate investment analysts specialize in market research, financial modeling, and identifying promising property investments to support strategic decision-making. Asset managers focus on maximizing the performance and value of existing property portfolios through operational oversight, tenant relations, and financial monitoring. Both roles are essential in optimizing real estate investments, with analysts driving acquisition strategies and asset managers ensuring sustained asset profitability.

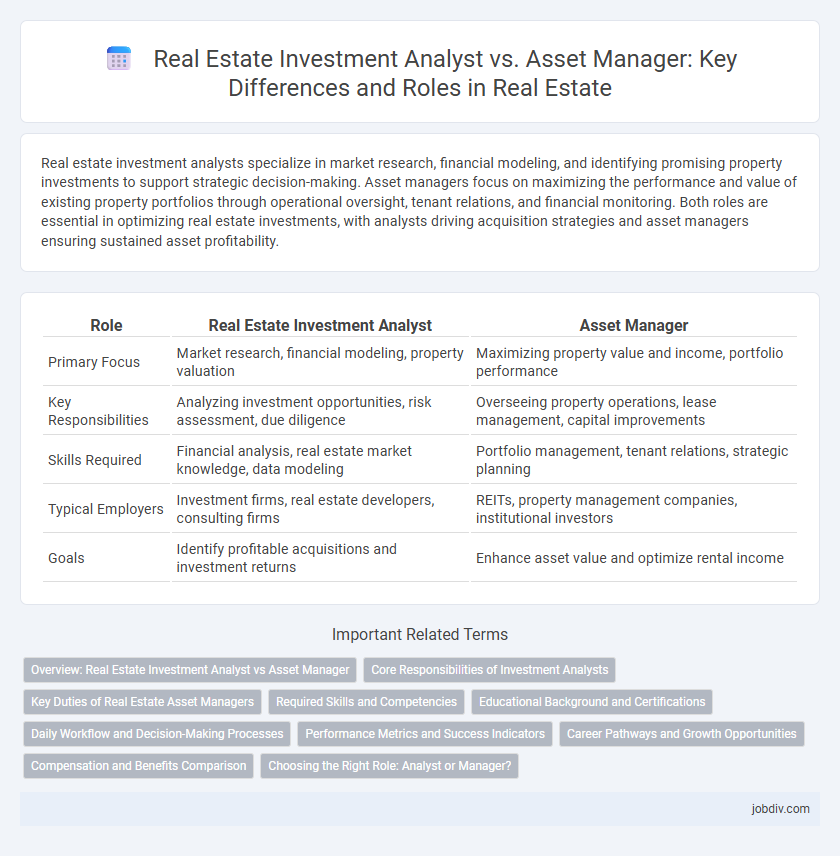

Table of Comparison

| Role | Real Estate Investment Analyst | Asset Manager |

|---|---|---|

| Primary Focus | Market research, financial modeling, property valuation | Maximizing property value and income, portfolio performance |

| Key Responsibilities | Analyzing investment opportunities, risk assessment, due diligence | Overseeing property operations, lease management, capital improvements |

| Skills Required | Financial analysis, real estate market knowledge, data modeling | Portfolio management, tenant relations, strategic planning |

| Typical Employers | Investment firms, real estate developers, consulting firms | REITs, property management companies, institutional investors |

| Goals | Identify profitable acquisitions and investment returns | Enhance asset value and optimize rental income |

Overview: Real Estate Investment Analyst vs Asset Manager

A Real Estate Investment Analyst primarily conducts market research, financial modeling, and due diligence to evaluate potential property investments and support acquisition decisions. In contrast, an Asset Manager oversees a portfolio of real estate assets, focusing on maximizing property performance, managing tenant relationships, and executing strategic plans to enhance value. The analyst's role is more data-driven and investment-focused, while the asset manager emphasizes operational management and long-term portfolio growth.

Core Responsibilities of Investment Analysts

Real Estate Investment Analysts primarily focus on conducting market research, financial modeling, and due diligence to assess the viability of potential property acquisitions or developments. They analyze property performance metrics, forecast returns, and prepare investment memos to support decision-making by asset managers and executives. Their core responsibility centers on identifying profitable investment opportunities and mitigating risks through careful financial assessment.

Key Duties of Real Estate Asset Managers

Real estate asset managers oversee property portfolios to maximize investment returns through strategic planning, budgeting, and lease management. They coordinate with property managers, negotiate contracts, and monitor market trends to ensure assets align with financial goals. Their key duties include optimizing operational efficiency, managing tenant relationships, and conducting performance analysis to drive value appreciation.

Required Skills and Competencies

A Real Estate Investment Analyst requires strong financial modeling skills, market research expertise, and proficiency in investment analysis tools such as Excel and Argus. An Asset Manager must excel in portfolio management, lease negotiation, and property operations, with competencies in risk assessment and stakeholder communication. Both roles demand a deep understanding of real estate markets, but the Investment Analyst focuses more on data-driven decision-making, while the Asset Manager prioritizes operational execution and asset optimization.

Educational Background and Certifications

Real Estate Investment Analysts typically hold degrees in finance, economics, or real estate and often pursue certifications like the CFA (Chartered Financial Analyst) or CCIM (Certified Commercial Investment Member) to enhance analytical skills. Asset Managers usually have backgrounds in real estate, business administration, or finance and may earn designations such as CPM (Certified Property Manager) or RPA (Real Property Administrator) to demonstrate expertise in property management and operations. Both roles benefit from continuous professional development, but analysts emphasize financial modeling and market analysis, while asset managers focus on portfolio management and maximizing asset value.

Daily Workflow and Decision-Making Processes

Real Estate Investment Analysts focus on market research, financial modeling, and evaluating property performance to identify viable investment opportunities, utilizing data-driven insights to forecast returns and risks. Asset Managers oversee the operational and financial performance of real estate assets, managing tenant relationships, budgeting, and implementing strategies to maximize property value and cash flow. Decision-making for Investment Analysts revolves around acquisition and disposition strategies based on analytics, while Asset Managers make ongoing decisions about property management, capital improvements, and portfolio optimization.

Performance Metrics and Success Indicators

Real Estate Investment Analysts primarily focus on evaluating property acquisition prospects using key performance metrics such as Internal Rate of Return (IRR), Net Present Value (NPV), and Cash-on-Cash Return to forecast investment viability. Asset Managers emphasize ongoing portfolio optimization, tracking metrics like occupancy rates, Net Operating Income (NOI), and Capitalization Rate (Cap Rate) to ensure sustained asset performance and value appreciation. Success for Investment Analysts is measured by accuracy in financial modeling and deal sourcing, while Asset Managers are judged on portfolio yield improvement and risk mitigation.

Career Pathways and Growth Opportunities

Real Estate Investment Analysts primarily focus on market research, financial modeling, and due diligence to identify lucrative property investments, often serving as entry-level roles with strong pathways toward senior analyst or associate positions. Asset Managers oversee property portfolios, optimizing operational performance, tenant relations, and value appreciation, typically requiring more experience and leading to senior management or executive roles such as Director of Asset Management. Career growth for analysts generally involves transitioning into asset management or acquisitions, while asset managers move toward strategic leadership within real estate firms or investment funds.

Compensation and Benefits Comparison

Real Estate Investment Analysts typically earn a base salary ranging from $60,000 to $90,000 annually, with bonuses tied to deal performance, while Asset Managers command higher compensation, often between $90,000 and $150,000, plus substantial profit-sharing and incentive bonuses. Benefits for Investment Analysts may include standard health insurance and 401(k) plans, whereas Asset Managers often receive enhanced perks such as equity stakes, performance bonuses, and comprehensive retirement packages. The compensation gap reflects the increased responsibility Asset Managers hold in overseeing property portfolios and maximizing asset value over time.

Choosing the Right Role: Analyst or Manager?

Real estate investment analysts specialize in evaluating market trends, conducting financial modeling, and assessing property performance to guide investment decisions, while asset managers focus on maximizing property value through strategic operations and portfolio management. Professionals choosing between these roles should consider their strengths in analytical research versus hands-on management and client relations. Understanding the distinct responsibilities and career trajectories of each role helps align personal skills with industry demands for optimal job satisfaction and growth.

Real Estate Investment Analyst vs Asset Manager Infographic

jobdiv.com

jobdiv.com