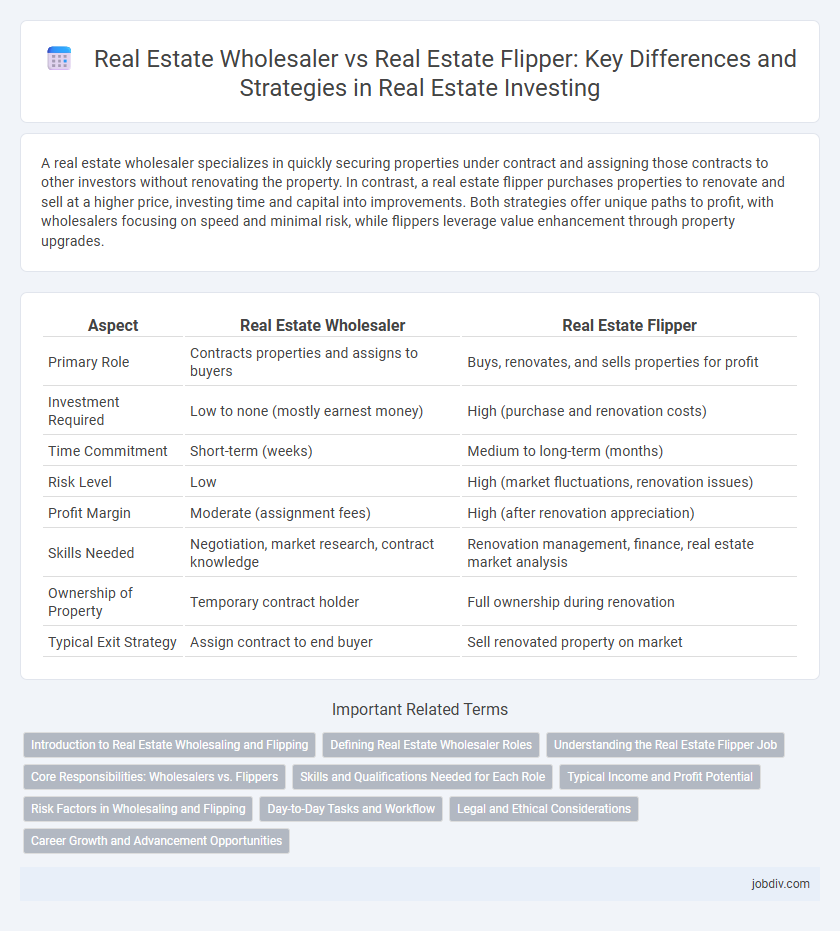

A real estate wholesaler specializes in quickly securing properties under contract and assigning those contracts to other investors without renovating the property. In contrast, a real estate flipper purchases properties to renovate and sell at a higher price, investing time and capital into improvements. Both strategies offer unique paths to profit, with wholesalers focusing on speed and minimal risk, while flippers leverage value enhancement through property upgrades.

Table of Comparison

| Aspect | Real Estate Wholesaler | Real Estate Flipper |

|---|---|---|

| Primary Role | Contracts properties and assigns to buyers | Buys, renovates, and sells properties for profit |

| Investment Required | Low to none (mostly earnest money) | High (purchase and renovation costs) |

| Time Commitment | Short-term (weeks) | Medium to long-term (months) |

| Risk Level | Low | High (market fluctuations, renovation issues) |

| Profit Margin | Moderate (assignment fees) | High (after renovation appreciation) |

| Skills Needed | Negotiation, market research, contract knowledge | Renovation management, finance, real estate market analysis |

| Ownership of Property | Temporary contract holder | Full ownership during renovation |

| Typical Exit Strategy | Assign contract to end buyer | Sell renovated property on market |

Introduction to Real Estate Wholesaling and Flipping

Real estate wholesaling involves securing a property under contract and quickly assigning that contract to another buyer for a fee, requiring minimal upfront investment and quick turnaround. In contrast, real estate flipping entails purchasing a property, renovating it, and selling it at a higher price, demanding significant capital and hands-on management. Both strategies offer unique pathways to profit in the real estate market, with wholesaling focusing on fast transactions and flipping emphasizing value addition through improvement.

Defining Real Estate Wholesaler Roles

A real estate wholesaler specializes in securing properties under contract at below-market prices and then assigning these contracts to end buyers for a profit, without taking ownership of the property. This role focuses on market research, negotiation, and rapid deal execution to bridge sellers and investors. Wholesalers often leverage extensive networking and marketing strategies to identify distressed or undervalued properties and ensure a steady pipeline of profitable assignments.

Understanding the Real Estate Flipper Job

A Real Estate Flipper purchases properties with the intention to renovate and resell them quickly at a profit, emphasizing property improvement and market timing. Unlike wholesalers who assign contracts without owning the property, flippers take full ownership and bear renovation costs and risks. Successful flipping requires expertise in construction, market analysis, and project management to maximize return on investment.

Core Responsibilities: Wholesalers vs. Flippers

Real estate wholesalers primarily focus on finding undervalued properties and securing purchase contracts to assign them to end buyers, relying on negotiation skills and market analysis. Real estate flippers invest capital to purchase, renovate, and resell properties at a profit, emphasizing project management and construction oversight. Both roles require deep market knowledge, but wholesalers act as intermediaries while flippers directly enhance property value through improvements.

Skills and Qualifications Needed for Each Role

Real estate wholesalers require strong negotiation skills, market analysis abilities, and a network of buyers and sellers to quickly assign contracts without owning properties. Real estate flippers need expertise in property valuation, renovation project management, and access to capital for purchasing and improving homes before resale. Both roles demand knowledge of local real estate laws, market trends, and effective communication to maximize profit margins.

Typical Income and Profit Potential

Real estate wholesalers typically earn income through assignment fees ranging from $5,000 to $20,000 per deal by quickly connecting sellers with buyers without holding property. Real estate flippers generate profit by purchasing undervalued properties, renovating, and reselling them, with average returns between $20,000 and $50,000 per flip after expenses. Flippers face higher capital requirements and market risk but often realize greater overall profit potential compared to wholesalers.

Risk Factors in Wholesaling and Flipping

Real estate wholesalers face lower financial risk due to minimal upfront investment but encounter challenges such as difficulty securing end buyers and potential contractual disputes. Flippers assume higher financial exposure, investing significant capital in property acquisition and renovation, which can be impacted by market fluctuations and unforeseen repair costs. Both strategies demand careful risk management, with wholesalers relying on swift transactions and flippers requiring accurate market analysis and budget control.

Day-to-Day Tasks and Workflow

Real estate wholesalers primarily focus on sourcing undervalued properties, negotiating contracts, and assigning these contracts to end buyers, relying heavily on networking and lead generation as their daily activities. Real estate flippers concentrate on property acquisition, renovation management, and resale, which involves coordinating with contractors, overseeing repairs, and marketing the finished property. Workflow for wholesalers is centered around quick transactions and lead conversions, while flippers engage in project management and market analysis for maximizing property value.

Legal and Ethical Considerations

Real estate wholesalers typically assign contracts to buyers without taking ownership, requiring strict adherence to state-specific licensing laws and transparent disclosure to avoid legal pitfalls. Real estate flippers purchase properties outright to renovate and resell, facing zoning regulations, renovation permits, and ethical obligations related to property condition disclosures. Both roles must comply with fair housing laws and avoid deceptive marketing practices to uphold ethical standards in real estate transactions.

Career Growth and Advancement Opportunities

Real estate wholesalers rapidly build a network by acquiring contracts and assigning them, offering quick entry but limited long-term wealth potential compared to flippers. Real estate flippers invest in property renovation and market timing, enabling higher profit margins and stronger portfolio growth, which translates into scalable career advancement. Flipping skills cultivate deeper market expertise and financial leverage, providing greater opportunities for leadership roles like investment management or launching a real estate investment firm.

Real Estate Wholesaler vs Real Estate Flipper Infographic

jobdiv.com

jobdiv.com