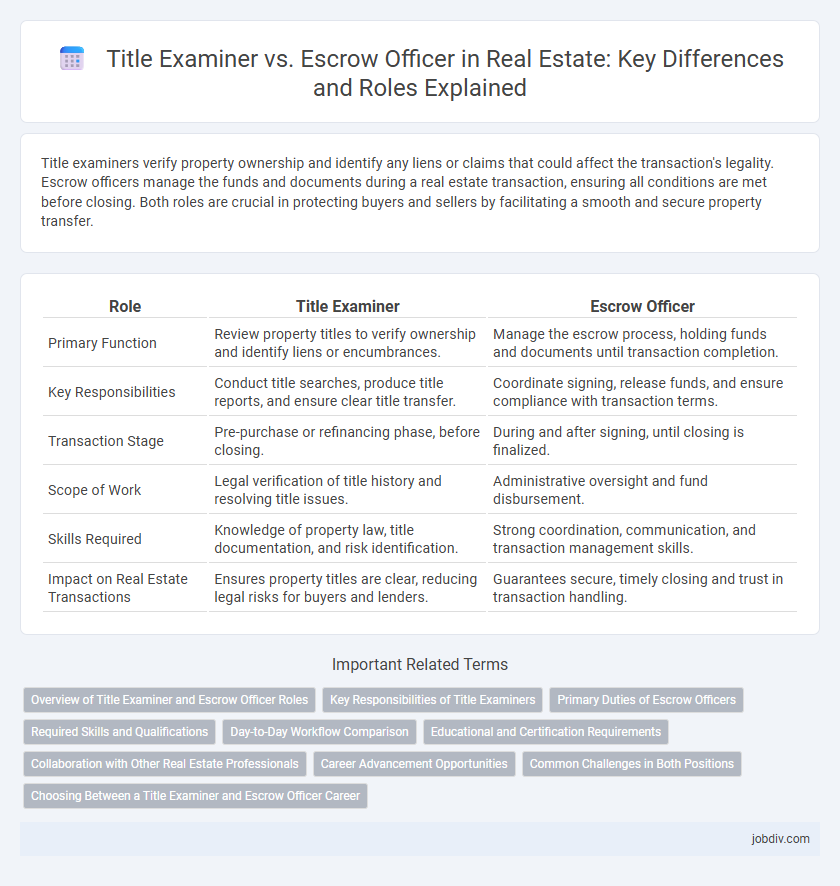

Title examiners verify property ownership and identify any liens or claims that could affect the transaction's legality. Escrow officers manage the funds and documents during a real estate transaction, ensuring all conditions are met before closing. Both roles are crucial in protecting buyers and sellers by facilitating a smooth and secure property transfer.

Table of Comparison

| Role | Title Examiner | Escrow Officer |

|---|---|---|

| Primary Function | Review property titles to verify ownership and identify liens or encumbrances. | Manage the escrow process, holding funds and documents until transaction completion. |

| Key Responsibilities | Conduct title searches, produce title reports, and ensure clear title transfer. | Coordinate signing, release funds, and ensure compliance with transaction terms. |

| Transaction Stage | Pre-purchase or refinancing phase, before closing. | During and after signing, until closing is finalized. |

| Scope of Work | Legal verification of title history and resolving title issues. | Administrative oversight and fund disbursement. |

| Skills Required | Knowledge of property law, title documentation, and risk identification. | Strong coordination, communication, and transaction management skills. |

| Impact on Real Estate Transactions | Ensures property titles are clear, reducing legal risks for buyers and lenders. | Guarantees secure, timely closing and trust in transaction handling. |

Overview of Title Examiner and Escrow Officer Roles

A Title Examiner reviews property records, identifying liens, claims, or errors to ensure a clear title for buyers and lenders in real estate transactions. An Escrow Officer manages the escrow process, holding funds and documents securely while coordinating communication between buyers, sellers, and lenders until closing. Both roles are critical in mitigating risks and facilitating smooth property transfers.

Key Responsibilities of Title Examiners

Title examiners conduct thorough searches of public records to verify the legal ownership and identify any liens, encumbrances, or defects affecting a property's title. They analyze deeds, mortgages, wills, and court judgments to ensure the title can be legally transferred without disputes. Accurate title examination is crucial for minimizing risks and guaranteeing clear ownership before closing real estate transactions.

Primary Duties of Escrow Officers

Escrow officers manage the closing process in real estate transactions by holding and disbursing funds, ensuring all contractual conditions are met before property ownership transfers. They coordinate between buyers, sellers, lenders, and title companies to verify documentation accuracy and compliance. Their primary duties include facilitating the signing of documents, resolving discrepancies, and safeguarding financial assets until the transaction is completed.

Required Skills and Qualifications

A Title Examiner requires strong analytical skills, attention to detail, and in-depth knowledge of property laws, zoning regulations, and title search processes. An Escrow Officer needs excellent communication abilities, organizational skills, and expertise in escrow agreements, transaction management, and regulatory compliance. Both roles demand proficiency in real estate documentation and a deep understanding of industry standards.

Day-to-Day Workflow Comparison

Title Examiners focus on researching property titles, verifying ownership, identifying liens, and ensuring clear title transfer, while Escrow Officers manage contract compliance, coordinate between buyers, sellers, and lenders, and oversee the proper handling of funds during closing. Title Examiners spend their days analyzing public records and resolving title defects, whereas Escrow Officers prioritize communication and document preparation to facilitate a smooth transaction. Both roles are essential in the real estate closing process but specialize in distinct aspects of title verification and escrow management.

Educational and Certification Requirements

Title examiners typically require a background in real estate law or paralegal studies, often obtained through associate degrees or specialized certification programs such as those offered by the American Land Title Association (ALTA). Escrow officers usually need formal training in escrow processes and real estate transactions, often supported by state-specific licensing or certification, including courses from organizations like the Escrow Institute. Both roles demand a thorough understanding of property laws and documentation, but title examiners focus more on legal aspects while escrow officers emphasize transaction management and regulatory compliance.

Collaboration with Other Real Estate Professionals

Title examiners and escrow officers collaborate closely with real estate agents, lenders, and attorneys to ensure smooth property transactions. Title examiners verify property ownership and identify any liens or encumbrances, while escrow officers manage the funds and documents during closing. Their coordinated efforts mitigate risks and facilitate clear, secure transfers of ownership.

Career Advancement Opportunities

Title examiners have career advancement opportunities in roles such as title abstractor, title officer, or underwriter, leveraging in-depth knowledge of property records and legal documentation. Escrow officers can progress to senior escrow officer or escrow manager positions, where expertise in transaction coordination and regulatory compliance is critical. Both careers offer potential growth in real estate law firms, title companies, and financial institutions, emphasizing specialization and leadership development.

Common Challenges in Both Positions

Title examiners and escrow officers often face common challenges such as ensuring accuracy in property records, managing tight deadlines, and verifying the legitimacy of documents to prevent fraud. Both roles require navigating complex legal and financial regulations while coordinating with multiple parties, which can lead to communication delays and increased risk of errors. Maintaining compliance with evolving real estate laws and effectively resolving discrepancies are critical obstacles impacting transaction efficiency.

Choosing Between a Title Examiner and Escrow Officer Career

Choosing a career as a title examiner involves analyzing property titles to identify defects, liens, or encumbrances, ensuring clear ownership before real estate transactions close. An escrow officer manages the escrow process by holding funds and documents, coordinating between buyers, sellers, and lenders to facilitate smooth closings. Title examiners typically require strong attention to detail and legal research skills, while escrow officers benefit from excellent communication and organizational abilities, making the choice dependent on one's strengths and interest in either title analysis or transaction coordination.

Title Examiner vs Escrow Officer Infographic

jobdiv.com

jobdiv.com