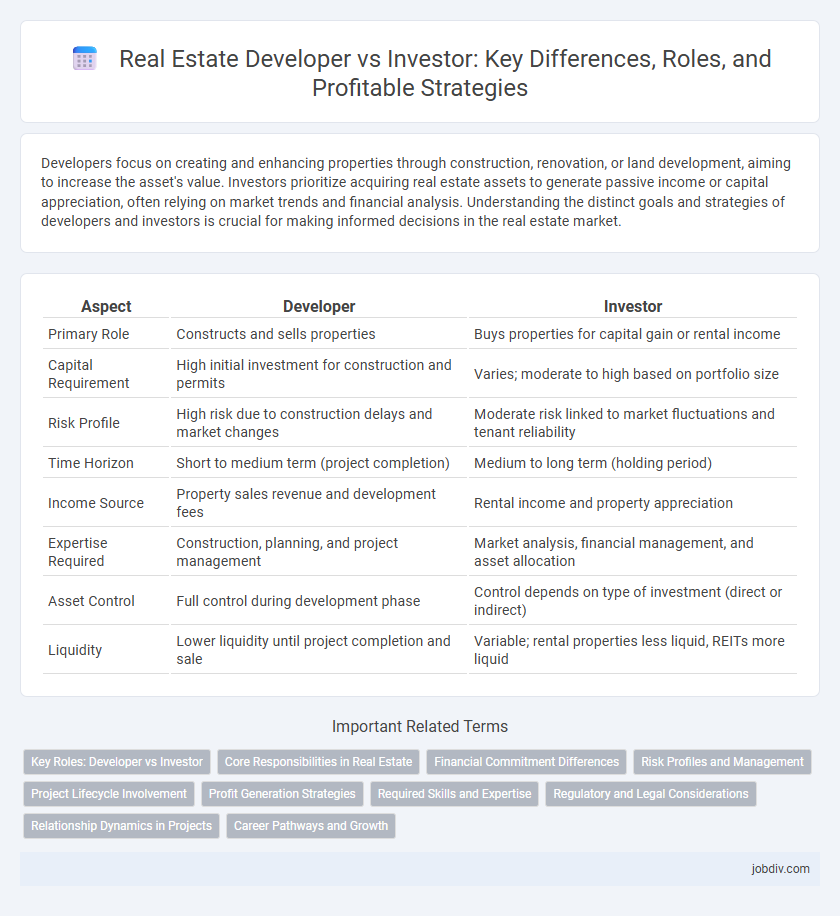

Developers focus on creating and enhancing properties through construction, renovation, or land development, aiming to increase the asset's value. Investors prioritize acquiring real estate assets to generate passive income or capital appreciation, often relying on market trends and financial analysis. Understanding the distinct goals and strategies of developers and investors is crucial for making informed decisions in the real estate market.

Table of Comparison

| Aspect | Developer | Investor |

|---|---|---|

| Primary Role | Constructs and sells properties | Buys properties for capital gain or rental income |

| Capital Requirement | High initial investment for construction and permits | Varies; moderate to high based on portfolio size |

| Risk Profile | High risk due to construction delays and market changes | Moderate risk linked to market fluctuations and tenant reliability |

| Time Horizon | Short to medium term (project completion) | Medium to long term (holding period) |

| Income Source | Property sales revenue and development fees | Rental income and property appreciation |

| Expertise Required | Construction, planning, and project management | Market analysis, financial management, and asset allocation |

| Asset Control | Full control during development phase | Control depends on type of investment (direct or indirect) |

| Liquidity | Lower liquidity until project completion and sale | Variable; rental properties less liquid, REITs more liquid |

Key Roles: Developer vs Investor

Developers focus on transforming land or properties through planning, construction, and project management to create market-ready real estate assets. Investors primarily provide capital and strategic oversight, seeking returns through property appreciation, rental income, or resale profits. The developer handles operational execution while the investor emphasizes financial performance and risk management.

Core Responsibilities in Real Estate

Developers are responsible for land acquisition, project planning, obtaining permits, and managing construction to create new properties or renovate existing ones. Investors focus on identifying profitable real estate assets, analyzing market trends, securing financing, and optimizing returns through property ownership or resale. Both roles require strategic decision-making but differ in their operational involvement and risk exposure within the real estate lifecycle.

Financial Commitment Differences

Developers in real estate commit substantial capital upfront to acquire land, secure permits, and manage construction costs, often facing extended timelines before returns materialize. Investors prioritize allocating funds to completed properties or income-generating assets, emphasizing cash flow and market appreciation with relatively lower immediate financial exposure. The financial commitment of developers involves higher risk and longer capital lock-in, whereas investors utilize flexible investment strategies to balance risk and liquidity.

Risk Profiles and Management

Developers face higher operational risks including construction delays and regulatory approvals, requiring active project management and contingency planning. Investors primarily encounter market risks such as fluctuations in property values and rental demand, relying on portfolio diversification and passive oversight. Effective risk management for developers involves hands-on control and risk mitigation strategies, while investors benefit from financial analysis and asset allocation techniques.

Project Lifecycle Involvement

Developers engage in the real estate project lifecycle from acquisition and design through construction and final delivery, ensuring all phases align with regulatory and market requirements. Investors typically enter after initial planning or during construction, focusing on financing, risk management, and return optimization. Developers manage operational execution while investors prioritize capital allocation and exit strategies within the project's timeline.

Profit Generation Strategies

Developers generate profit by acquiring land, securing permits, and constructing properties to sell or lease at a premium, capitalizing on market demand and property appreciation. Investors focus on acquiring finished properties, leveraging rental income, tax benefits, and long-term asset appreciation to build wealth. Both strategies require market analysis, risk management, and capital allocation to maximize returns in the real estate sector.

Required Skills and Expertise

Developers require expertise in project management, zoning laws, and construction processes to successfully oversee property development from inception to completion. Investors focus on financial analysis, market trends, and risk assessment to identify profitable real estate opportunities and maximize returns. Both roles demand strong negotiation skills and a deep understanding of local real estate markets for optimal decision-making.

Regulatory and Legal Considerations

Developers must navigate complex zoning laws, building codes, and environmental regulations to obtain permits and ensure project compliance, while investors primarily assess legal risks related to property titles, contract enforceability, and market regulations. Regulatory frameworks differ significantly between development projects, which involve active construction and land use changes, and investment activities that focus on asset acquisition and portfolio management. Understanding local, state, and federal real estate laws is essential for minimizing legal liabilities and optimizing financial outcomes in both roles.

Relationship Dynamics in Projects

Developers drive project creation by managing design, construction, and regulatory approvals, while investors primarily provide capital to fund these activities. Their relationship hinges on aligning project timelines, financial goals, and risk tolerance to ensure profitable outcomes. Clear communication and trust between developers and investors enhance decision-making and project success in dynamic real estate markets.

Career Pathways and Growth

Developers primarily focus on project creation, managing construction, zoning approvals, and design, which cultivates skills in project management, negotiation, and market analysis. Investors concentrate on capital allocation, risk assessment, and portfolio diversification, developing expertise in financial modeling, market trends, and asset management. Both career pathways offer significant growth potential within real estate, with developers advancing towards large-scale development projects and investors moving into strategic investment leadership roles.

Developer vs Investor Infographic

jobdiv.com

jobdiv.com