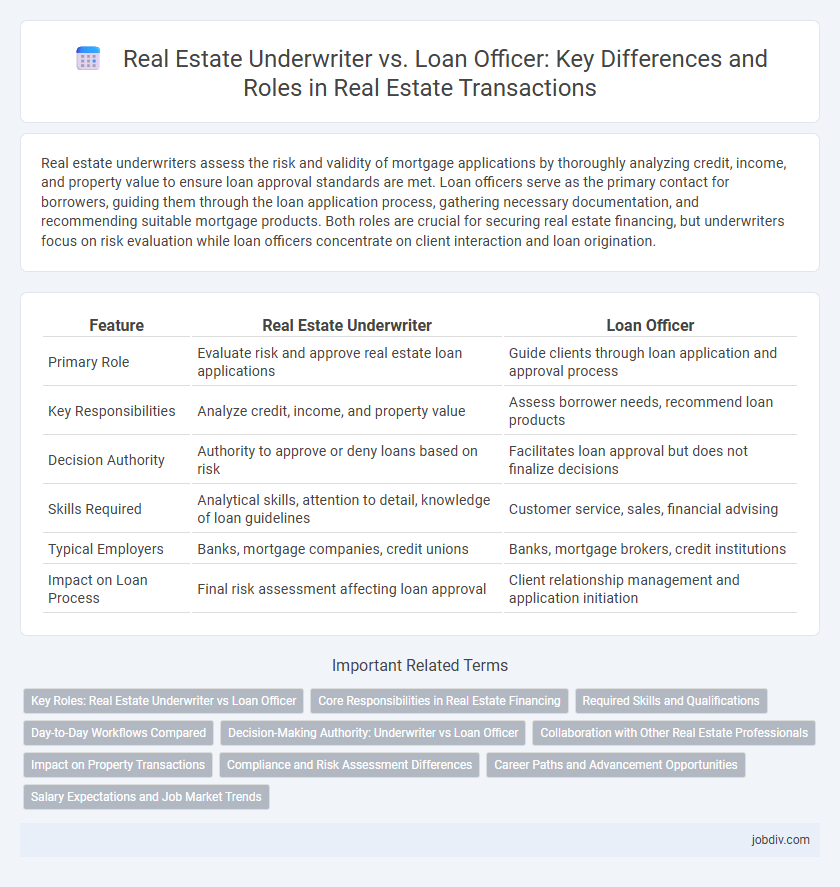

Real estate underwriters assess the risk and validity of mortgage applications by thoroughly analyzing credit, income, and property value to ensure loan approval standards are met. Loan officers serve as the primary contact for borrowers, guiding them through the loan application process, gathering necessary documentation, and recommending suitable mortgage products. Both roles are crucial for securing real estate financing, but underwriters focus on risk evaluation while loan officers concentrate on client interaction and loan origination.

Table of Comparison

| Feature | Real Estate Underwriter | Loan Officer |

|---|---|---|

| Primary Role | Evaluate risk and approve real estate loan applications | Guide clients through loan application and approval process |

| Key Responsibilities | Analyze credit, income, and property value | Assess borrower needs, recommend loan products |

| Decision Authority | Authority to approve or deny loans based on risk | Facilitates loan approval but does not finalize decisions |

| Skills Required | Analytical skills, attention to detail, knowledge of loan guidelines | Customer service, sales, financial advising |

| Typical Employers | Banks, mortgage companies, credit unions | Banks, mortgage brokers, credit institutions |

| Impact on Loan Process | Final risk assessment affecting loan approval | Client relationship management and application initiation |

Key Roles: Real Estate Underwriter vs Loan Officer

Real estate underwriters assess loan applications by analyzing creditworthiness, property value, and risk factors to approve or deny mortgage loans. Loan officers serve as the primary contact for borrowers, guiding them through the loan process, collecting necessary documents, and recommending loan products. Both roles are essential; underwriters focus on risk assessment and compliance, while loan officers emphasize client interaction and loan origination.

Core Responsibilities in Real Estate Financing

Real estate underwriters analyze financial documents, credit reports, and property appraisals to assess loan risk and ensure compliance with lending standards. Loan officers originate and evaluate loan applications, guide borrowers through the approval process, and recommend suitable mortgage products based on client financial profiles. Both roles are critical in real estate financing, with underwriters focusing on risk assessment and loan officers managing customer interactions and loan structuring.

Required Skills and Qualifications

Real estate underwriters require strong analytical skills, attention to detail, and expertise in risk assessment, often holding degrees in finance, economics, or related fields along with certifications such as the Certified Residential Underwriter (CRU). Loan officers must possess excellent interpersonal and sales skills, a deep understanding of mortgage products, and licensing through the Nationwide Multistate Licensing System (NMLS). Both roles demand proficiency in financial analysis, knowledge of lending regulations, and the ability to evaluate creditworthiness within the real estate financing process.

Day-to-Day Workflows Compared

Real estate underwriters analyze loan applications by assessing credit risk, property value, and borrower financials to determine loan approval viability, whereas loan officers directly interact with clients to collect documentation, discuss loan options, and initiate the application process. Underwriters review appraisal reports, verify income statements, and ensure compliance with lending guidelines, whereas loan officers manage client relationships and guide borrowers through pre-approval to closing stages. The underwriter's workflow centers on risk evaluation and loan decision-making, while loan officers focus on customer service and loan origination tasks.

Decision-Making Authority: Underwriter vs Loan Officer

Real estate underwriters possess the authority to make final decisions on loan approvals by thoroughly evaluating risk factors, creditworthiness, and compliance with lending guidelines. Loan officers serve as the primary point of contact for borrowers, collecting documentation and submitting applications but rely on underwriters for the definitive loan assessment. The underwriter's decision-making power is critical in ensuring loans meet regulatory standards and financial risk thresholds, whereas loan officers focus on client interactions and facilitating the loan process.

Collaboration with Other Real Estate Professionals

Real estate underwriters collaborate closely with loan officers to assess the risk and feasibility of mortgage applications, ensuring accurate financial evaluations. Loan officers work with real estate agents and appraisers to gather necessary documents and property information, streamlining the loan approval process. This teamwork enhances communication between all parties, facilitating smoother transactions and better client outcomes.

Impact on Property Transactions

Real estate underwriters evaluate loan risk by analyzing property appraisals, credit reports, and financial documentation to ensure transaction viability, directly impacting loan approval speed and terms. Loan officers work closely with clients to initiate loan applications, gather necessary documentation, and provide guidance, influencing buyer qualifications and transaction flow. Together, underwriters and loan officers play crucial roles in streamlining property transactions, affecting closing timelines and overall market activity.

Compliance and Risk Assessment Differences

Real estate underwriters specialize in assessing compliance with loan guidelines and evaluating risk factors such as creditworthiness, property value, and market conditions to determine loan eligibility. Loan officers focus on client interaction, gathering financial information, and guiding applicants through the loan process while ensuring preliminary compliance with lending policies. The key difference lies in underwriters' detailed risk assessment to approve or deny loans versus loan officers' role in facilitating applications and maintaining communication with borrowers.

Career Paths and Advancement Opportunities

Real estate underwriters specialize in evaluating loan applications by analyzing credit risk and property values to determine lending eligibility, often advancing to senior underwriting or risk management roles. Loan officers focus on client interactions, guiding borrowers through loan processes and building relationships, with career growth commonly leading to branch manager or mortgage consultant positions. Both paths offer advancement through certifications, experience, and expertise in financial regulations and real estate markets.

Salary Expectations and Job Market Trends

Real estate underwriters typically earn a median salary ranging from $60,000 to $85,000 annually, influenced by experience and company size, while loan officers have a broader salary range from $45,000 to $100,000, with commissions significantly impacting total earnings. The job market for real estate underwriters is steadily growing due to increased regulatory scrutiny and demand for risk assessment in mortgage lending. Loan officers face a more competitive market influenced by interest rate fluctuations and housing demand, with growth projections tied to economic cycles and housing market activity.

Real Estate Underwriter vs Loan Officer Infographic

jobdiv.com

jobdiv.com