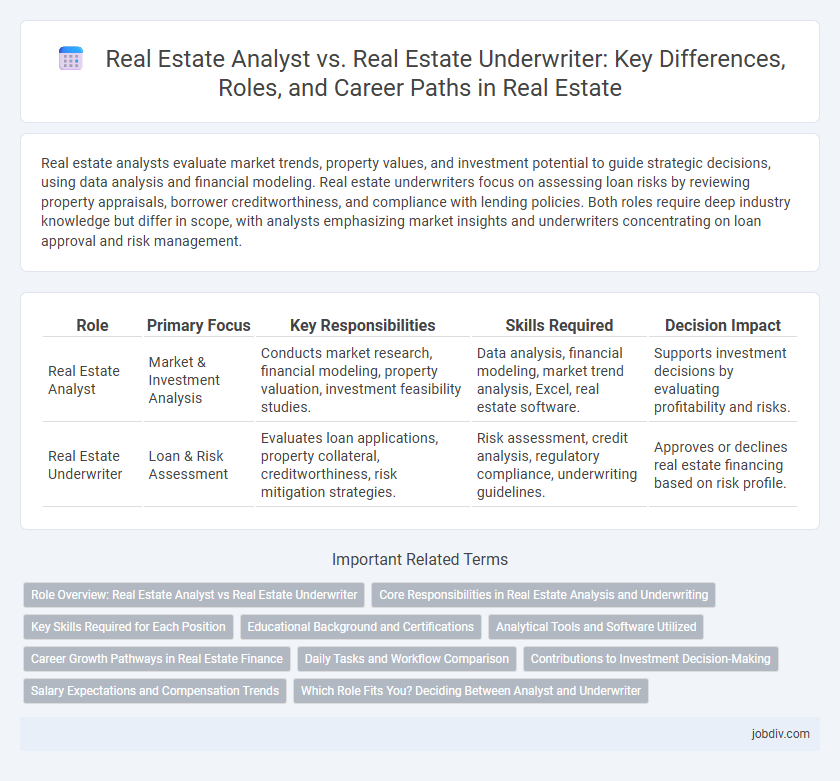

Real estate analysts evaluate market trends, property values, and investment potential to guide strategic decisions, using data analysis and financial modeling. Real estate underwriters focus on assessing loan risks by reviewing property appraisals, borrower creditworthiness, and compliance with lending policies. Both roles require deep industry knowledge but differ in scope, with analysts emphasizing market insights and underwriters concentrating on loan approval and risk management.

Table of Comparison

| Role | Primary Focus | Key Responsibilities | Skills Required | Decision Impact |

|---|---|---|---|---|

| Real Estate Analyst | Market & Investment Analysis | Conducts market research, financial modeling, property valuation, investment feasibility studies. | Data analysis, financial modeling, market trend analysis, Excel, real estate software. | Supports investment decisions by evaluating profitability and risks. |

| Real Estate Underwriter | Loan & Risk Assessment | Evaluates loan applications, property collateral, creditworthiness, risk mitigation strategies. | Risk assessment, credit analysis, regulatory compliance, underwriting guidelines. | Approves or declines real estate financing based on risk profile. |

Role Overview: Real Estate Analyst vs Real Estate Underwriter

A Real Estate Analyst evaluates market trends, property performance, and investment opportunities using data-driven models to guide strategic decisions. A Real Estate Underwriter assesses the financial risk of lending or investing in real estate projects by analyzing creditworthiness, loan applications, and property valuations. While analysts focus on market potential and forecasting, underwriters emphasize risk assessment and compliance with lending criteria.

Core Responsibilities in Real Estate Analysis and Underwriting

Real estate analysts conduct market research, assess property values, and forecast investment performance using data-driven models to guide strategic decision-making. Real estate underwriters evaluate loan applications by scrutinizing financial documents, credit reports, and property appraisals to determine risk and approve financing. Both roles leverage financial analysis skills but differ in focus: analysts provide investment insights while underwriters ensure loan viability and risk mitigation.

Key Skills Required for Each Position

Real Estate Analysts require strong analytical skills, proficiency in financial modeling, and expertise in market research to evaluate property investments and forecast market trends. Real Estate Underwriters need attention to detail, risk assessment capabilities, and knowledge of loan guidelines to assess the creditworthiness and viability of real estate loans. Both roles demand proficiency in data analysis and familiarity with real estate finance principles, but Analysts focus more on market dynamics while Underwriters emphasize risk evaluation and compliance.

Educational Background and Certifications

Real estate analysts typically hold a bachelor's degree in finance, economics, or real estate, with certifications like the Certified Commercial Investment Member (CCIM) enhancing their expertise in market analysis and property valuation. Real estate underwriters often possess a background in finance, business administration, or real estate alongside certifications such as the Chartered Property Casualty Underwriter (CPCU) or Mortgage Underwriter Certification, which emphasize risk assessment and loan approval processes. Both roles benefit from advanced knowledge in real estate finance, but analysts prioritize market research skills while underwriters focus on risk management qualifications.

Analytical Tools and Software Utilized

Real estate analysts primarily utilize data visualization tools like Excel, Tableau, and ARGUS to assess market trends, financial modeling, and investment performance. Real estate underwriters rely heavily on underwriting software such as Moody's Analytics RiskCalc and CoreLogic to evaluate loan risk, property value, and creditworthiness. Both professionals use Geographic Information Systems (GIS) for spatial analysis, but their software applications are tailored toward investment analysis versus risk assessment.

Career Growth Pathways in Real Estate Finance

Real estate analysts focus on market research, financial modeling, and investment analysis to support property acquisitions and portfolio management, often advancing to senior analyst or asset manager roles. Real estate underwriters specialize in assessing loan risks, evaluating borrower creditworthiness, and ensuring compliance with lending criteria, with career progression leading to senior underwriter or credit risk manager positions. Both pathways offer growth into executive roles such as director of real estate finance or chief investment officer, leveraging analytical expertise to drive strategic investment decisions.

Daily Tasks and Workflow Comparison

Real estate analysts evaluate market trends, financial data, and property performance to provide investment recommendations, focusing on data modeling and forecasting. Real estate underwriters assess loan applications by analyzing credit, risk, and property valuations to determine loan eligibility and terms, emphasizing compliance and risk mitigation. Daily workflows for analysts center on extensive data analysis and report generation, while underwriters prioritize document review and risk assessment to approve or decline mortgage applications.

Contributions to Investment Decision-Making

A Real Estate Analyst evaluates market trends, property values, and financial metrics to identify lucrative investment opportunities, providing detailed reports that guide strategic decisions. A Real Estate Underwriter assesses the risk and financial viability of deals by rigorously analyzing loan applications, creditworthiness, and collateral quality. Their combined insights ensure informed investment choices, balancing potential returns with acceptable risk levels.

Salary Expectations and Compensation Trends

Real estate analysts typically earn an average salary ranging from $60,000 to $85,000 annually, with compensation influenced by market research expertise and data analysis skills. Real estate underwriters command higher salaries, often between $75,000 and $110,000, reflecting their responsibility for risk assessment and loan approval. Compensation trends show increasing demand for technology proficiency, with performance bonuses and profit-sharing becoming common in both roles.

Which Role Fits You? Deciding Between Analyst and Underwriter

Real estate analysts specialize in evaluating market trends, financial performance, and investment potential to guide property acquisitions and development decisions. Real estate underwriters focus on assessing risk and determining loan eligibility by thoroughly analyzing property values, borrower creditworthiness, and market conditions. Choosing between these roles depends on whether you prefer data-driven market analysis or risk assessment in financing decisions.

Real Estate Analyst vs Real Estate Underwriter Infographic

jobdiv.com

jobdiv.com