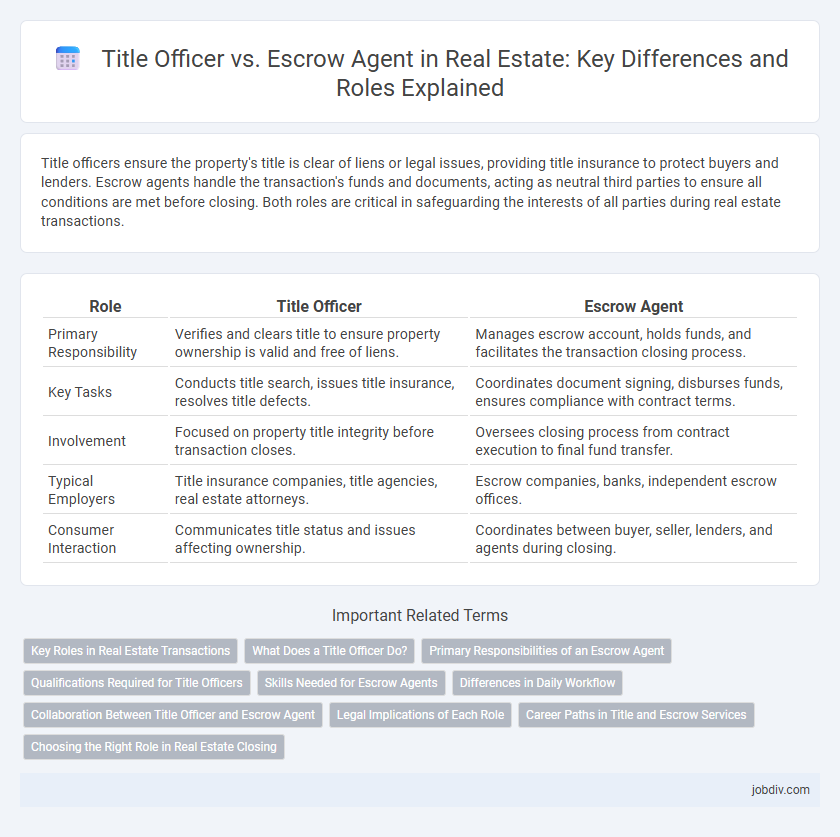

Title officers ensure the property's title is clear of liens or legal issues, providing title insurance to protect buyers and lenders. Escrow agents handle the transaction's funds and documents, acting as neutral third parties to ensure all conditions are met before closing. Both roles are critical in safeguarding the interests of all parties during real estate transactions.

Table of Comparison

| Role | Title Officer | Escrow Agent |

|---|---|---|

| Primary Responsibility | Verifies and clears title to ensure property ownership is valid and free of liens. | Manages escrow account, holds funds, and facilitates the transaction closing process. |

| Key Tasks | Conducts title search, issues title insurance, resolves title defects. | Coordinates document signing, disburses funds, ensures compliance with contract terms. |

| Involvement | Focused on property title integrity before transaction closes. | Oversees closing process from contract execution to final fund transfer. |

| Typical Employers | Title insurance companies, title agencies, real estate attorneys. | Escrow companies, banks, independent escrow offices. |

| Consumer Interaction | Communicates title status and issues affecting ownership. | Coordinates between buyer, seller, lenders, and agents during closing. |

Key Roles in Real Estate Transactions

Title officers conduct thorough searches to verify property ownership and identify liens or encumbrances, ensuring clear title for buyers. Escrow agents manage the transaction process by holding and disbursing funds, coordinating documentation, and ensuring all conditions of the sale are met before closing. Both roles are critical in safeguarding parties' interests and facilitating a smooth, legally compliant real estate transaction.

What Does a Title Officer Do?

A Title Officer thoroughly researches property titles to ensure clear ownership and identify any liens, encumbrances, or legal issues affecting the property. They prepare title commitments and policies to protect buyers and lenders from potential title defects during real estate transactions. Their expertise ensures a smooth closing process by verifying that the property's title is marketable and free of disputes.

Primary Responsibilities of an Escrow Agent

An escrow agent primarily manages the holding and disbursement of funds and documents during real estate transactions, ensuring all conditions of the sale are met before closing. They act as a neutral third party to safeguard the interests of both buyers and sellers by overseeing the execution of contracts and coordinating between involved parties. This role includes verifying the accuracy of transaction details, managing escrow accounts, and facilitating the final transfer of property ownership.

Qualifications Required for Title Officers

Title officers typically require a background in real estate law, strong analytical skills, and knowledge of property titles, liens, and encumbrances. Many hold certifications such as the Title Insurance Producer license or state-specific licensing to validate their expertise. Proficiency in title searches, risk assessment, and attention to detail distinguishes qualified title officers in the real estate closing process.

Skills Needed for Escrow Agents

Escrow agents require strong organizational skills, attention to detail, and a thorough understanding of real estate contracts and closing procedures. Proficiency in managing trust accounts and ensuring compliance with state and federal regulations is essential. Effective communication and problem-solving abilities help escrow agents coordinate between buyers, sellers, lenders, and title officers to facilitate smooth property transactions.

Differences in Daily Workflow

Title Officers primarily conduct title searches, verify property ownership, and resolve title defects to ensure clear property titles, while Escrow Agents manage the transfer of funds, documents, and instructions between buyers and sellers during the closing process. Title Officers work extensively with public records and legal documents to guarantee title insurance, whereas Escrow Agents coordinate communication among all parties, safeguard deposits, and ensure conditions of the sale are met before closing. The daily workflow of Title Officers centers on legal accuracy and title validation, while Escrow Agents focus on transactional coordination and fund disbursement.

Collaboration Between Title Officer and Escrow Agent

Title officers and escrow agents collaborate closely to ensure smooth real estate transactions by verifying property ownership and managing funds securely. The title officer conducts thorough title searches to identify liens or claims, while the escrow agent holds and disburses funds according to contractual terms. Their coordinated efforts minimize risks, facilitate clear title transfers, and guarantee compliance with legal and financial requirements throughout the closing process.

Legal Implications of Each Role

Title officers review property records to ensure clear ownership and issue title insurance protecting buyers and lenders from legal claims or liens. Escrow agents manage the transfer of funds and documents during real estate transactions, holding assets in trust to ensure contractual obligations are met before closing. Legal implications for title officers involve verifying title validity and mitigating risks of ownership disputes, while escrow agents face fiduciary responsibilities to handle funds accurately and comply with regulatory requirements governing escrow accounts.

Career Paths in Title and Escrow Services

Title officers primarily focus on examining property titles, ensuring legal ownership, and resolving title issues, which requires strong knowledge in title law and real estate regulations. Escrow agents manage the escrow process, handling funds and documents to facilitate smooth real estate transactions, demanding expertise in contract compliance and fiduciary duties. Both career paths offer advancement opportunities in real estate law firms, title companies, and escrow agencies, with potential growth into senior management or specialized legal consulting roles.

Choosing the Right Role in Real Estate Closing

Choosing the right role in real estate closing depends on understanding the distinct responsibilities of a Title Officer and an Escrow Agent. A Title Officer ensures the legal ownership of the property is clear by conducting title searches and issuing title insurance policies. An Escrow Agent manages the funds and documents during the transaction, acting as a neutral third party to facilitate the closing process securely and efficiently.

Title Officer vs Escrow Agent Infographic

jobdiv.com

jobdiv.com