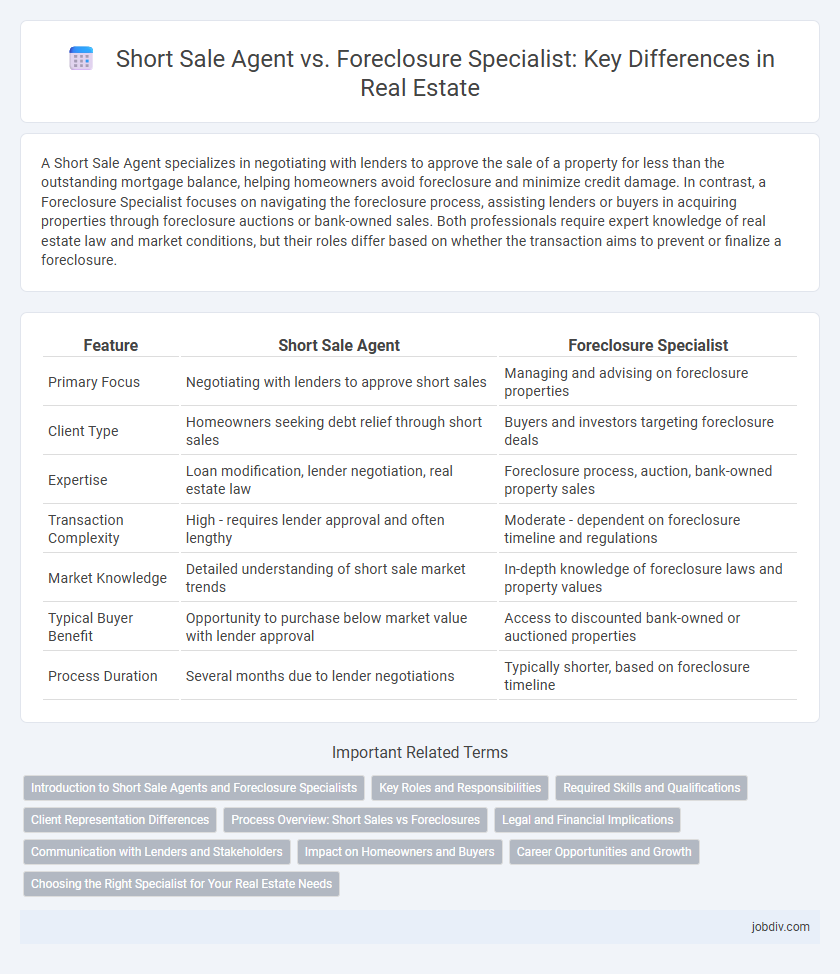

A Short Sale Agent specializes in negotiating with lenders to approve the sale of a property for less than the outstanding mortgage balance, helping homeowners avoid foreclosure and minimize credit damage. In contrast, a Foreclosure Specialist focuses on navigating the foreclosure process, assisting lenders or buyers in acquiring properties through foreclosure auctions or bank-owned sales. Both professionals require expert knowledge of real estate law and market conditions, but their roles differ based on whether the transaction aims to prevent or finalize a foreclosure.

Table of Comparison

| Feature | Short Sale Agent | Foreclosure Specialist |

|---|---|---|

| Primary Focus | Negotiating with lenders to approve short sales | Managing and advising on foreclosure properties |

| Client Type | Homeowners seeking debt relief through short sales | Buyers and investors targeting foreclosure deals |

| Expertise | Loan modification, lender negotiation, real estate law | Foreclosure process, auction, bank-owned property sales |

| Transaction Complexity | High - requires lender approval and often lengthy | Moderate - dependent on foreclosure timeline and regulations |

| Market Knowledge | Detailed understanding of short sale market trends | In-depth knowledge of foreclosure laws and property values |

| Typical Buyer Benefit | Opportunity to purchase below market value with lender approval | Access to discounted bank-owned or auctioned properties |

| Process Duration | Several months due to lender negotiations | Typically shorter, based on foreclosure timeline |

Introduction to Short Sale Agents and Foreclosure Specialists

Short sale agents specialize in negotiating with lenders to sell properties for less than the outstanding mortgage balance, helping homeowners avoid foreclosure and minimize credit damage. Foreclosure specialists focus on managing the foreclosure process, working with lenders, attorneys, and borrowers to resolve or expedite property repossession. Both types of agents require deep knowledge of local real estate laws, lender requirements, and market conditions to effectively guide clients through distressed property sales.

Key Roles and Responsibilities

A Short Sale Agent primarily negotiates with lenders to approve property sales below mortgage balances, coordinates with sellers to prepare documentation, and markets distressed properties to potential buyers. A Foreclosure Specialist focuses on understanding foreclosure timelines, advises homeowners on avoiding auction sales, and manages interactions with banks and legal entities to navigate the foreclosure process. Both roles require expertise in distressed property transactions but differ in their approach to resolving financial challenges for homeowners.

Required Skills and Qualifications

Short sale agents must possess strong negotiation skills, knowledge of lender requirements, and expertise in preparing and submitting complex financial documents to facilitate property sales under market value. Foreclosure specialists require in-depth understanding of foreclosure laws, timelines, and court procedures, along with skills in asset valuation and risk assessment to manage distressed property sales efficiently. Both roles demand excellent communication abilities, market analysis proficiency, and certification or licensing as mandated by state real estate boards.

Client Representation Differences

A Short Sale Agent specializes in negotiating with lenders to accept less than the owed mortgage balance, prioritizing sellers facing financial hardship who want to avoid foreclosure and protect their credit. Foreclosure Specialists guide clients through the legal and procedural aspects of foreclosure, often representing buyers or investors looking to purchase repossessed properties. The key difference in client representation lies in the Short Sale Agent advocating for distressed homeowners to minimize credit damage, while Foreclosure Specialists focus on navigating post-foreclosure transactions and opportunities.

Process Overview: Short Sales vs Foreclosures

Short sale agents negotiate with lenders to approve a sale price below the mortgage balance, requiring buyer, seller, and lender cooperation, often taking 60-90 days to finalize. Foreclosure specialists manage the lender's legal process to repossess and sell the property after the homeowner defaults, with timelines varying by state, typically lasting several months. Understanding these distinct processes helps clients navigate timelines, lender requirements, and potential financial impacts effectively.

Legal and Financial Implications

Short sale agents navigate complex negotiations with lenders to approve property sales below mortgage balances, minimizing borrower credit damage and avoiding judicial foreclosure. Foreclosure specialists manage the legal process of reclaiming property through court action, often resulting in significant credit score declines and potential deficiency judgments against borrowers. Understanding the financial impact and legal obligations in both processes is crucial for real estate professionals to advise clients effectively.

Communication with Lenders and Stakeholders

Short Sale Agents excel in negotiating with lenders to approve discounted property sales, leveraging strong communication skills to facilitate lender cooperation and streamline complex approval processes. Foreclosure Specialists prioritize timely, clear dialogue with banks and legal entities to manage default timelines and minimize property losses. Effective communication strategies in both roles ensure alignment among homeowners, lenders, and buyers, enhancing transaction success rates in distressed property sales.

Impact on Homeowners and Buyers

A short sale agent helps homeowners avoid foreclosure by negotiating with lenders to sell the property for less than the outstanding mortgage, reducing credit damage and offering a faster resolution for sellers. Foreclosure specialists focus on managing the foreclosure process, often resulting in prolonged credit harm and potential loss of homeowner equity, but can provide buyers with opportunities to purchase distressed properties at below-market prices. Both roles significantly impact buyers by influencing market inventory and pricing, while homeowners face different outcomes in credit recovery and financial stability depending on the chosen path.

Career Opportunities and Growth

Short sale agents specialize in negotiating with lenders to sell properties below mortgage balance, offering unique career opportunities in distressed property markets and requiring advanced skills in communication and negotiation. Foreclosure specialists focus on managing and resolving foreclosure processes, providing expertise in legal procedures and property auctions, with growth potential tied to economic fluctuations and housing market trends. Both roles demand comprehensive knowledge of real estate law and finance, but foreclosure specialists often experience more cyclical demand, while short sale agents benefit from steady opportunities in areas with high mortgage delinquencies.

Choosing the Right Specialist for Your Real Estate Needs

Selecting the right expert for distressed property transactions hinges on understanding the distinct roles of a Short Sale Agent and a Foreclosure Specialist. A Short Sale Agent navigates lender negotiations to sell properties below mortgage value, preserving credit and facilitating smoother sales, while a Foreclosure Specialist focuses on properties in the foreclosure process, often leveraging legal and auction insights to manage asset recovery. Aligning your real estate goals with the specialist's expertise, whether seeking negotiation finesse or foreclosure market knowledge, optimizes outcomes in challenging property sales.

Short Sale Agent vs Foreclosure Specialist Infographic

jobdiv.com

jobdiv.com