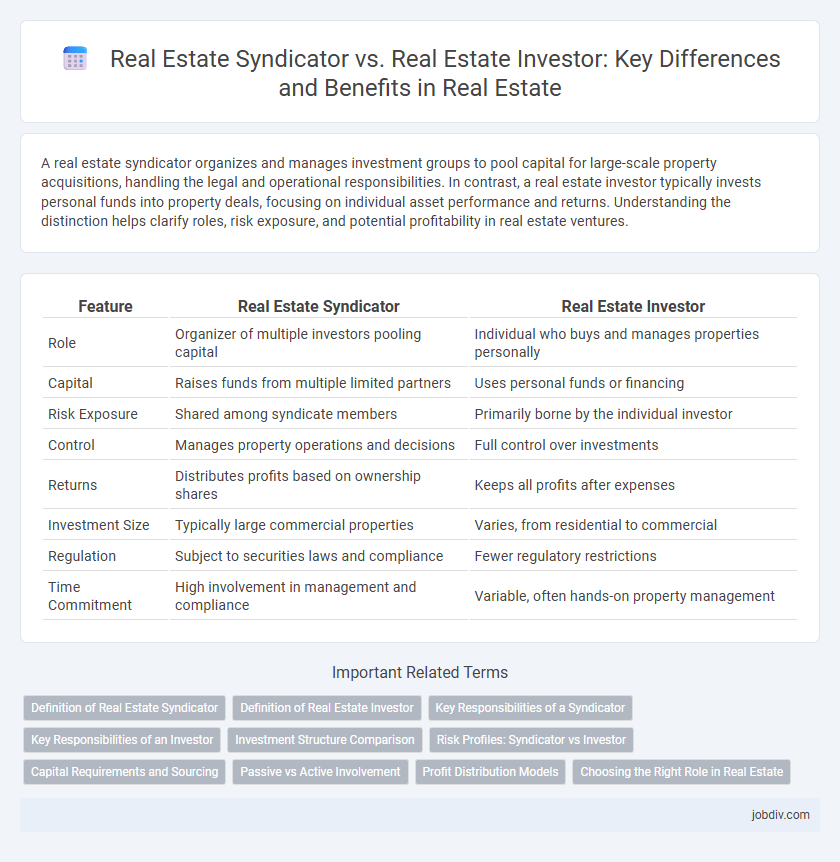

A real estate syndicator organizes and manages investment groups to pool capital for large-scale property acquisitions, handling the legal and operational responsibilities. In contrast, a real estate investor typically invests personal funds into property deals, focusing on individual asset performance and returns. Understanding the distinction helps clarify roles, risk exposure, and potential profitability in real estate ventures.

Table of Comparison

| Feature | Real Estate Syndicator | Real Estate Investor |

|---|---|---|

| Role | Organizer of multiple investors pooling capital | Individual who buys and manages properties personally |

| Capital | Raises funds from multiple limited partners | Uses personal funds or financing |

| Risk Exposure | Shared among syndicate members | Primarily borne by the individual investor |

| Control | Manages property operations and decisions | Full control over investments |

| Returns | Distributes profits based on ownership shares | Keeps all profits after expenses |

| Investment Size | Typically large commercial properties | Varies, from residential to commercial |

| Regulation | Subject to securities laws and compliance | Fewer regulatory restrictions |

| Time Commitment | High involvement in management and compliance | Variable, often hands-on property management |

Definition of Real Estate Syndicator

A real estate syndicator is an individual or entity that pools capital from multiple investors to acquire, manage, and sell large real estate assets, structuring these deals to maximize returns. Unlike a typical real estate investor who invests personal funds in properties, syndicators act as sponsors or managers responsible for deal sourcing, due diligence, and asset oversight. Syndication enables access to larger, institutional-grade real estate opportunities that typically require substantial capital and expertise.

Definition of Real Estate Investor

A real estate investor is an individual or entity that purchases properties to generate income through rental, resale, or appreciation. They actively manage or oversee real estate assets to maximize returns, often using personal capital or financing. Unlike real estate syndicators who pool resources from multiple investors, real estate investors typically bear direct ownership and decision-making responsibilities.

Key Responsibilities of a Syndicator

A Real Estate Syndicator primarily organizes and manages investment groups by sourcing properties, conducting market analysis, and structuring deals to attract passive investors. They oversee legal documentation, coordinate due diligence, and handle asset management to maximize returns. Syndicators also build investor relationships and ensure compliance with securities regulations, distinguishing their role from that of individual real estate investors who typically focus solely on property acquisition and management.

Key Responsibilities of an Investor

Real estate investors primarily focus on identifying and acquiring properties with strong potential for appreciation or income generation. Their key responsibilities include conducting thorough market research, performing due diligence on property conditions and financials, and managing property portfolios to maximize returns. Investors also oversee financing arrangements and make strategic decisions regarding holding, renovating, or selling assets to optimize investment performance.

Investment Structure Comparison

Real estate syndicators pool capital from multiple investors to acquire large-scale properties, managing the entire investment process, while real estate investors typically invest individually or in smaller groups with more direct control over their assets. Syndicators create structured investment vehicles such as Limited Partnerships (LPs) or Limited Liability Companies (LLCs), offering passive income and risk diversification, whereas individual investors often use direct ownership or real estate investment trusts (REITs) for more hands-on portfolio management. The syndication model scales investment opportunities and operational responsibilities, contrasting with the more autonomous approach of solo investors.

Risk Profiles: Syndicator vs Investor

Real estate syndicators typically face higher risk profiles than individual investors due to their responsibility for managing property acquisitions, financing, and operations, which exposes them to potential legal liabilities and market fluctuations. Investors in syndications generally assume more limited risks, primarily related to the capital they contribute and the performance of the underlying assets, without direct involvement in property management. Understanding these differing risk profiles is crucial for stakeholders when deciding between active syndication roles or passive investment opportunities.

Capital Requirements and Sourcing

Real estate syndicators typically require significant capital to pool funds from multiple investors, allowing access to larger projects with diversified risk, while individual real estate investors often rely on personal savings or smaller loans to purchase single properties. Syndicators focus on sourcing capital through private equity, institutional investors, and crowdfunding platforms, leveraging networks and legal structures like limited partnerships. In contrast, individual investors primarily source capital from traditional financing methods such as mortgages or personal funds, limiting the scale and scope of investment opportunities.

Passive vs Active Involvement

Real estate syndicators primarily take a passive role by pooling capital from multiple investors to fund large-scale properties, managing acquisition, financing, and operations on their behalf. In contrast, real estate investors are actively involved in property selection, management, and decision-making processes, often directly overseeing day-to-day operations and maintenance. Passive syndication offers diversification and reduced personal risk, while active investing requires hands-on engagement and greater time commitment.

Profit Distribution Models

Real estate syndicators typically manage pooled funds from multiple investors and distribute profits based on a preferred return structure combined with a profit split or equity share, aligning incentives between sponsors and passive investors. Investors in syndications often receive periodic distributions proportional to their ownership stake, benefiting from tiered promote waterfalls that reward syndicators after hitting return thresholds. In contrast, individual real estate investors directly own properties, retain all rental income, and realize profits solely upon property sale, resulting in a simpler profit distribution model without intermediary share splits.

Choosing the Right Role in Real Estate

Real estate syndicators pool capital from multiple investors to acquire larger properties, offering passive income and reduced individual risk, while real estate investors directly purchase, manage, and profit from properties, demanding active involvement and decision-making. Selecting the right role depends on your risk tolerance, capital availability, and desired level of engagement; syndicators suit those seeking leadership without full personal financial exposure, whereas investors benefit from hands-on control and potentially higher returns. Understanding market trends, investment horizons, and legal structures is critical for aligning your real estate career with personal financial goals.

Real Estate Syndicator vs Real Estate Investor Infographic

jobdiv.com

jobdiv.com