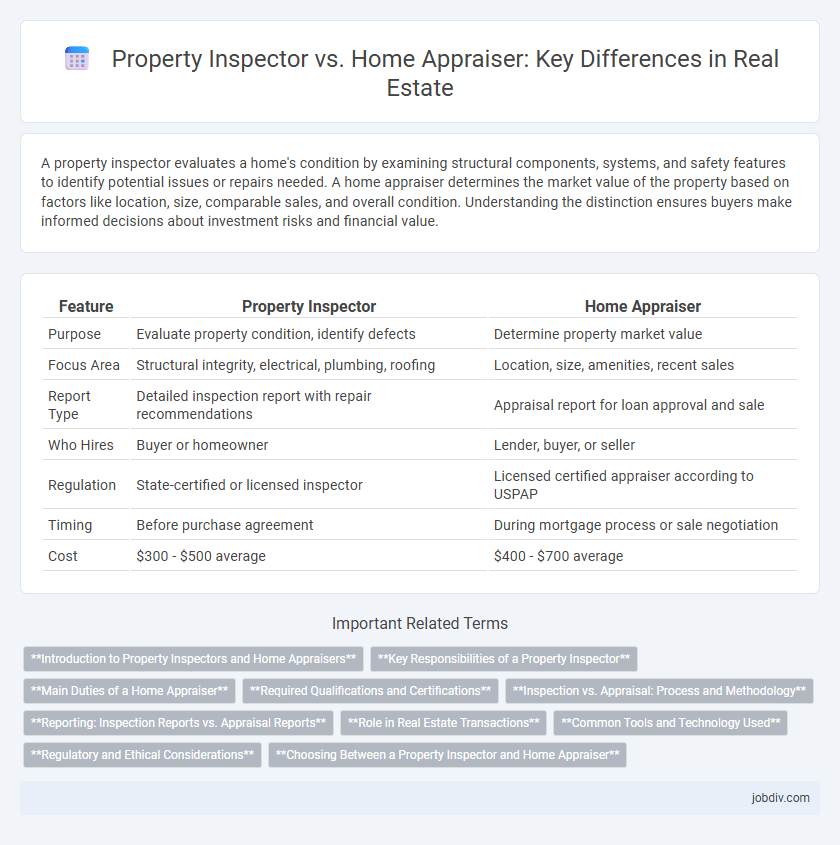

A property inspector evaluates a home's condition by examining structural components, systems, and safety features to identify potential issues or repairs needed. A home appraiser determines the market value of the property based on factors like location, size, comparable sales, and overall condition. Understanding the distinction ensures buyers make informed decisions about investment risks and financial value.

Table of Comparison

| Feature | Property Inspector | Home Appraiser |

|---|---|---|

| Purpose | Evaluate property condition, identify defects | Determine property market value |

| Focus Area | Structural integrity, electrical, plumbing, roofing | Location, size, amenities, recent sales |

| Report Type | Detailed inspection report with repair recommendations | Appraisal report for loan approval and sale |

| Who Hires | Buyer or homeowner | Lender, buyer, or seller |

| Regulation | State-certified or licensed inspector | Licensed certified appraiser according to USPAP |

| Timing | Before purchase agreement | During mortgage process or sale negotiation |

| Cost | $300 - $500 average | $400 - $700 average |

Introduction to Property Inspectors and Home Appraisers

Property inspectors assess the physical condition of a property, identifying structural issues, safety hazards, and necessary repairs to help buyers make informed decisions. Home appraisers determine a property's market value by analyzing comparable sales, location, and overall condition, providing crucial data for mortgage lending and sale negotiations. Understanding the distinct roles of inspectors and appraisers is essential for navigating real estate transactions efficiently.

Key Responsibilities of a Property Inspector

A Property Inspector conducts a thorough examination of a property's physical condition, identifying structural issues, safety hazards, and maintenance needs. They assess systems such as plumbing, electrical, HVAC, and roofing to ensure functionality and code compliance. Their detailed inspection reports provide buyers and sellers with crucial information for decision-making and negotiations in real estate transactions.

Main Duties of a Home Appraiser

Home appraisers primarily determine a property's market value by analyzing factors like location, condition, comparable sales, and recent market trends. They conduct thorough inspections to assess structural integrity, age, and improvements, ensuring an accurate valuation essential for mortgage lending and investment purposes. Appraisers produce detailed reports that influence loan approvals, real estate transactions, and property tax assessments.

Required Qualifications and Certifications

Property inspectors typically require certification from organizations such as the American Society of Home Inspectors (ASHI) or the International Association of Certified Home Inspectors (InterNACHI), along with state licensing where applicable. Home appraisers must obtain a state license or certification by completing courses in real estate appraisal, passing the Uniform Standards of Professional Appraisal Practice (USPAP) exam, and gaining supervised experience. Both roles demand ongoing education to maintain credentials and ensure compliance with industry regulations.

Inspection vs. Appraisal: Process and Methodology

A property inspector evaluates the physical condition of a home through a comprehensive visual examination, focusing on structural elements, systems, and potential safety issues. A home appraiser determines the property's market value by analyzing recent sales, location, size, and condition, using standardized valuation methods. While inspection emphasizes identifying defects and maintenance needs, appraisal centers on financial worth for lending or sale purposes.

Reporting: Inspection Reports vs. Appraisal Reports

Inspection reports provide detailed documentation of a property's physical condition, identifying structural issues, safety hazards, and maintenance needs. Appraisal reports focus on estimating the market value of the property, incorporating comparative market analysis, location, and recent sales data. Both reports serve distinct purposes in real estate transactions, with inspection reports guiding repair decisions and appraisal reports influencing financing and pricing.

Role in Real Estate Transactions

Property inspectors evaluate a home's physical condition, identifying structural, electrical, and plumbing issues to inform buyers about potential repairs. Home appraisers determine a property's market value based on location, comparable sales, and overall condition, supporting mortgage lenders in financing decisions. Both roles are critical in real estate transactions, ensuring informed buying decisions and accurate property valuations.

Common Tools and Technology Used

Property inspectors and home appraisers both rely on advanced tools and technology to assess real estate accurately. Inspectors commonly use moisture meters, infrared cameras, and electrical testers to evaluate a property's condition, while appraisers utilize drones, geographic information systems (GIS), and multiple listing service (MLS) data for market analysis and property valuation. Both professionals increasingly incorporate digital reporting software and mobile apps to streamline data collection and improve precision in their assessments.

Regulatory and Ethical Considerations

Property inspectors adhere to strict licensing requirements and standards set by organizations like the American Society of Home Inspectors (ASHI), ensuring unbiased and thorough evaluations focused on safety and functionality. Home appraisers must comply with regulations under the Uniform Standards of Professional Appraisal Practice (USPAP) and the Financial Institutions Reform, Recovery, and Enforcement Act (FIRREA), maintaining impartiality to provide accurate market value assessments. Both roles emphasize ethical responsibilities to avoid conflicts of interest, uphold client confidentiality, and deliver objective findings critical in real estate transactions.

Choosing Between a Property Inspector and Home Appraiser

Choosing between a property inspector and a home appraiser depends on the purpose of the evaluation; property inspectors assess the condition and safety of a home by examining structural elements, systems, and potential hazards, while home appraisers provide an expert opinion on the property's market value based on factors like location, comparable sales, and overall condition. Homebuyers typically need a property inspection to identify issues before purchase, whereas lenders require appraisals to ensure the loan amount aligns with the home's worth. Understanding these distinct roles helps buyers and sellers make informed decisions during real estate transactions.

Property Inspector vs Home Appraiser Infographic

jobdiv.com

jobdiv.com