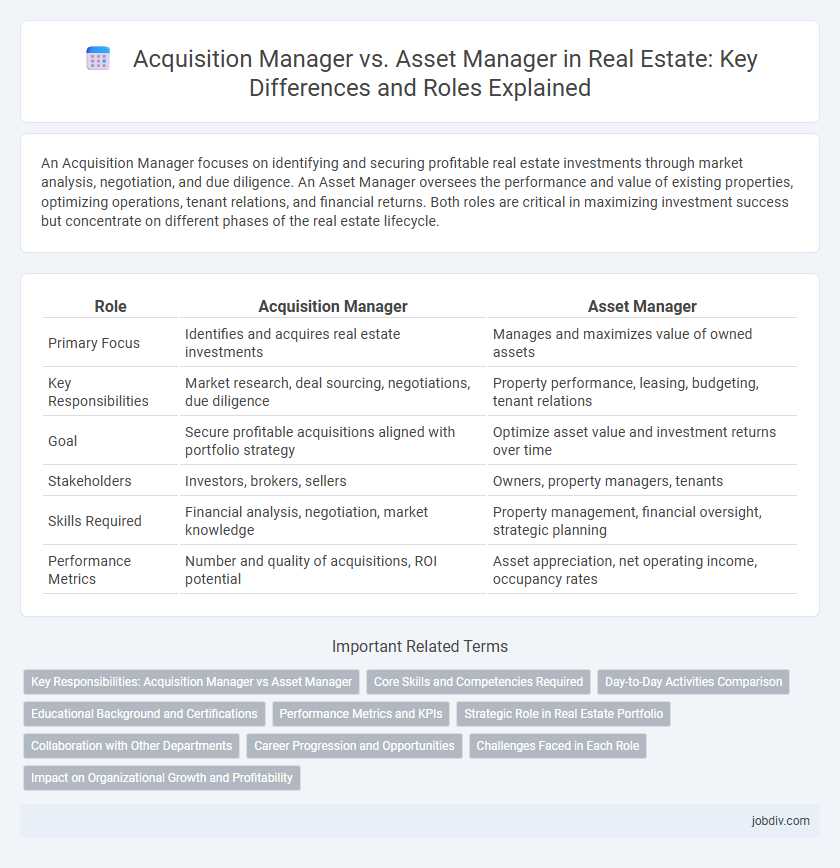

An Acquisition Manager focuses on identifying and securing profitable real estate investments through market analysis, negotiation, and due diligence. An Asset Manager oversees the performance and value of existing properties, optimizing operations, tenant relations, and financial returns. Both roles are critical in maximizing investment success but concentrate on different phases of the real estate lifecycle.

Table of Comparison

| Role | Acquisition Manager | Asset Manager |

|---|---|---|

| Primary Focus | Identifies and acquires real estate investments | Manages and maximizes value of owned assets |

| Key Responsibilities | Market research, deal sourcing, negotiations, due diligence | Property performance, leasing, budgeting, tenant relations |

| Goal | Secure profitable acquisitions aligned with portfolio strategy | Optimize asset value and investment returns over time |

| Stakeholders | Investors, brokers, sellers | Owners, property managers, tenants |

| Skills Required | Financial analysis, negotiation, market knowledge | Property management, financial oversight, strategic planning |

| Performance Metrics | Number and quality of acquisitions, ROI potential | Asset appreciation, net operating income, occupancy rates |

Key Responsibilities: Acquisition Manager vs Asset Manager

Acquisition Managers focus on identifying, evaluating, and negotiating property purchases to expand a real estate portfolio, emphasizing market analysis, due diligence, and financial modeling. Asset Managers oversee property performance post-acquisition, managing leasing, operations, and financial reporting to optimize asset value and maximize returns. Both roles require strategic decision-making but differ in lifecycle focus: acquisition targets portfolio growth, while asset management ensures long-term profitability.

Core Skills and Competencies Required

Acquisition Managers require strong financial analysis, market research, and negotiation skills to identify and secure profitable real estate investments. Asset Managers must excel in portfolio management, performance monitoring, and stakeholder communication to maximize property value and returns. Proficiency in risk assessment, contract management, and strategic planning is essential for both roles within the real estate sector.

Day-to-Day Activities Comparison

An Acquisition Manager primarily focuses on identifying, evaluating, and negotiating property purchases, conducting market research, and coordinating due diligence processes to secure profitable investments. An Asset Manager oversees the performance of acquired properties by managing tenant relations, optimizing operational expenses, and implementing value-add strategies to maximize return on investment. Both roles require strong financial analysis skills, but the Acquisition Manager is transaction-driven while the Asset Manager emphasizes portfolio management and long-term asset growth.

Educational Background and Certifications

Acquisition Managers in real estate typically hold degrees in finance, business administration, or real estate, often complemented by certifications like Certified Commercial Investment Member (CCIM) or Real Estate Finance Certification. Asset Managers usually possess educational backgrounds in finance, accounting, or real estate management, with professional credentials such as Certified Property Manager (CPM) or Accredited Residential Manager (ARM) enhancing their qualifications. Both roles benefit from advanced certifications, but Acquisition Managers focus more on investment analysis credentials, while Asset Managers prioritize property management and operational expertise.

Performance Metrics and KPIs

Acquisition Managers focus on KPIs such as deal flow velocity, acquisition cost per asset, and internal rate of return (IRR) to measure the effectiveness of property sourcing and negotiation strategies. Asset Managers prioritize performance metrics like net operating income (NOI), occupancy rates, and capital expenditure efficiency to optimize property value and income generation. Both roles use cash-on-cash return and portfolio growth rates as key indicators to evaluate overall investment performance.

Strategic Role in Real Estate Portfolio

Acquisition Managers focus on identifying and securing high-potential real estate properties to expand and optimize the portfolio's value, leveraging market analysis and negotiation expertise. Asset Managers oversee the performance and strategic management of acquired properties, ensuring maximum return through operational efficiency, tenant relations, and capital improvements. Both roles collaborate strategically to drive long-term portfolio growth and risk management in real estate investments.

Collaboration with Other Departments

Acquisition Managers collaborate closely with Marketing and Research teams to identify profitable investment opportunities and conduct due diligence. Asset Managers work alongside Property Management and Finance departments to optimize property performance and ensure financial targets are met. Effective communication between Acquisition and Asset Managers enhances seamless transition from acquisition to asset optimization, maximizing portfolio value.

Career Progression and Opportunities

Acquisition Managers concentrate on identifying and securing valuable real estate properties, leveraging market analysis and negotiation expertise to drive portfolio growth, which often leads to senior roles such as Director of Acquisitions or Head of Investment. Asset Managers focus on maximizing property performance and value through operational oversight, financial analysis, and strategic planning, positioning themselves for advancement to Chief Asset Officer or Real Estate Portfolio Manager. Career progression in both roles benefits from strong analytical skills, market knowledge, and leadership, with opportunities expanding into broader investment management or executive positions within real estate firms.

Challenges Faced in Each Role

Acquisition Managers face challenges such as identifying high-potential properties, conducting due diligence under tight timelines, and negotiating favorable purchase terms in competitive markets. Asset Managers struggle with optimizing property performance, managing tenant relations, and navigating fluctuating market conditions to maximize return on investment. Both roles require strategic decision-making but differ in focus: acquisitions center on growth and portfolio expansion, while asset management emphasizes operational efficiency and value preservation.

Impact on Organizational Growth and Profitability

Acquisition Managers drive organizational growth by identifying and securing high-potential real estate investments that expand the property portfolio, directly influencing revenue generation and market positioning. Asset Managers optimize profitability through strategic property management, maximizing income streams, controlling expenses, and enhancing asset value over time. Together, their coordinated efforts ensure sustained growth and increased returns on investment in the real estate sector.

Acquisition Manager vs Asset Manager Infographic

jobdiv.com

jobdiv.com