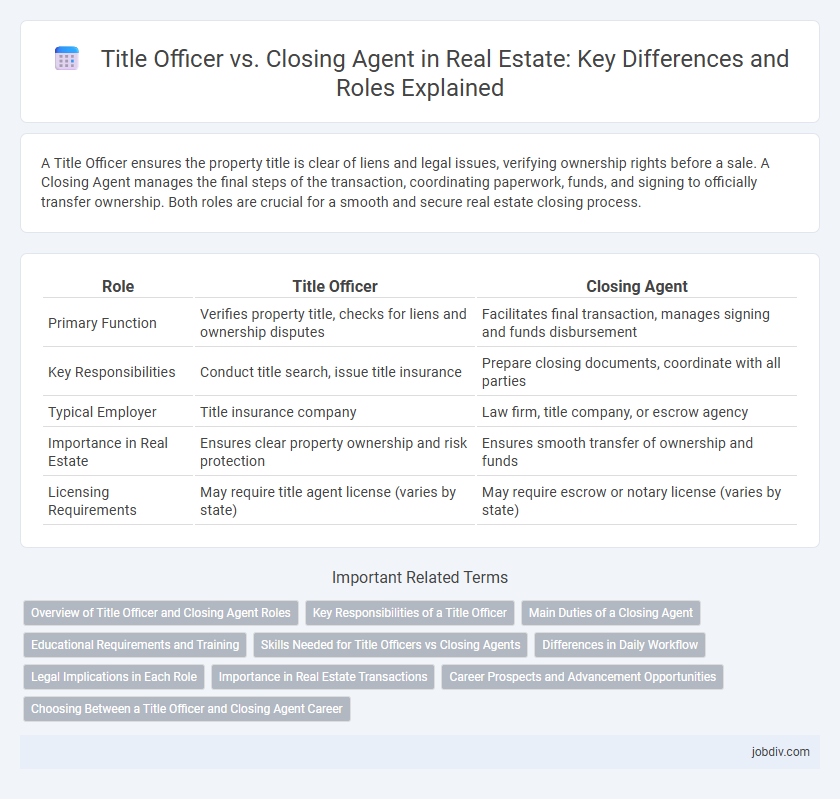

A Title Officer ensures the property title is clear of liens and legal issues, verifying ownership rights before a sale. A Closing Agent manages the final steps of the transaction, coordinating paperwork, funds, and signing to officially transfer ownership. Both roles are crucial for a smooth and secure real estate closing process.

Table of Comparison

| Role | Title Officer | Closing Agent |

|---|---|---|

| Primary Function | Verifies property title, checks for liens and ownership disputes | Facilitates final transaction, manages signing and funds disbursement |

| Key Responsibilities | Conduct title search, issue title insurance | Prepare closing documents, coordinate with all parties |

| Typical Employer | Title insurance company | Law firm, title company, or escrow agency |

| Importance in Real Estate | Ensures clear property ownership and risk protection | Ensures smooth transfer of ownership and funds |

| Licensing Requirements | May require title agent license (varies by state) | May require escrow or notary license (varies by state) |

Overview of Title Officer and Closing Agent Roles

A Title Officer conducts thorough title searches and ensures clear property ownership by identifying liens, easements, or encumbrances that could affect the transaction. A Closing Agent coordinates final paperwork, fund disbursement, and legal documentation to facilitate the official transfer of property ownership at closing. Both roles are essential in providing title insurance protection and ensuring a smooth real estate closing process.

Key Responsibilities of a Title Officer

A Title Officer is responsible for conducting thorough title searches to ensure property ownership is clear and free of liens or encumbrances, which protects buyers and lenders from legal disputes. They prepare title insurance policies that guarantee the legitimacy of the title and assist in resolving any title defects or claims. These responsibilities are crucial for maintaining transaction integrity and facilitating smooth real estate closings.

Main Duties of a Closing Agent

A Closing Agent primarily manages the real estate closing process by coordinating between buyers, sellers, lenders, and real estate agents to ensure all documents are accurately signed and legally binding. They handle the disbursement of funds, prepare the closing statement, and record the deed with the appropriate government office to finalize ownership transfer. Unlike a Title Officer who focuses on verifying and insuring the title, the Closing Agent ensures the smooth execution of the transaction's last steps.

Educational Requirements and Training

Title officers typically require a high school diploma and specialized training in title insurance, property records, and real estate laws, often obtained through on-the-job experience or industry courses. Closing agents, also known as settlement agents, generally need similar foundational knowledge but may pursue certifications such as the Certified Closing Specialist (CCS) to enhance their expertise in managing escrow accounts and facilitating the closing process. Both roles benefit from continuous education to stay current with legal regulations and best practices in real estate transactions.

Skills Needed for Title Officers vs Closing Agents

Title officers require a strong understanding of insurance policies, legal documentation, and risk assessment to accurately verify property titles and ensure clear ownership. Closing agents must excel in communication, coordination, and attention to detail to facilitate smooth real estate transactions and manage escrow processes effectively. Both roles demand proficiency in regulatory compliance and real estate law, but title officers emphasize analytical skills while closing agents focus on operational and interpersonal capabilities.

Differences in Daily Workflow

Title officers primarily focus on examining property titles, ensuring there are no liens or legal issues, and preparing title commitments. Closing agents coordinate the final steps of real estate transactions, managing document signing, fund disbursement, and communication between buyers, sellers, and lenders. The daily workflow of a title officer centers on title research and clearance, whereas closing agents handle logistics, client interactions, and the execution of closing documents.

Legal Implications in Each Role

Title officers verify property ownership and identify liens or legal claims to ensure clear title transfer, mitigating risks of post-sale disputes. Closing agents manage the finalization of real estate transactions, overseeing document execution and fund disbursement to comply with legal requirements and avoid contract breaches. Both roles carry critical legal implications, with title officers focusing on title accuracy and closing agents ensuring lawful transaction completion.

Importance in Real Estate Transactions

Title officers play a crucial role in real estate transactions by conducting thorough title searches to ensure the property is free of liens and legal issues, which protects buyers and lenders. Closing agents manage the final steps of the transaction, including document preparation and fund disbursement, ensuring a smooth transfer of ownership. Both professionals are essential for verifying property ownership and facilitating a legally binding and efficient closing process.

Career Prospects and Advancement Opportunities

Title officers specialize in researching property titles to ensure clear ownership, offering steady career growth through expertise in legal documentation and risk assessment. Closing agents coordinate real estate transactions, providing diverse advancement opportunities in transaction management and client relations. Both roles offer pathways to senior positions in real estate law firms, title companies, or escrow services, with potential to evolve into managerial or executive roles.

Choosing Between a Title Officer and Closing Agent Career

Choosing between a career as a Title Officer and a Closing Agent hinges on your preference for detailed title research versus client coordination during property transactions. Title Officers specialize in examining property records to ensure clear ownership and resolve title issues, emphasizing analytical skills and legal knowledge. Closing Agents focus on managing the closing process, coordinating with buyers, sellers, lenders, and attorneys to finalize real estate deals efficiently.

Title Officer vs Closing Agent Infographic

jobdiv.com

jobdiv.com