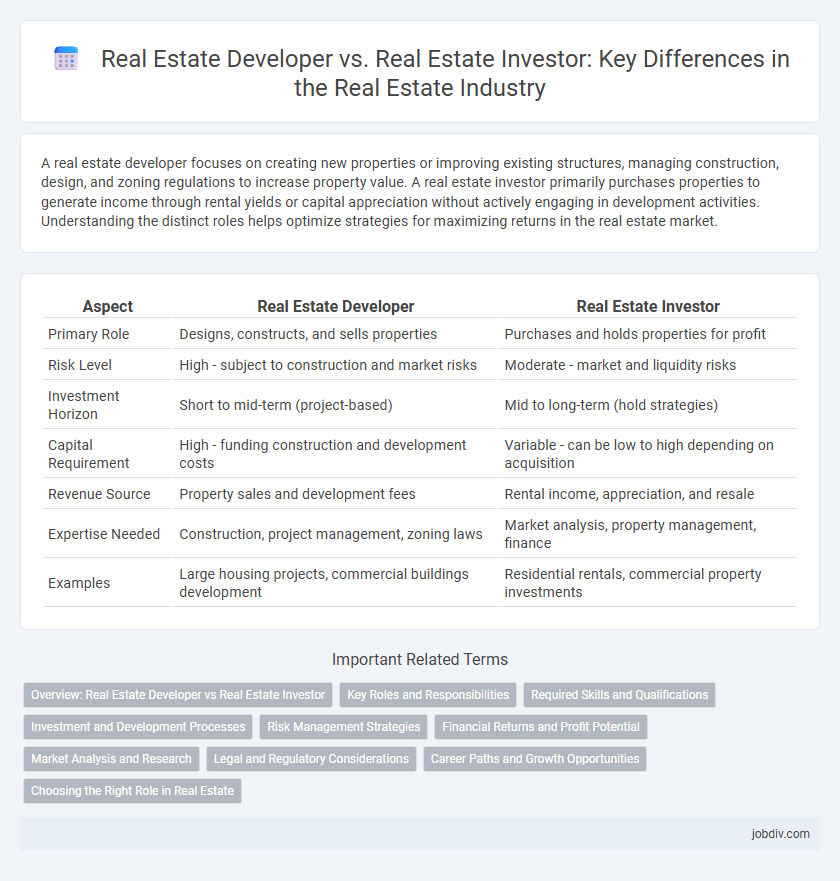

A real estate developer focuses on creating new properties or improving existing structures, managing construction, design, and zoning regulations to increase property value. A real estate investor primarily purchases properties to generate income through rental yields or capital appreciation without actively engaging in development activities. Understanding the distinct roles helps optimize strategies for maximizing returns in the real estate market.

Table of Comparison

| Aspect | Real Estate Developer | Real Estate Investor |

|---|---|---|

| Primary Role | Designs, constructs, and sells properties | Purchases and holds properties for profit |

| Risk Level | High - subject to construction and market risks | Moderate - market and liquidity risks |

| Investment Horizon | Short to mid-term (project-based) | Mid to long-term (hold strategies) |

| Capital Requirement | High - funding construction and development costs | Variable - can be low to high depending on acquisition |

| Revenue Source | Property sales and development fees | Rental income, appreciation, and resale |

| Expertise Needed | Construction, project management, zoning laws | Market analysis, property management, finance |

| Examples | Large housing projects, commercial buildings development | Residential rentals, commercial property investments |

Overview: Real Estate Developer vs Real Estate Investor

Real estate developers focus on purchasing land, financing real estate deals, and overseeing construction projects to create new residential or commercial properties. Real estate investors primarily acquire properties to generate income through rental yields or capital appreciation without managing construction or development. Both roles aim to build wealth, but developers take on higher risk with active project management, while investors typically pursue lower-risk strategies centered on property acquisition.

Key Roles and Responsibilities

Real estate developers manage the planning, financing, and construction of new properties, coordinating architects, contractors, and city officials to ensure successful project completion. Real estate investors focus on acquiring, holding, and selling properties to generate returns, analyzing market trends and property values to optimize investment portfolios. Developers take on higher project risks and oversee physical development, while investors prioritize capital growth and income through strategic property acquisition.

Required Skills and Qualifications

Real estate developers require expertise in project management, financial analysis, zoning laws, and construction processes, often holding degrees in finance, business, or urban planning. Real estate investors prioritize market analysis, risk assessment, and portfolio management skills, with qualifications ranging from certifications in real estate investment to experience in financial markets. Both roles demand strong negotiation abilities and a deep understanding of local real estate markets to maximize profit and minimize risks.

Investment and Development Processes

Real estate developers focus on acquiring land, securing permits, and overseeing construction to transform raw properties into profitable residential or commercial projects. Real estate investors prioritize acquiring finished or income-generating properties, leveraging rental income, and capital appreciation for financial returns. Both roles require market analysis, risk assessment, and capital management but differ in project involvement and timelines.

Risk Management Strategies

Real estate developers mitigate risks by conducting thorough market research, securing pre-leases, and implementing phased project development to manage cash flow and reduce exposure. Real estate investors focus on diversifying property portfolios, employing conservative financing, and performing rigorous property due diligence to minimize financial and market risks. Both professionals utilize risk assessment tools and monitor economic indicators to anticipate and respond to market fluctuations effectively.

Financial Returns and Profit Potential

Real estate developers typically achieve higher financial returns by creating value through property development, involving construction, zoning, and design, which allows for significant profit margins upon project completion. Real estate investors focus on acquiring income-generating assets, prioritizing steady cash flow and long-term appreciation, resulting in more consistent but often lower immediate profits. Understanding the distinctions in risk exposure, capital requirements, and market timing is essential for maximizing profit potential in either role.

Market Analysis and Research

Real estate developers focus on comprehensive market analysis to identify emerging trends, zoning regulations, and growth opportunities that influence project feasibility and design. In contrast, real estate investors prioritize market research to evaluate property values, rental yields, and risk factors that affect investment returns. Both roles rely heavily on data-driven insights but apply them differently to either create or capitalize on real estate assets.

Legal and Regulatory Considerations

Real estate developers must navigate complex zoning laws, environmental regulations, and building codes to obtain necessary permits before construction. Real estate investors face due diligence requirements including title searches, contract reviews, and compliance with local tenant laws to mitigate legal risks. Both roles require adherence to tax regulations and disclosure obligations, but developers often encounter more stringent regulatory oversight during project approval phases.

Career Paths and Growth Opportunities

Real estate developers focus on project management, land acquisition, and construction, offering career growth through increasing project scale and specialization in commercial or residential developments. Real estate investors prioritize property acquisition, portfolio management, and financial analysis, with growth opportunities tied to market knowledge, capital accumulation, and diversification strategies. Both paths demand strong analytical skills and market insight, but developers primarily drive value through development expertise, while investors leverage market timing and investment acumen for wealth creation.

Choosing the Right Role in Real Estate

Real estate developers focus on creating and managing property projects from inception to completion, involving land acquisition, construction, and marketing. Real estate investors typically purchase properties with the intent to generate passive income or capital appreciation through rentals or resale. Choosing the right role depends on factors like risk tolerance, capital availability, active involvement preference, and long-term financial goals in the real estate market.

Real Estate Developer vs Real Estate Investor Infographic

jobdiv.com

jobdiv.com