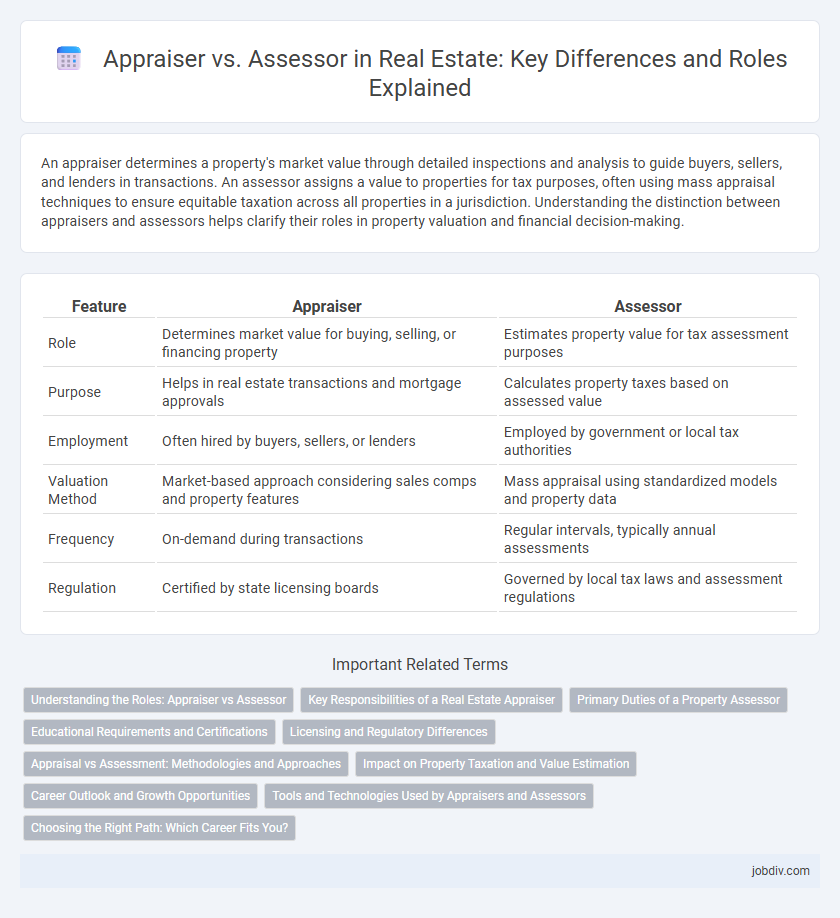

An appraiser determines a property's market value through detailed inspections and analysis to guide buyers, sellers, and lenders in transactions. An assessor assigns a value to properties for tax purposes, often using mass appraisal techniques to ensure equitable taxation across all properties in a jurisdiction. Understanding the distinction between appraisers and assessors helps clarify their roles in property valuation and financial decision-making.

Table of Comparison

| Feature | Appraiser | Assessor |

|---|---|---|

| Role | Determines market value for buying, selling, or financing property | Estimates property value for tax assessment purposes |

| Purpose | Helps in real estate transactions and mortgage approvals | Calculates property taxes based on assessed value |

| Employment | Often hired by buyers, sellers, or lenders | Employed by government or local tax authorities |

| Valuation Method | Market-based approach considering sales comps and property features | Mass appraisal using standardized models and property data |

| Frequency | On-demand during transactions | Regular intervals, typically annual assessments |

| Regulation | Certified by state licensing boards | Governed by local tax laws and assessment regulations |

Understanding the Roles: Appraiser vs Assessor

Appraisers determine a property's market value based on current conditions, comparable sales, and property specifics to support real estate transactions and financing. Assessors focus on evaluating property values within a jurisdiction for tax assessment purposes, using standardized methods and mass appraisal techniques. Understanding these roles clarifies how market value and assessed value differ, impacting buying decisions and property tax obligations.

Key Responsibilities of a Real Estate Appraiser

A real estate appraiser evaluates property value through comprehensive market analysis, property inspection, and comparative sales data to provide accurate and objective appraisals for buyers, sellers, and lenders. They prepare detailed appraisal reports used in mortgage financing, property tax assessments, and investment decisions. Appraisers ensure compliance with industry standards such as the Uniform Standards of Professional Appraisal Practice (USPAP) to maintain credibility and accuracy in valuation.

Primary Duties of a Property Assessor

A property assessor primarily determines the value of real estate for taxation purposes by conducting detailed property inspections and analyzing market data. They ensure that property assessments are accurate and comply with local tax laws, affecting homeowners' tax bills. Unlike appraisers who serve buyers or sellers, assessors work for government entities to establish fair property tax rates.

Educational Requirements and Certifications

Appraisers in real estate must complete specific education programs, often including courses in appraisal principles, practices, and ethics, followed by certification through organizations like the Appraisal Institute or state licensing boards. Assessors typically require a degree in public administration, finance, or a related field, coupled with government certification or licensure standards that vary by jurisdiction. Both roles demand continuing education to maintain credentials and stay updated on industry regulations and valuation techniques.

Licensing and Regulatory Differences

Appraisers are licensed professionals required to meet state-specific certification standards, including rigorous education, training, and passing a comprehensive exam, ensuring accurate property valuation for transactions. Assessors, often employed by local governments, may not require formal licensing but must comply with state regulations governing property tax assessments and public transparency. Licensing for appraisers emphasizes valuation expertise and independence, while assessors focus on uniformity and regulatory compliance in property tax administration.

Appraisal vs Assessment: Methodologies and Approaches

Appraisal utilizes market-based methodologies, incorporating comparables, cost, and income approaches to determine a property's fair market value for financing or sale purposes. Assessment relies on mass appraisal techniques, often employing standardized formulas and statistical models to assign values for tax purposes within a jurisdiction. Both processes analyze property characteristics but differ in scope, frequency, and application objectives.

Impact on Property Taxation and Value Estimation

Appraisers provide a market-based property valuation primarily used in buying, selling, and refinancing, directly influencing property tax appeals and mortgage decisions. Assessors determine the assessed value for taxation based on standardized formulas and local tax regulations, impacting the annual property tax bill. Differences in methodologies between appraisers and assessors can lead to variations in property tax amounts and perceived market value.

Career Outlook and Growth Opportunities

Appraisers, specializing in property valuation for sales and financing, often experience steady demand driven by real estate market fluctuations and lending activity, with projected job growth of around 5% through 2031. Assessors, who determine property tax values for local governments, have more stable employment but slower growth rates, typically below average compared to other real estate careers. Career advancement for appraisers includes certification and specialization in commercial or residential properties, while assessors may progress within government agencies to supervisory or managerial roles.

Tools and Technologies Used by Appraisers and Assessors

Appraisers utilize advanced software such as computer-assisted mass appraisal (CAMA) systems, geographic information systems (GIS), and 3D modeling tools to evaluate property value accurately. Assessors rely heavily on databases, aerial imagery, and automated valuation models (AVMs) to determine property assessments for tax purposes. Both professions employ mobile data collection devices and digital mapping technologies to enhance data accuracy and efficiency.

Choosing the Right Path: Which Career Fits You?

Appraisers and assessors both play crucial roles in real estate valuation, but choosing the right path depends on your career goals and skills. Appraisers provide detailed property value reports for transactions, requiring strong analytical skills and certification, while assessors focus on valuing properties for tax purposes, involving public sector work and expertise in local tax laws. Understanding the differences in job responsibilities, work environments, and certification requirements can help you determine which career aligns best with your interests in real estate valuation.

Appraiser vs Assessor Infographic

jobdiv.com

jobdiv.com