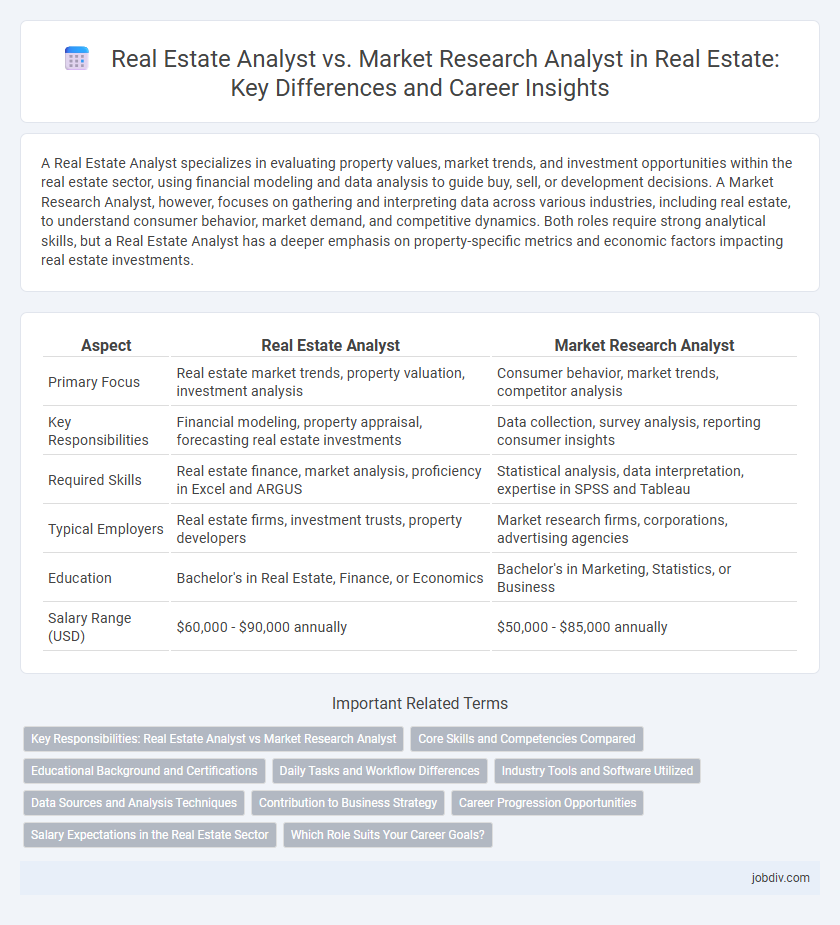

A Real Estate Analyst specializes in evaluating property values, market trends, and investment opportunities within the real estate sector, using financial modeling and data analysis to guide buy, sell, or development decisions. A Market Research Analyst, however, focuses on gathering and interpreting data across various industries, including real estate, to understand consumer behavior, market demand, and competitive dynamics. Both roles require strong analytical skills, but a Real Estate Analyst has a deeper emphasis on property-specific metrics and economic factors impacting real estate investments.

Table of Comparison

| Aspect | Real Estate Analyst | Market Research Analyst |

|---|---|---|

| Primary Focus | Real estate market trends, property valuation, investment analysis | Consumer behavior, market trends, competitor analysis |

| Key Responsibilities | Financial modeling, property appraisal, forecasting real estate investments | Data collection, survey analysis, reporting consumer insights |

| Required Skills | Real estate finance, market analysis, proficiency in Excel and ARGUS | Statistical analysis, data interpretation, expertise in SPSS and Tableau |

| Typical Employers | Real estate firms, investment trusts, property developers | Market research firms, corporations, advertising agencies |

| Education | Bachelor's in Real Estate, Finance, or Economics | Bachelor's in Marketing, Statistics, or Business |

| Salary Range (USD) | $60,000 - $90,000 annually | $50,000 - $85,000 annually |

Key Responsibilities: Real Estate Analyst vs Market Research Analyst

Real Estate Analysts focus on evaluating property values, conducting financial modeling, and assessing market trends to support investment decisions in real estate portfolios. Market Research Analysts gather and analyze consumer data, study market conditions, and forecast demand to help businesses optimize product positioning and marketing strategies. Both roles require strong analytical skills, but Real Estate Analysts specialize in property-specific data while Market Research Analysts emphasize broader market and consumer insights.

Core Skills and Competencies Compared

Real Estate Analysts excel in financial modeling, property valuation, and market trend forecasting, requiring strong quantitative analysis and knowledge of real estate laws. Market Research Analysts focus on data collection, consumer behavior analysis, and statistical software proficiency to interpret market conditions and predict demand. Both roles demand critical thinking and data interpretation skills, but Real Estate Analysts must integrate industry-specific economic indicators, while Market Research Analysts emphasize broad market dynamics and competitive analysis.

Educational Background and Certifications

Real Estate Analysts typically hold degrees in finance, economics, or real estate, often complemented by certifications such as Certified Commercial Investment Member (CCIM) or Real Estate Financial Modeling (REFM) credentials. Market Research Analysts usually possess degrees in marketing, statistics, or business administration, with relevant certifications like Professional Researcher Certification (PRC) or Certified Market Research Analyst (CMRA). Both roles emphasize strong analytical skills, but Real Estate Analysts focus on property valuation and investment analysis, while Market Research Analysts specialize in consumer behavior and market trends.

Daily Tasks and Workflow Differences

Real Estate Analysts primarily evaluate property values, analyze market trends, and prepare investment reports, focusing on financial modeling and real estate-specific data sets. Market Research Analysts gather and interpret broader consumer and market data, conduct surveys, and assess industry competition to identify market opportunities beyond real estate. Workflow for Real Estate Analysts centers around property metrics and transactional data, while Market Research Analysts engage in diverse data collection methods and trend analysis across various industries.

Industry Tools and Software Utilized

Real Estate Analysts leverage industry-specific software such as CoStar, Argus Enterprise, and REoptimizer to evaluate property performance, forecast market trends, and conduct investment analysis. Market Research Analysts utilize tools like SPSS, Tableau, and Google Analytics to analyze consumer behavior, market conditions, and competitive landscapes across various industries. Both roles require proficiency in data visualization and statistical software, but Real Estate Analysts focus on property and financial modeling tools tailored to commercial and residential real estate markets.

Data Sources and Analysis Techniques

Real Estate Analysts primarily utilize property transaction records, zoning laws, and geographic information systems (GIS) data to evaluate market trends and investment potential, employing statistical modeling and financial forecasting techniques. Market Research Analysts gather consumer behavior data, competitor analysis, and industry reports through surveys, focus groups, and secondary sources, applying qualitative analysis and predictive analytics to understand market demand. Both roles leverage big data and machine learning algorithms but differ in their focus--Real Estate Analysts emphasize asset valuation and location-based insights, while Market Research Analysts concentrate on consumer preferences and market segmentation.

Contribution to Business Strategy

Real Estate Analysts provide critical insights by evaluating property values, market trends, and financial risks to guide investment decisions and optimize portfolio performance. Market Research Analysts contribute by analyzing consumer behavior, competitive landscapes, and economic indicators to shape marketing strategies and forecast demand in real estate sectors. Both roles collaboratively enhance business strategy through data-driven recommendations, with Real Estate Analysts focusing on asset valuation and Market Research Analysts on market positioning.

Career Progression Opportunities

Real Estate Analysts often advance to senior roles such as Portfolio Manager or Real Estate Investment Director, leveraging expertise in property valuation, market trends, and financial modeling. Market Research Analysts typically progress into positions like Market Research Manager or Consumer Insights Director, focusing on broad industry trends, data analytics, and strategic planning across various sectors. Career progression for Real Estate Analysts is specialized within real estate investments, while Market Research Analysts enjoy diverse opportunities across multiple industries.

Salary Expectations in the Real Estate Sector

Real estate analysts in the real estate sector typically command higher salaries than market research analysts due to their specialized focus on property valuation, investment potential, and financial forecasting. According to industry reports, real estate analysts earn an average annual salary ranging from $65,000 to $90,000, while market research analysts working within real estate often make between $50,000 and $75,000. Salary expectations increase with experience, geographic location, and the complexity of real estate projects handled, highlighting the premium placed on sector-specific analytical skills.

Which Role Suits Your Career Goals?

Real Estate Analysts specialize in evaluating property values, market trends, and investment opportunities within the real estate sector, making them ideal for careers focused on property development and investment strategy. Market Research Analysts gather and analyze consumer data across various industries, offering broader insights suitable for roles in marketing, product development, or business strategy beyond real estate. Choosing between the two depends on whether your career goals align with in-depth real estate market expertise or versatile analytical skills applicable to multiple sectors.

Real Estate Analyst vs Market Research Analyst Infographic

jobdiv.com

jobdiv.com