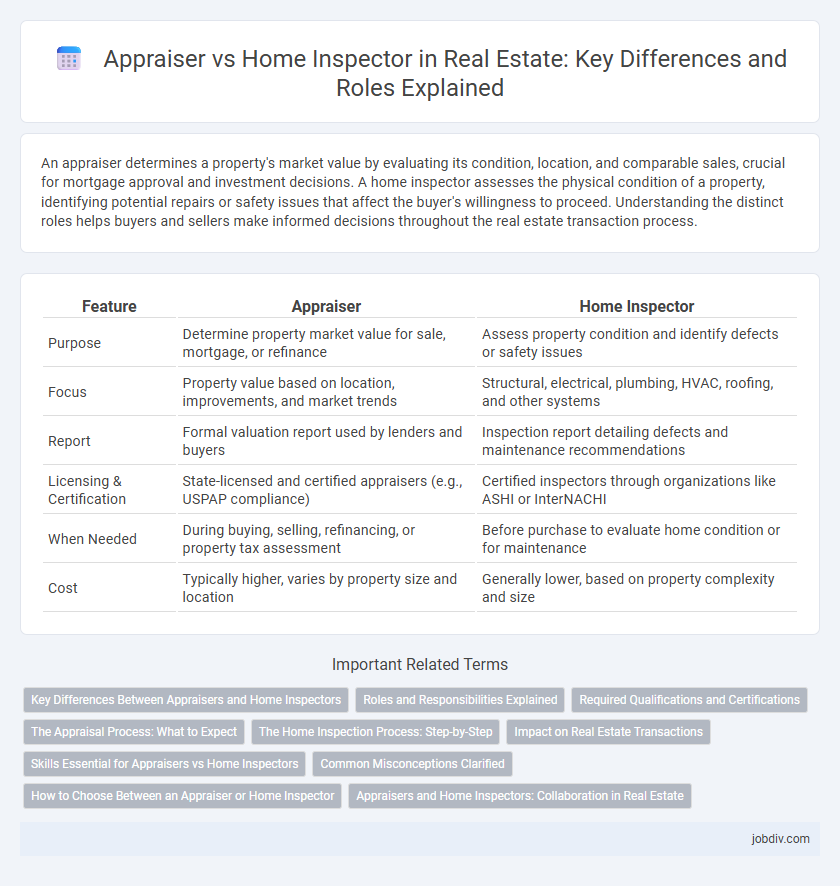

An appraiser determines a property's market value by evaluating its condition, location, and comparable sales, crucial for mortgage approval and investment decisions. A home inspector assesses the physical condition of a property, identifying potential repairs or safety issues that affect the buyer's willingness to proceed. Understanding the distinct roles helps buyers and sellers make informed decisions throughout the real estate transaction process.

Table of Comparison

| Feature | Appraiser | Home Inspector |

|---|---|---|

| Purpose | Determine property market value for sale, mortgage, or refinance | Assess property condition and identify defects or safety issues |

| Focus | Property value based on location, improvements, and market trends | Structural, electrical, plumbing, HVAC, roofing, and other systems |

| Report | Formal valuation report used by lenders and buyers | Inspection report detailing defects and maintenance recommendations |

| Licensing & Certification | State-licensed and certified appraisers (e.g., USPAP compliance) | Certified inspectors through organizations like ASHI or InterNACHI |

| When Needed | During buying, selling, refinancing, or property tax assessment | Before purchase to evaluate home condition or for maintenance |

| Cost | Typically higher, varies by property size and location | Generally lower, based on property complexity and size |

Key Differences Between Appraisers and Home Inspectors

Appraisers determine a property's market value by analyzing recent sales, location, and condition to support mortgage lending decisions, while home inspectors evaluate a home's structural integrity, systems, and safety to identify defects and potential repairs. Appraisals focus primarily on financial valuation, whereas inspections provide detailed assessments of a property's physical condition. Both roles are essential in real estate transactions but serve distinct purposes for buyers, sellers, and lenders.

Roles and Responsibilities Explained

Appraisers determine a property's market value by analyzing comparable sales, property condition, and location for lending and sale purposes. Home inspectors assess the physical condition of a property, identifying potential defects or safety issues in systems like plumbing, electrical, and structural integrity. While appraisers focus on valuation for financing decisions, home inspectors provide a detailed report on the property's overall condition for buyers' informed decisions.

Required Qualifications and Certifications

Appraisers must hold a state license or certification, which requires completing specific education, passing a comprehensive exam, and gaining supervised experience as mandated by the Appraiser Qualifications Board (AQB). Home inspectors generally need to be licensed or certified according to state regulations, often requiring completion of a standardized training program and passing an exam by organizations such as the International Association of Certified Home Inspectors (InterNACHI) or the American Society of Home Inspectors (ASHI). Both roles demand continued education to maintain credentials, but appraisers focus on valuation standards under USPAP, while home inspectors emphasize structural and safety assessment criteria.

The Appraisal Process: What to Expect

The appraisal process involves a licensed appraiser evaluating a property's market value by examining its condition, location, and comparable sales. Appraisers conduct thorough inspections, assessing structural elements, amenities, and overall market trends to provide an unbiased, professional estimate. The final appraisal report is crucial for lenders and buyers, influencing mortgage approval and sale price negotiations.

The Home Inspection Process: Step-by-Step

The home inspection process begins with a thorough examination of the property's major systems, including roofing, plumbing, electrical, HVAC, and structural components, to identify potential defects or safety issues. The home inspector documents findings with detailed notes, photographs, and recommendations for repairs or further evaluation by specialists. This step-by-step inspection ensures buyers understand the condition of the property before closing, reducing risks and aiding in informed decision-making.

Impact on Real Estate Transactions

Appraisers provide an objective property valuation essential for securing mortgages and finalizing real estate transactions, directly influencing loan approvals and sale prices. Home inspectors assess the condition and safety of the property, identifying potential issues that can affect buyer decisions and negotiation terms. Both roles are critical, with appraisers impacting financial aspects and inspectors ensuring the property's structural and equipment integrity.

Skills Essential for Appraisers vs Home Inspectors

Appraisers require strong analytical skills and expertise in market trends evaluation, property value assessment, and financial knowledge to determine accurate real estate values. Home Inspectors must possess thorough knowledge of building systems, structural integrity, and safety standards to identify defects or maintenance issues within a property. Precision, attention to detail, and understanding of regulatory compliance are essential skills that differentiate each professional's role in the real estate transaction process.

Common Misconceptions Clarified

Appraisers provide an unbiased estimate of a property's market value based on factors like location, condition, and comparable sales, whereas home inspectors assess the physical condition of a property, identifying potential defects and safety issues. A common misconception is that appraisers inspect the home's structural integrity, but their main focus is valuation, not detailed inspections. Understanding these distinct roles ensures better decision-making during real estate transactions and avoids confusion about the scope and purpose of each professional's report.

How to Choose Between an Appraiser or Home Inspector

Choosing between an appraiser and a home inspector depends on your specific real estate needs: an appraiser provides a professional property valuation crucial for mortgage approval and market pricing, while a home inspector thoroughly examines the property's physical condition to identify repairs or safety issues. For accurate home value assessment, select a licensed appraiser with expertise in local market trends. Opt for a certified home inspector to uncover potential structural defects and maintenance problems before finalizing a purchase.

Appraisers and Home Inspectors: Collaboration in Real Estate

Appraisers and Home Inspectors collaborate closely to ensure accurate property valuations and thorough condition assessments, critical for successful real estate transactions. While appraisers focus on determining market value through detailed analysis of comparable sales and property characteristics, home inspectors evaluate structural integrity, system functionality, and potential safety issues. Their combined expertise provides buyers, sellers, and lenders with comprehensive insights, reducing risks and supporting informed decision-making in the housing market.

Appraiser vs Home Inspector Infographic

jobdiv.com

jobdiv.com