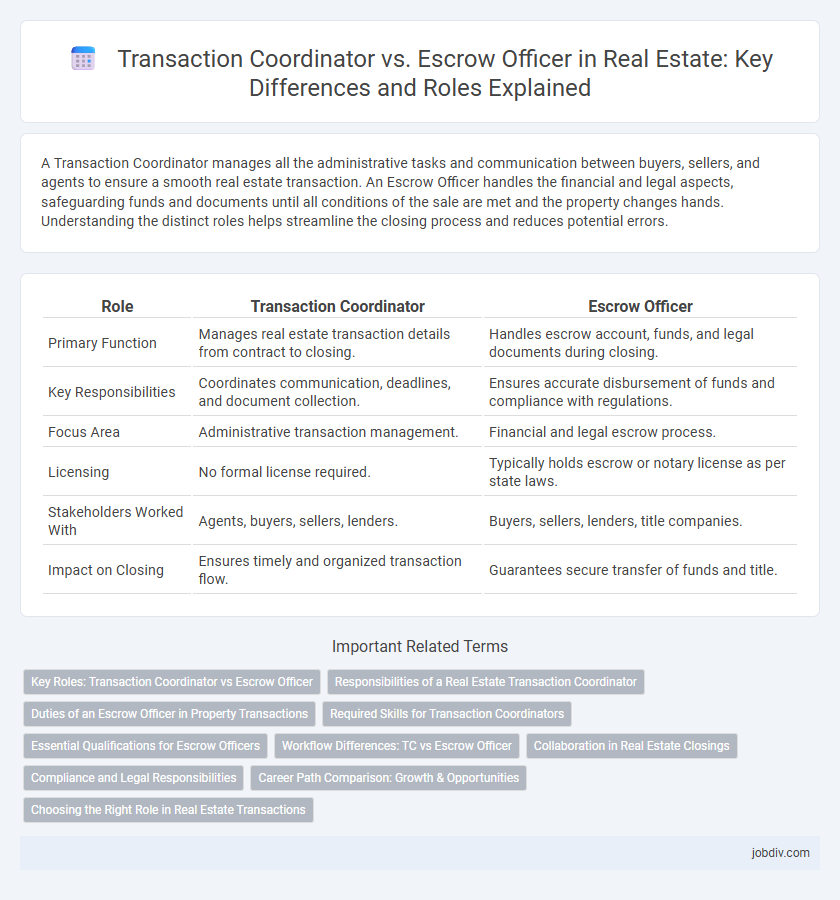

A Transaction Coordinator manages all the administrative tasks and communication between buyers, sellers, and agents to ensure a smooth real estate transaction. An Escrow Officer handles the financial and legal aspects, safeguarding funds and documents until all conditions of the sale are met and the property changes hands. Understanding the distinct roles helps streamline the closing process and reduces potential errors.

Table of Comparison

| Role | Transaction Coordinator | Escrow Officer |

|---|---|---|

| Primary Function | Manages real estate transaction details from contract to closing. | Handles escrow account, funds, and legal documents during closing. |

| Key Responsibilities | Coordinates communication, deadlines, and document collection. | Ensures accurate disbursement of funds and compliance with regulations. |

| Focus Area | Administrative transaction management. | Financial and legal escrow process. |

| Licensing | No formal license required. | Typically holds escrow or notary license as per state laws. |

| Stakeholders Worked With | Agents, buyers, sellers, lenders. | Buyers, sellers, lenders, title companies. |

| Impact on Closing | Ensures timely and organized transaction flow. | Guarantees secure transfer of funds and title. |

Key Roles: Transaction Coordinator vs Escrow Officer

Transaction Coordinators manage and streamline real estate contract processes, ensuring all documents are complete and deadlines are met, facilitating smooth communication between buyers, sellers, and agents. Escrow Officers handle the financial aspects of the transaction, securely managing funds, preparing escrow instructions, and ensuring proper disbursement upon closing. While Transaction Coordinators focus on administrative coordination, Escrow Officers specialize in compliance and the legal transfer of property ownership.

Responsibilities of a Real Estate Transaction Coordinator

Real estate transaction coordinators manage the administrative tasks involved in closing deals, including document preparation, deadline tracking, and communication between agents, clients, and lenders. They ensure all contracts, disclosures, and contingencies are completed accurately and submitted on time to prevent delays. Their role streamlines the transaction process, allowing agents to focus on client relationships and sales.

Duties of an Escrow Officer in Property Transactions

An Escrow Officer manages the escrow process in property transactions, ensuring all contractual obligations between buyer and seller are fulfilled before closing. They handle the collection and disbursement of funds, review legal documents, and coordinate with lenders, real estate agents, and title companies to guarantee a smooth transfer of ownership. Escrow Officers also verify that contingencies such as inspections and appraisals are satisfied, safeguarding both parties' interests throughout the closing process.

Required Skills for Transaction Coordinators

Transaction coordinators must excel in organization, communication, and detailed record-keeping to manage multiple real estate contracts and deadlines efficiently. Proficiency in real estate software and understanding compliance regulations ensure smooth transaction processing and risk mitigation. Strong problem-solving skills and client coordination abilities are essential to facilitate seamless collaboration among agents, lenders, and escrow officers.

Essential Qualifications for Escrow Officers

Escrow officers must possess a thorough understanding of real estate contracts, title insurance, and regulatory compliance to ensure smooth transaction closings. Essential qualifications include strong attention to detail, excellent organizational skills, and the ability to handle sensitive financial documents securely. Certification through state licensing or industry-specific training programs often enhances their credibility and expertise in managing escrow processes.

Workflow Differences: TC vs Escrow Officer

Transaction Coordinators streamline the real estate process by managing contract deadlines, communication, and document organization from contract to closing, ensuring smooth timely transactions. Escrow Officers handle funds, title searches, and legal documentation, acting as a neutral third party to facilitate the transfer of property ownership. While Transaction Coordinators focus on process management and client coordination, Escrow Officers concentrate on financial and legal aspects within the escrow workflow.

Collaboration in Real Estate Closings

Transaction Coordinators and Escrow Officers collaborate closely to ensure seamless real estate closings by managing documentation, deadlines, and communication between buyers, sellers, and agents. Transaction Coordinators oversee contract compliance and coordinate with all parties to keep the process on track, while Escrow Officers handle the financial aspects and escrow account management to secure funds until closing. Their combined efforts streamline the closing process, reduce errors, and enhance client satisfaction through efficient coordination and precise execution.

Compliance and Legal Responsibilities

Transaction Coordinators manage real estate contracts, ensuring all documentation complies with state laws and brokerage policies, thereby streamlining the closing process. Escrow Officers hold legal responsibility for safeguarding funds and documents, verifying compliance with escrow agreements and regulatory requirements to prevent fraud. Both roles are critical for maintaining legal integrity and adhering to compliance standards throughout real estate transactions.

Career Path Comparison: Growth & Opportunities

Transaction Coordinators often advance by gaining expertise in contract management and client communications, opening pathways to project management or broker roles within real estate firms. Escrow Officers build specialized skills in legal compliance and financial settlements, enabling progression into senior escrow management or compliance officer positions. Both careers offer distinct growth opportunities, with Transaction Coordinators leaning towards broader operational roles and Escrow Officers focusing on regulatory and fiduciary responsibilities.

Choosing the Right Role in Real Estate Transactions

Transaction coordinators streamline real estate deals by managing paperwork, deadlines, and communication between agents, buyers, and sellers, ensuring smooth contract execution. Escrow officers handle the fiduciary process, safeguarding funds, preparing closing documents, and facilitating title transfers to guarantee a secure transaction. Selecting the right role depends on whether you prefer administrative coordination or managing legal and financial responsibilities during closing.

Transaction Coordinator vs Escrow Officer Infographic

jobdiv.com

jobdiv.com