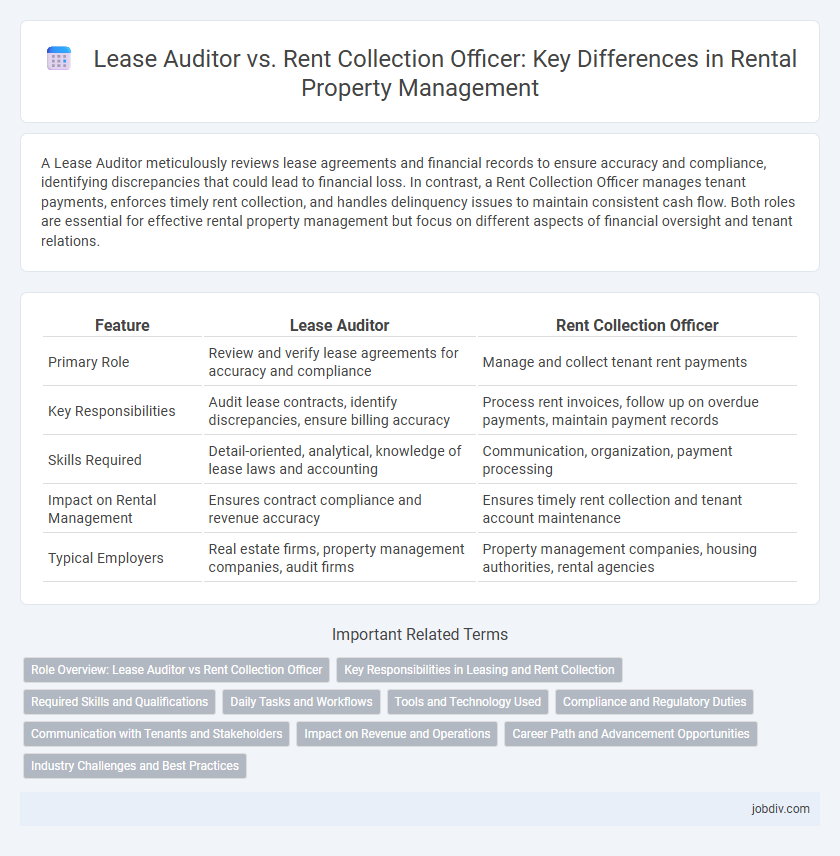

A Lease Auditor meticulously reviews lease agreements and financial records to ensure accuracy and compliance, identifying discrepancies that could lead to financial loss. In contrast, a Rent Collection Officer manages tenant payments, enforces timely rent collection, and handles delinquency issues to maintain consistent cash flow. Both roles are essential for effective rental property management but focus on different aspects of financial oversight and tenant relations.

Table of Comparison

| Feature | Lease Auditor | Rent Collection Officer |

|---|---|---|

| Primary Role | Review and verify lease agreements for accuracy and compliance | Manage and collect tenant rent payments |

| Key Responsibilities | Audit lease contracts, identify discrepancies, ensure billing accuracy | Process rent invoices, follow up on overdue payments, maintain payment records |

| Skills Required | Detail-oriented, analytical, knowledge of lease laws and accounting | Communication, organization, payment processing |

| Impact on Rental Management | Ensures contract compliance and revenue accuracy | Ensures timely rent collection and tenant account maintenance |

| Typical Employers | Real estate firms, property management companies, audit firms | Property management companies, housing authorities, rental agencies |

Role Overview: Lease Auditor vs Rent Collection Officer

Lease Auditors analyze lease agreements and financial records to ensure accuracy, compliance, and appropriate rent calculations, often identifying discrepancies or potential cost savings for landlords or property managers. Rent Collection Officers focus on managing tenant payments, tracking rent receipts, and addressing late payments or delinquencies to maintain consistent cash flow. Both roles are essential for effective rental property management but emphasize distinct aspects of lease and financial oversight.

Key Responsibilities in Leasing and Rent Collection

Lease auditors specialize in reviewing and verifying lease agreements to ensure compliance, accuracy of rent calculations, and identification of discrepancies or errors. Rent collection officers focus on managing tenant payments, processing rent receipts, addressing overdue accounts, and maintaining accurate financial records for rental income. Both roles are essential for optimizing lease management and ensuring timely rent collection within property management.

Required Skills and Qualifications

Lease Auditors require strong analytical skills, proficiency in financial analysis software, and a deep understanding of lease agreements and real estate law to accurately review and verify lease terms and financial records. Rent Collection Officers need excellent communication skills, knowledge of payment processing systems, and a solid grasp of debt collection laws to efficiently manage rent payments and resolve arrears. Both roles benefit from attention to detail, organizational skills, and a background in property management or accounting.

Daily Tasks and Workflows

Lease auditors conduct detailed reviews of lease agreements, verifying accuracy in rent calculations, expense allocations, and compliance with contract terms. Rent collection officers manage daily rent payments, track overdue accounts, and communicate directly with tenants to resolve payment issues. Both roles require close collaboration with property management teams to ensure accurate financial records and smooth operational workflows.

Tools and Technology Used

Lease Auditors leverage advanced data analytics software and automated lease abstraction tools to meticulously verify lease terms and detect discrepancies. Rent Collection Officers utilize property management platforms integrated with payment processing systems to efficiently track rent payments and manage tenant accounts. Both roles benefit from cloud-based solutions to enhance real-time data access and streamline financial workflows.

Compliance and Regulatory Duties

Lease Auditors ensure compliance by meticulously reviewing lease agreements and financial records to identify discrepancies and enforce regulatory standards. Rent Collection Officers focus on adherence to rent collection policies, ensuring timely payments and maintaining accurate tenant payment records to meet legal obligations. Both roles are critical in maintaining regulatory compliance within property management but address different aspects of financial oversight.

Communication with Tenants and Stakeholders

A Lease Auditor specializes in reviewing lease agreements and ensuring compliance, requiring clear and precise communication with tenants and stakeholders to clarify contract terms and resolve discrepancies. Rent Collection Officers focus on collecting rent payments and managing arrears, necessitating frequent, solution-oriented interaction to negotiate payment plans and address tenant concerns. Both roles demand effective communication skills, but Lease Auditors emphasize contractual clarity, while Rent Collection Officers prioritize payment resolution and tenant relationship management.

Impact on Revenue and Operations

A Lease Auditor enhances revenue accuracy by identifying discrepancies and ensuring lease compliance, thereby minimizing financial losses due to billing errors or overlooked charges. In contrast, a Rent Collection Officer directly influences cash flow by efficiently managing tenant payments and reducing delinquency rates, which stabilizes daily operations. Both roles are critical, as auditors optimize long-term financial health while collection officers maintain operational liquidity.

Career Path and Advancement Opportunities

Lease Auditors specialize in reviewing and verifying lease agreements to ensure accuracy and compliance, often advancing into senior audit roles or financial management positions within real estate firms. Rent Collection Officers focus on managing tenant payments and resolving delinquencies, with career paths leading toward credit control management or property management roles. Both roles offer pathways into broader real estate finance or administration but diverge in their specialization and progression opportunities.

Industry Challenges and Best Practices

Lease auditors navigate complex financial records to identify discrepancies, ensuring accuracy in rent calculations and compliance with lease terms, which addresses common industry challenges like overbilling and missed revenue. Rent collection officers manage timely payments and tenant communications to reduce delinquencies and improve cash flow, tackling issues such as late payments and tenant disputes. Best practices include integrating advanced software for real-time data tracking and fostering transparent communication channels between auditors, collection officers, and tenants to enhance overall rental management efficiency.

Lease Auditor vs Rent Collection Officer Infographic

jobdiv.com

jobdiv.com