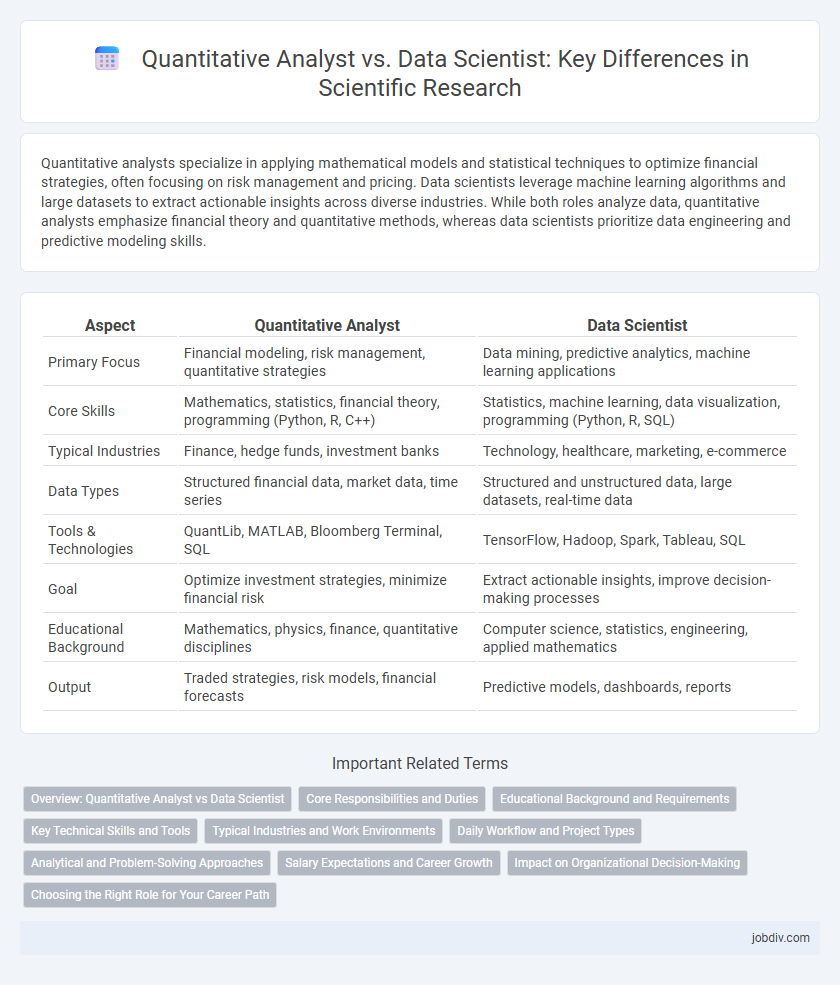

Quantitative analysts specialize in applying mathematical models and statistical techniques to optimize financial strategies, often focusing on risk management and pricing. Data scientists leverage machine learning algorithms and large datasets to extract actionable insights across diverse industries. While both roles analyze data, quantitative analysts emphasize financial theory and quantitative methods, whereas data scientists prioritize data engineering and predictive modeling skills.

Table of Comparison

| Aspect | Quantitative Analyst | Data Scientist |

|---|---|---|

| Primary Focus | Financial modeling, risk management, quantitative strategies | Data mining, predictive analytics, machine learning applications |

| Core Skills | Mathematics, statistics, financial theory, programming (Python, R, C++) | Statistics, machine learning, data visualization, programming (Python, R, SQL) |

| Typical Industries | Finance, hedge funds, investment banks | Technology, healthcare, marketing, e-commerce |

| Data Types | Structured financial data, market data, time series | Structured and unstructured data, large datasets, real-time data |

| Tools & Technologies | QuantLib, MATLAB, Bloomberg Terminal, SQL | TensorFlow, Hadoop, Spark, Tableau, SQL |

| Goal | Optimize investment strategies, minimize financial risk | Extract actionable insights, improve decision-making processes |

| Educational Background | Mathematics, physics, finance, quantitative disciplines | Computer science, statistics, engineering, applied mathematics |

| Output | Traded strategies, risk models, financial forecasts | Predictive models, dashboards, reports |

Overview: Quantitative Analyst vs Data Scientist

Quantitative analysts specialize in applying mathematical models and statistical techniques to financial markets, primarily focusing on risk management, trading strategies, and portfolio optimization. Data scientists utilize machine learning, data mining, and big data technologies to extract actionable insights across various industries, including healthcare, marketing, and technology. While both roles require strong programming skills and statistical knowledge, quantitative analysts emphasize finance-specific quantitative methods, whereas data scientists adopt broader data analysis and predictive modeling approaches.

Core Responsibilities and Duties

Quantitative analysts primarily develop mathematical models to evaluate financial risks and optimize investment strategies, leveraging statistics, calculus, and programming skills. Data scientists focus on extracting actionable insights from large datasets using machine learning, data mining, and statistical analysis to support business decision-making. Both roles require strong analytical skills, but quantitative analysts emphasize financial theory and predictive modeling, while data scientists integrate domain knowledge with data engineering and visualization techniques.

Educational Background and Requirements

Quantitative Analysts typically possess advanced degrees in mathematics, finance, or statistics, emphasizing strong skills in stochastic calculus, financial modeling, and programming languages like Python and R. Data Scientists usually hold degrees in computer science, statistics, or engineering, with a focus on machine learning, data mining, and big data technologies such as Hadoop and Spark. Both professions require proficiency in statistical analysis and programming, but Quantitative Analysts often need deeper expertise in financial theory while Data Scientists prioritize data engineering and algorithm development.

Key Technical Skills and Tools

Quantitative Analysts excel in advanced mathematical modeling, statistical analysis, and proficiency with tools like MATLAB, SAS, and R for financial data interpretation. Data Scientists specialize in machine learning, big data frameworks such as Hadoop and Spark, alongside Python and SQL for data extraction, cleaning, and predictive analytics. Both roles require strong programming skills, but Quant Analysts focus more on quantitative finance algorithms, whereas Data Scientists emphasize scalable data processing and algorithm development across various domains.

Typical Industries and Work Environments

Quantitative analysts primarily operate in financial services, hedge funds, and investment banking, leveraging statistical models to assess risk and optimize trading strategies. Data scientists are widely employed across tech companies, healthcare, retail, and marketing sectors, where they extract insights from large datasets to drive decision-making and innovation. Work environments for quantitative analysts often involve high-pressure, fast-paced settings, while data scientists typically work in collaborative, multidisciplinary teams using advanced machine learning techniques.

Daily Workflow and Project Types

Quantitative Analysts primarily engage in developing complex mathematical models for financial forecasting and risk management, focusing on structured data and real-time trading analytics within their daily workflow. Data Scientists work extensively on diverse datasets, applying machine learning algorithms and statistical analysis to extract actionable insights across industries such as healthcare, marketing, and technology. Project types for Quantitative Analysts often involve asset pricing and algorithmic trading strategies, whereas Data Scientist projects emphasize customer segmentation, predictive modeling, and natural language processing.

Analytical and Problem-Solving Approaches

Quantitative Analysts employ advanced mathematical models and statistical techniques to optimize financial decision-making and risk management, emphasizing precise data interpretation within structured frameworks. Data Scientists utilize a broader range of machine learning algorithms, big data tools, and exploratory data analysis to uncover patterns and generate predictive insights across diverse industries. Both roles prioritize analytical rigor, but Quantitative Analysts focus on quantitative modeling primarily in finance, while Data Scientists apply versatile data-driven problem-solving skills to complex, unstructured datasets.

Salary Expectations and Career Growth

Quantitative analysts typically earn higher salaries in finance sectors, with median compensation ranging from $90,000 to $150,000 annually, reflecting strong demand for expertise in mathematical modeling and risk assessment. Data scientists command salaries between $85,000 and $140,000, driven by their proficiency in machine learning, data analytics, and business intelligence across diverse industries. Career growth for quantitative analysts often leads to senior risk management or portfolio strategy roles, while data scientists advance toward specialization in artificial intelligence, big data engineering, or data-driven product management.

Impact on Organizational Decision-Making

Quantitative Analysts leverage advanced mathematical models and statistical techniques to optimize financial strategies, directly influencing investment decisions and risk management within organizations. Data Scientists integrate diverse data sources and apply machine learning algorithms to uncover patterns that inform business strategies across various departments. The complementary roles enhance organizational decision-making by combining rigorous quantitative analysis with broad data-driven insights, leading to more informed and actionable outcomes.

Choosing the Right Role for Your Career Path

Quantitative Analysts specialize in mathematical modeling and statistical analysis primarily for financial markets, leveraging strong programming skills in languages like Python, R, and MATLAB. Data Scientists encompass a broader scope, integrating machine learning, data engineering, and domain expertise to extract actionable insights from large, diverse datasets across various industries. Choosing the right role depends on your interest in finance-specific quantitative techniques versus a versatile data-driven approach applicable to multiple sectors.

Quantitative Analyst vs Data Scientist Infographic

jobdiv.com

jobdiv.com