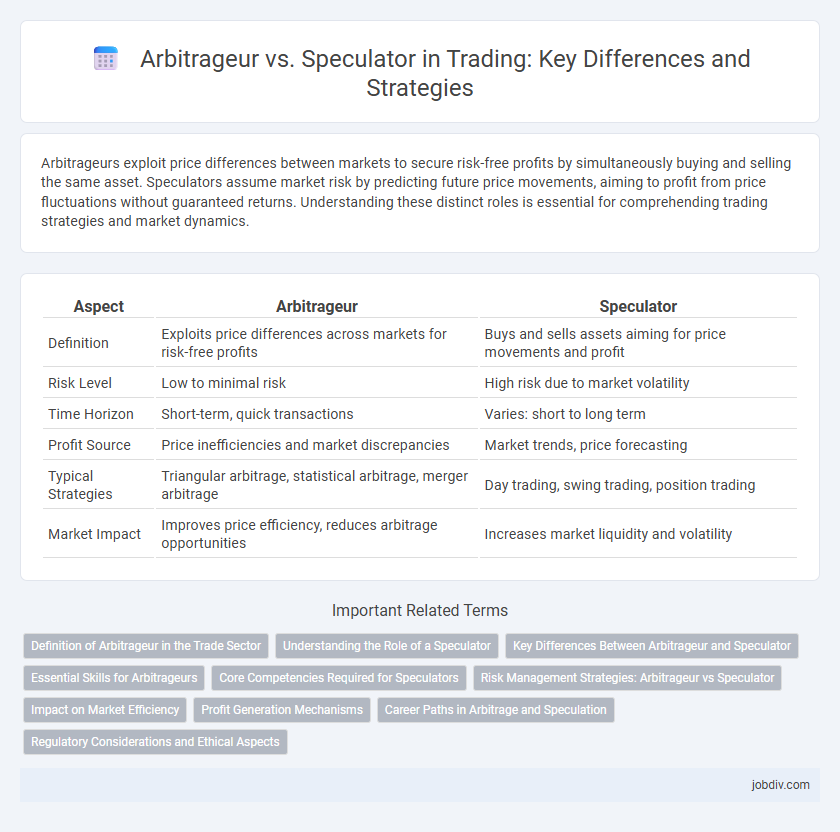

Arbitrageurs exploit price differences between markets to secure risk-free profits by simultaneously buying and selling the same asset. Speculators assume market risk by predicting future price movements, aiming to profit from price fluctuations without guaranteed returns. Understanding these distinct roles is essential for comprehending trading strategies and market dynamics.

Table of Comparison

| Aspect | Arbitrageur | Speculator |

|---|---|---|

| Definition | Exploits price differences across markets for risk-free profits | Buys and sells assets aiming for price movements and profit |

| Risk Level | Low to minimal risk | High risk due to market volatility |

| Time Horizon | Short-term, quick transactions | Varies: short to long term |

| Profit Source | Price inefficiencies and market discrepancies | Market trends, price forecasting |

| Typical Strategies | Triangular arbitrage, statistical arbitrage, merger arbitrage | Day trading, swing trading, position trading |

| Market Impact | Improves price efficiency, reduces arbitrage opportunities | Increases market liquidity and volatility |

Definition of Arbitrageur in the Trade Sector

An arbitrageur in the trade sector exploits price discrepancies of identical or similar financial instruments across different markets to secure risk-free profits. By simultaneously buying low in one market and selling high in another, arbitrageurs enhance market efficiency and liquidity. Their trading strategies rely on quick executions and advanced algorithms to capitalize on transient price variations.

Understanding the Role of a Speculator

A speculator assumes significant market risk by anticipating price movements in stocks, commodities, or currencies to generate profit, often using leverage to amplify returns. Unlike arbitrageurs who exploit price discrepancies for near risk-free gains, speculators rely on market trends, economic indicators, and sentiment analysis to make informed bets on future price direction. Their activity increases market liquidity and can contribute to price discovery but also introduces volatility due to the speculative nature of their trades.

Key Differences Between Arbitrageur and Speculator

Arbitrageurs exploit price discrepancies across different markets to secure risk-free profits by simultaneously buying low and selling high, ensuring minimal market exposure. Speculators assume significant market risk by betting on price movements and trends to generate high returns, often relying on market analysis and timing. The key difference lies in risk tolerance and strategy: arbitrageurs prioritize riskless profit from inefficiencies, while speculators accept uncertainty for potential gains.

Essential Skills for Arbitrageurs

Arbitrageurs require advanced analytical skills to rapidly identify and exploit price discrepancies across different markets, ensuring risk-free profits through precise timing and execution. Mastery of market microstructure and access to real-time data feeds are crucial for spotting fleeting arbitrage opportunities before they vanish. Strong risk management capabilities and algorithmic trading proficiency enable arbitrageurs to operate efficiently in highly competitive environments.

Core Competencies Required for Speculators

Speculators require strong analytical skills to predict market trends and interpret complex financial data accurately. Mastery of risk management techniques is essential to protect capital in volatile markets and to optimize leverage opportunities. Acute market intuition, combined with swift decision-making ability, enables speculators to capitalize on short-term price movements effectively.

Risk Management Strategies: Arbitrageur vs Speculator

Arbitrageurs employ risk management strategies centered on exploiting price discrepancies across markets with minimal exposure, often using hedging techniques to lock in profits and reduce market risk. Speculators, conversely, accept higher levels of risk by predicting price movements, utilizing stop-loss orders and position sizing to manage potential losses. Effective risk management for arbitrageurs involves deterministic trades with low volatility, while speculators rely on probabilistic assessments and dynamic adjustment of risk parameters.

Impact on Market Efficiency

Arbitrageurs enhance market efficiency by exploiting price discrepancies across different markets, ensuring prices converge to their true value and reducing arbitrage opportunities. Speculators contribute liquidity and risk absorption but can sometimes increase volatility due to their speculative bets on price movements. The combined activities of arbitrageurs and speculators help balance price discovery and market stability, promoting efficient allocation of resources in financial markets.

Profit Generation Mechanisms

Arbitrageurs generate profits by exploiting price discrepancies across different markets, executing simultaneous buy and sell transactions to ensure risk-free gains. Speculators achieve profits by forecasting market trends and assuming higher risks, aiming to capitalize on price fluctuations through strategic buying and selling. While arbitrageurs prioritize accuracy and speed to lock in guaranteed returns, speculators rely on market analysis and risk tolerance to maximize potential rewards.

Career Paths in Arbitrage and Speculation

Career paths for arbitrageurs often involve roles in hedge funds, proprietary trading firms, and investment banks where skills in quantitative analysis, risk management, and market inefficiencies exploitation are critical. Speculators typically pursue careers in commodities trading, stock market speculation, and derivatives markets, relying on market trend analysis, psychological insight, and rapid decision-making to capitalize on price volatility. Both paths demand strong financial acumen, but arbitrage focuses on low-risk, relative value strategies while speculation involves high-risk, directional bets.

Regulatory Considerations and Ethical Aspects

Arbitrageurs operate within clearly defined regulatory frameworks aimed at ensuring transparent market operations, often benefiting from lower compliance risks due to their role in exploiting price differentials across markets. Speculators face heightened regulatory scrutiny as their activities can increase market volatility and systemic risk, prompting rules designed to limit excessive risk-taking and potential manipulative behaviors. Ethical considerations emphasize that arbitrage contributes to market efficiency without distorting prices, whereas speculation can provoke debates on market fairness and the social impact of profit-driven risk exposure.

Arbitrageur vs Speculator Infographic

jobdiv.com

jobdiv.com