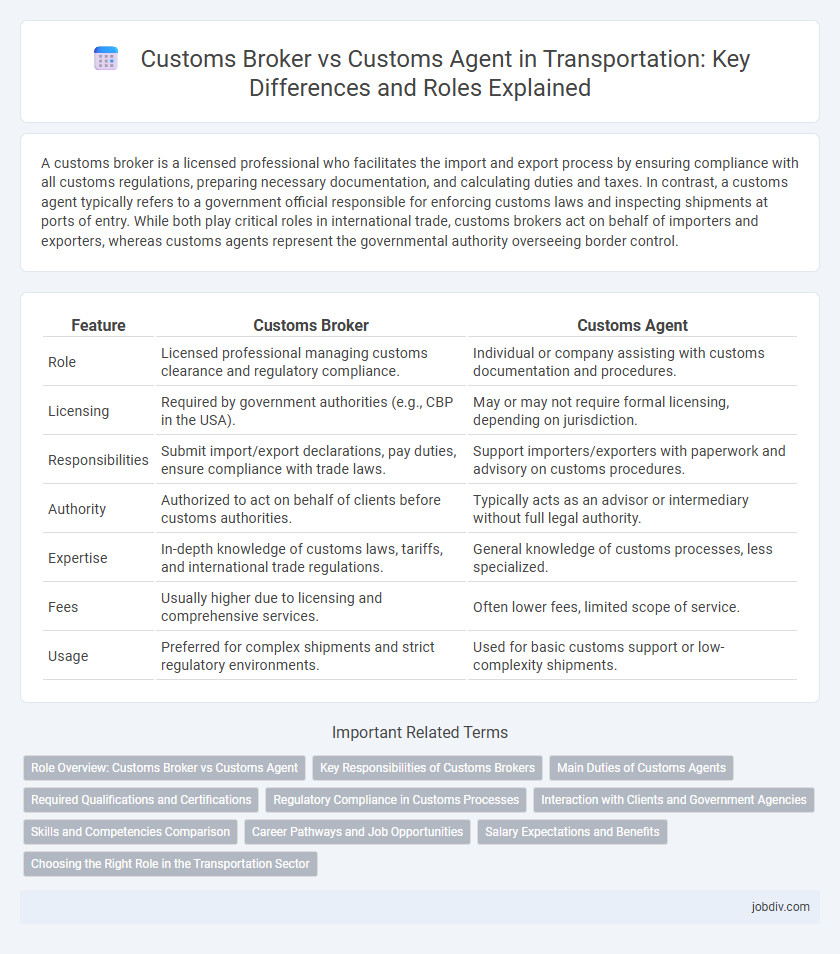

A customs broker is a licensed professional who facilitates the import and export process by ensuring compliance with all customs regulations, preparing necessary documentation, and calculating duties and taxes. In contrast, a customs agent typically refers to a government official responsible for enforcing customs laws and inspecting shipments at ports of entry. While both play critical roles in international trade, customs brokers act on behalf of importers and exporters, whereas customs agents represent the governmental authority overseeing border control.

Table of Comparison

| Feature | Customs Broker | Customs Agent |

|---|---|---|

| Role | Licensed professional managing customs clearance and regulatory compliance. | Individual or company assisting with customs documentation and procedures. |

| Licensing | Required by government authorities (e.g., CBP in the USA). | May or may not require formal licensing, depending on jurisdiction. |

| Responsibilities | Submit import/export declarations, pay duties, ensure compliance with trade laws. | Support importers/exporters with paperwork and advisory on customs procedures. |

| Authority | Authorized to act on behalf of clients before customs authorities. | Typically acts as an advisor or intermediary without full legal authority. |

| Expertise | In-depth knowledge of customs laws, tariffs, and international trade regulations. | General knowledge of customs processes, less specialized. |

| Fees | Usually higher due to licensing and comprehensive services. | Often lower fees, limited scope of service. |

| Usage | Preferred for complex shipments and strict regulatory environments. | Used for basic customs support or low-complexity shipments. |

Role Overview: Customs Broker vs Customs Agent

Customs brokers act as licensed intermediaries responsible for ensuring shipments comply with import and export regulations, handling documentation, duties, and tariffs on behalf of importers and exporters. Customs agents primarily assist in the enforcement of customs laws, conducting inspections and verifying cargo at borders to prevent illegal goods from entering a country. The key distinction lies in brokers facilitating compliance and clearance processes, while agents focus on regulatory enforcement and inspection duties.

Key Responsibilities of Customs Brokers

Customs brokers are licensed professionals responsible for ensuring shipments comply with all import and export regulations, preparing and submitting required documentation such as customs declarations, and calculating duties and tariffs accurately. They act as intermediaries between importers, exporters, and government customs authorities to facilitate smooth clearance of goods. Their expertise helps minimize delays and penalties by ensuring proper classification and valuation of products according to international trade laws.

Main Duties of Customs Agents

Customs agents primarily manage the clearance of goods through customs, ensuring compliance with import and export regulations while accurately preparing and submitting necessary documentation such as declarations and tariffs. They act as intermediaries between importers/exporters and government customs authorities, facilitating inspections and resolving disputes or delays. Customs agents also stay updated on changing trade laws and tariffs to provide expert guidance on duties and import restrictions.

Required Qualifications and Certifications

Customs brokers require a federal license issued by the U.S. Customs and Border Protection (CBP) after passing the Customs Broker License Exam, demonstrating knowledge in customs laws and regulations. Customs agents, often working for government agencies, typically need formal training and certifications specific to law enforcement or border protection, such as a background in import-export procedures and security clearance. Both roles demand comprehensive understanding of tariffs, import duties, and trade compliance, but customs brokers emphasize brokerage licensing while customs agents focus on enforcement credentials.

Regulatory Compliance in Customs Processes

Customs brokers and customs agents both play crucial roles in ensuring regulatory compliance during customs processes, but customs brokers are licensed professionals authorized by government agencies to prepare and submit customs documentation and facilitate the clearance of shipments. Customs agents often assist with routine administrative tasks and communication between importers, exporters, and customs authorities but typically lack the formal licensing required for full regulatory representation. Effective compliance management depends on the customs broker's in-depth knowledge of trade regulations, tariff classifications, and customs laws to prevent delays, fines, and shipment seizures.

Interaction with Clients and Government Agencies

Customs brokers act as authorized intermediaries who handle detailed documentation, compliance, and communication with government customs agencies to ensure smooth import and export processes. Customs agents primarily assist clients by facilitating cargo inspections and regulatory adherence but may have limited authority to submit official paperwork compared to brokers. Both roles require strong interaction skills with clients to provide updates and resolve issues while navigating complex customs regulations.

Skills and Competencies Comparison

Customs brokers possess in-depth knowledge of import-export regulations, tariff classification, and customs documentation, enabling them to facilitate smooth clearance processes and ensure compliance. Customs agents typically focus on coordination and communication between carriers, customs authorities, and clients, requiring strong negotiation and logistical skills. Expertise in regulatory updates and risk management is critical for customs brokers, while customs agents excel in operational execution and relationship management within transportation networks.

Career Pathways and Job Opportunities

Customs brokers manage the complex process of clearing goods through customs, requiring comprehensive knowledge of trade regulations and compliance, making them essential in import/export operations and offering career growth in international logistics firms or government agencies. Customs agents enforce customs laws and inspect shipments to prevent smuggling and illegal trade, providing career opportunities within government border protection and law enforcement. Both roles demand specialized training and certification, with customs brokers typically pursuing advanced roles in consultancy and global trade, whereas customs agents focus on regulatory enforcement and security.

Salary Expectations and Benefits

Customs brokers typically earn higher salaries, averaging between $50,000 and $75,000 annually, due to their licensing and responsibilities in clearing goods through customs. Customs agents, often employed by government agencies, have salaries ranging from $40,000 to $60,000, with benefits including job stability and government pensions. Benefits for brokers may include commissions and bonuses linked to successful clearance, while agents receive structured government healthcare and retirement plans.

Choosing the Right Role in the Transportation Sector

Choosing the right role in the transportation sector hinges on understanding the distinct responsibilities of a customs broker versus a customs agent. Customs brokers act as licensed professionals managing complex customs clearance, ensuring compliance with international trade regulations and tariff classifications. Customs agents typically support these processes by executing specific tasks under broker supervision, making it essential to select based on the level of expertise and regulatory authority required for your logistics operations.

Customs Broker vs Customs Agent Infographic

jobdiv.com

jobdiv.com