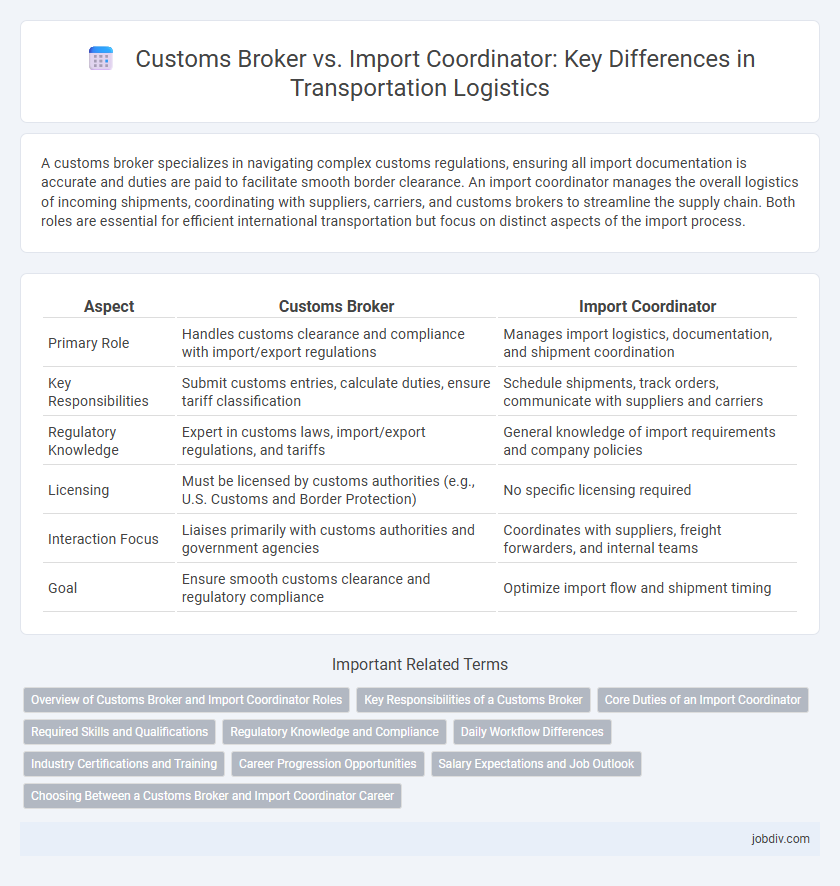

A customs broker specializes in navigating complex customs regulations, ensuring all import documentation is accurate and duties are paid to facilitate smooth border clearance. An import coordinator manages the overall logistics of incoming shipments, coordinating with suppliers, carriers, and customs brokers to streamline the supply chain. Both roles are essential for efficient international transportation but focus on distinct aspects of the import process.

Table of Comparison

| Aspect | Customs Broker | Import Coordinator |

|---|---|---|

| Primary Role | Handles customs clearance and compliance with import/export regulations | Manages import logistics, documentation, and shipment coordination |

| Key Responsibilities | Submit customs entries, calculate duties, ensure tariff classification | Schedule shipments, track orders, communicate with suppliers and carriers |

| Regulatory Knowledge | Expert in customs laws, import/export regulations, and tariffs | General knowledge of import requirements and company policies |

| Licensing | Must be licensed by customs authorities (e.g., U.S. Customs and Border Protection) | No specific licensing required |

| Interaction Focus | Liaises primarily with customs authorities and government agencies | Coordinates with suppliers, freight forwarders, and internal teams |

| Goal | Ensure smooth customs clearance and regulatory compliance | Optimize import flow and shipment timing |

Overview of Customs Broker and Import Coordinator Roles

Customs brokers specialize in navigating customs regulations, managing import/export documentation, and ensuring compliance with government requirements to facilitate smooth international shipments. Import coordinators focus on coordinating the logistics of incoming goods, managing supplier communications, and tracking shipment timelines to optimize supply chain efficiency. Both roles are essential in international trade but differ in regulatory expertise versus operational coordination within transportation management.

Key Responsibilities of a Customs Broker

Customs brokers are responsible for managing and facilitating the import and export of goods by ensuring compliance with all customs regulations and government policies, preparing and submitting necessary documentation such as customs declarations and invoices, and calculating duties, taxes, and tariffs accurately. They act as intermediaries between importers/exporters and government authorities, resolving any customs-related issues or disputes to avoid shipment delays. Their expertise in classification, valuation, and clearance protocols helps streamline the customs process and ensures timely delivery of international shipments.

Core Duties of an Import Coordinator

An Import Coordinator manages the end-to-end process of shipping goods across international borders, including tracking shipments, preparing documentation, and coordinating with customs officials to ensure compliance with import regulations. Core duties involve liaising with freight forwarders, managing import licenses, and resolving discrepancies in shipment details to prevent delays. This role emphasizes operational oversight, whereas a Customs Broker primarily handles legal clearance and tariff classification.

Required Skills and Qualifications

Customs brokers require in-depth knowledge of international trade laws, tariff classification, and customs clearance procedures, often holding certifications like the Customs Broker License. Import coordinators must possess strong organizational skills, communication abilities, and familiarity with supply chain logistics and import documentation to manage shipments efficiently. Both roles benefit from proficiency in trade compliance software and understanding of regulatory requirements, but customs brokers focus more on legal expertise while import coordinators emphasize operational coordination.

Regulatory Knowledge and Compliance

Customs brokers possess in-depth regulatory knowledge essential for ensuring compliance with complex customs laws and international trade agreements, facilitating accurate documentation and tariff classifications. Import coordinators manage the logistical aspects of shipments but rely on customs brokers for expert guidance on regulatory requirements and compliance issues. Effective collaboration between customs brokers and import coordinators ensures shipments clear customs efficiently while adhering to all legal and regulatory standards.

Daily Workflow Differences

Customs brokers primarily manage the clearance of goods through customs by preparing and submitting necessary documentation, ensuring compliance with import/export regulations, and coordinating with customs officials. Import coordinators focus on overseeing the entire shipment process, tracking inventory, liaising with suppliers and freight carriers, and managing delivery schedules. While customs brokers concentrate on regulatory compliance and customs clearance, import coordinators handle logistical coordination and supply chain communication on a daily basis.

Industry Certifications and Training

Customs brokers typically require certifications such as the Licensed Customs Broker (LCB) license obtained through the U.S. Customs and Border Protection, demonstrating in-depth knowledge of import regulations and compliance. Import coordinators often pursue industry-recognized training programs like the Certified Import Specialist (CIS) to enhance skills in managing logistics and documentation but do not usually require a specific government license. Both roles benefit from continuous education in trade compliance, tariff classifications, and international shipping standards to ensure efficient global transportation operations.

Career Progression Opportunities

Customs brokers typically advance by obtaining additional certifications and gaining expertise in customs regulations, enabling them to manage complex international shipments and lead compliance teams. Import coordinators often progress by expanding their knowledge in supply chain logistics and vendor management, potentially moving into procurement or logistics manager roles. Both careers offer pathways to senior positions within global trade operations, with customs brokers focusing more on regulatory compliance and import coordinators emphasizing operational efficiency.

Salary Expectations and Job Outlook

Customs brokers typically earn an average salary ranging from $50,000 to $75,000 annually, with experienced professionals in major ports commanding higher wages due to their expertise in regulatory compliance and tariff classification. Import coordinators generally have a salary range of $40,000 to $65,000, reflecting their role in managing documentation, shipment scheduling, and vendor communication. The job outlook for customs brokers remains strong, driven by increasing global trade regulations, while import coordinators benefit from steady demand linked to the growth of e-commerce and international supply chain optimization.

Choosing Between a Customs Broker and Import Coordinator Career

Choosing between a Customs Broker and Import Coordinator career depends on your expertise in trade compliance and logistics management. Customs Brokers specialize in navigating complex customs regulations and ensuring timely clearance of shipments, requiring deep knowledge of tariff codes and import laws. Import Coordinators focus on coordinating shipments, managing documentation, and communication between suppliers and freight carriers, emphasizing operational efficiency and supply chain collaboration.

Customs Broker vs Import Coordinator Infographic

jobdiv.com

jobdiv.com