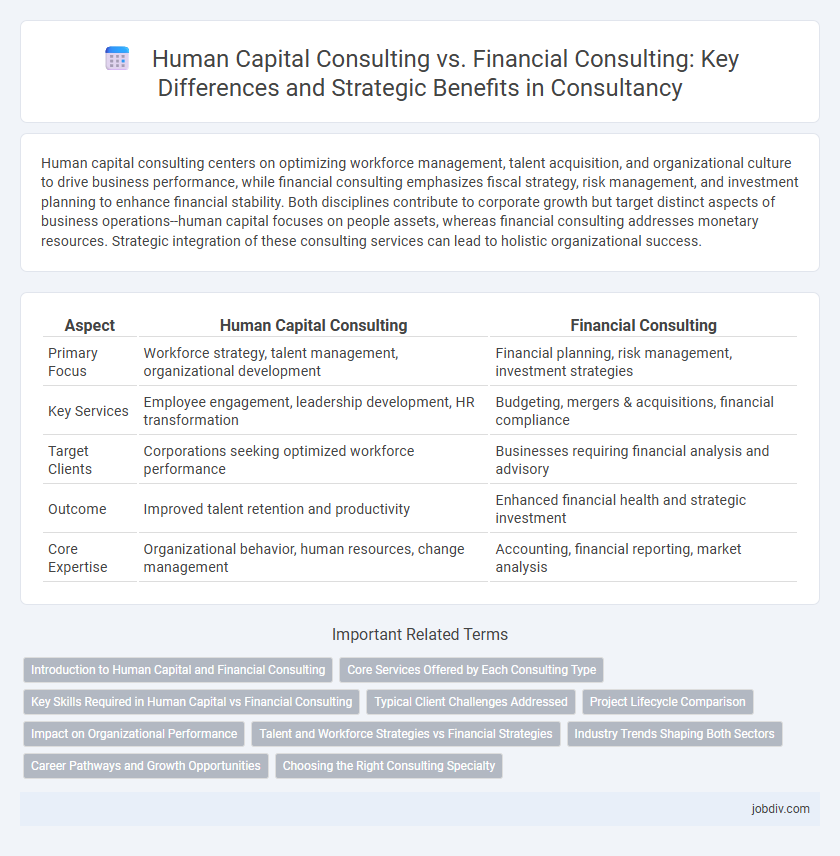

Human capital consulting centers on optimizing workforce management, talent acquisition, and organizational culture to drive business performance, while financial consulting emphasizes fiscal strategy, risk management, and investment planning to enhance financial stability. Both disciplines contribute to corporate growth but target distinct aspects of business operations--human capital focuses on people assets, whereas financial consulting addresses monetary resources. Strategic integration of these consulting services can lead to holistic organizational success.

Table of Comparison

| Aspect | Human Capital Consulting | Financial Consulting |

|---|---|---|

| Primary Focus | Workforce strategy, talent management, organizational development | Financial planning, risk management, investment strategies |

| Key Services | Employee engagement, leadership development, HR transformation | Budgeting, mergers & acquisitions, financial compliance |

| Target Clients | Corporations seeking optimized workforce performance | Businesses requiring financial analysis and advisory |

| Outcome | Improved talent retention and productivity | Enhanced financial health and strategic investment |

| Core Expertise | Organizational behavior, human resources, change management | Accounting, financial reporting, market analysis |

Introduction to Human Capital and Financial Consulting

Human Capital Consulting focuses on optimizing workforce performance through talent management, organizational design, and employee engagement strategies to drive business growth. Financial Consulting centers on advising organizations on financial planning, risk management, and investment strategies to maximize profitability and ensure regulatory compliance. Both consulting areas are critical for holistic business success, addressing people-related challenges and financial health respectively.

Core Services Offered by Each Consulting Type

Human Capital Consulting primarily focuses on employee engagement, talent acquisition, leadership development, and organizational culture optimization to enhance workforce productivity and align human resources with strategic business goals. Financial Consulting offers expertise in financial planning, risk management, mergers and acquisitions, tax advisory, and investment strategies aimed at improving a company's financial health and compliance. Both consulting types deliver tailored solutions, with Human Capital emphasizing people-centric strategies and Financial Consulting targeting fiscal performance and regulatory adherence.

Key Skills Required in Human Capital vs Financial Consulting

Human Capital Consulting demands expertise in organizational behavior, talent management, and change leadership, emphasizing skills like employee engagement analysis and workforce planning. Financial Consulting requires strong analytical abilities in financial modeling, risk assessment, and investment strategies, alongside proficiency in regulatory compliance and budgeting. Both fields benefit from problem-solving capabilities, but Human Capital focuses on people-centric insights, whereas Financial Consulting centers on quantitative financial data.

Typical Client Challenges Addressed

Human Capital Consulting primarily addresses challenges related to workforce optimization, talent acquisition, employee engagement, and organizational change management, helping clients improve productivity and employee retention. Financial Consulting focuses on issues such as financial planning, risk management, capital structure optimization, and regulatory compliance, aiming to enhance profitability and ensure sustainable financial health. Both types of consulting target different aspects of business performance but often complement each other in driving overall organizational success.

Project Lifecycle Comparison

Human Capital Consulting emphasizes workforce planning, talent acquisition, and change management throughout the project lifecycle, ensuring alignment with organizational culture and employee engagement objectives. Financial Consulting concentrates on budgeting, risk assessment, and financial reporting, providing critical insights for investment decisions and compliance during project phases. Both consulting types integrate strategic analysis and performance metrics but differ in focus areas: human capital targets people-centric outcomes while financial consulting prioritizes fiscal sustainability.

Impact on Organizational Performance

Human Capital Consulting enhances organizational performance by optimizing workforce capabilities, improving employee engagement, and developing leadership strategies that drive productivity. Financial Consulting impacts performance through effective capital allocation, risk management, and financial planning that ensure sustainable growth and profitability. Both consulting types contribute uniquely, with Human Capital focusing on human resources development and Financial Consulting prioritizing fiscal health and strategic investments.

Talent and Workforce Strategies vs Financial Strategies

Human capital consulting emphasizes optimizing talent acquisition, employee engagement, and workforce development to align human resources with business goals. Financial consulting focuses on strategies involving budgeting, investment analysis, risk management, and capital allocation to enhance financial performance. Integrating talent strategies with financial insights drives sustainable organizational growth and competitive advantage.

Industry Trends Shaping Both Sectors

Human Capital Consulting increasingly integrates AI-driven talent analytics and remote workforce strategies to enhance employee engagement and productivity, reflecting a growing emphasis on digital transformation and diversity, equity, and inclusion (DEI) initiatives. Financial Consulting is evolving with the proliferation of blockchain technology, ESG (Environmental, Social, Governance) investing, and advanced data analytics, driving more transparent and sustainable financial decision-making. Both sectors are shaped by the accelerating adoption of AI and big data to optimize strategic outcomes and risk management across industries.

Career Pathways and Growth Opportunities

Human Capital Consulting emphasizes strategic workforce planning, leadership development, and talent management, providing professionals with pathways into organizational development, HR strategy, and employee engagement roles. Financial Consulting focuses on financial analysis, risk management, and mergers and acquisitions, offering career growth in corporate finance, audit, and advisory services. Growth opportunities in Human Capital Consulting often lead to executive HR positions, while Financial Consulting can lead to CFO roles or expertise in investment banking and corporate restructuring.

Choosing the Right Consulting Specialty

Choosing the right consulting specialty depends on your organization's core challenges and goals, where Human Capital Consulting targets workforce strategy, talent management, and organizational culture, while Financial Consulting centers on fiscal analysis, risk management, and investment advisory. Human Capital consultants help optimize employee performance and align human resources with long-term business objectives, critical for growth in competitive markets. Financial consultants drive profitability through budgeting, compliance, and capital structure optimization, essential for maintaining financial health and securing investment opportunities.

Human Capital Consulting vs Financial Consulting Infographic

jobdiv.com

jobdiv.com