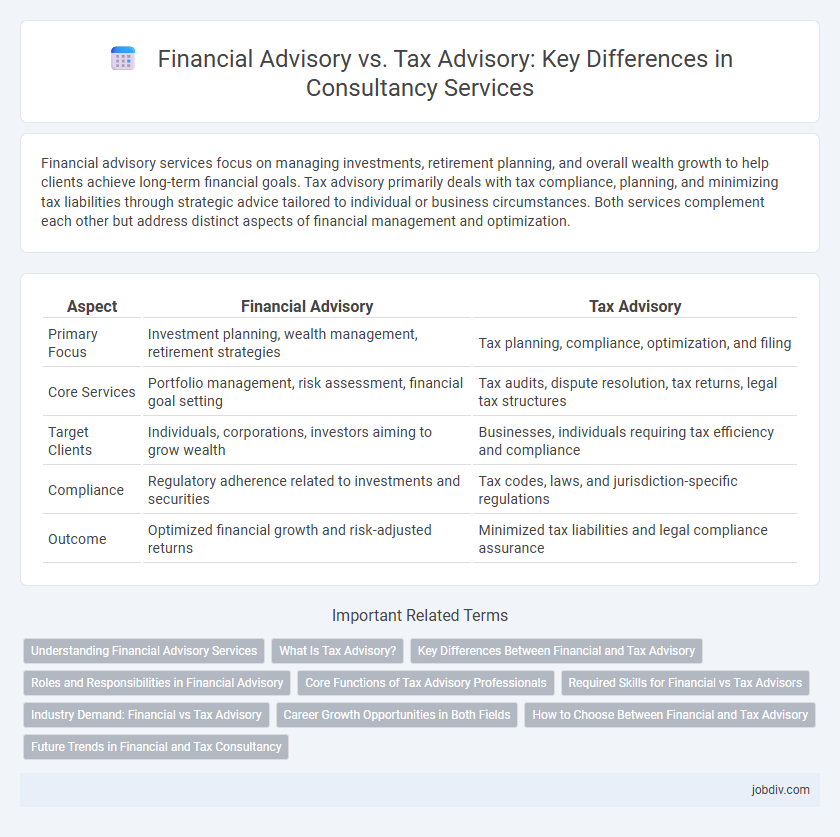

Financial advisory services focus on managing investments, retirement planning, and overall wealth growth to help clients achieve long-term financial goals. Tax advisory primarily deals with tax compliance, planning, and minimizing tax liabilities through strategic advice tailored to individual or business circumstances. Both services complement each other but address distinct aspects of financial management and optimization.

Table of Comparison

| Aspect | Financial Advisory | Tax Advisory |

|---|---|---|

| Primary Focus | Investment planning, wealth management, retirement strategies | Tax planning, compliance, optimization, and filing |

| Core Services | Portfolio management, risk assessment, financial goal setting | Tax audits, dispute resolution, tax returns, legal tax structures |

| Target Clients | Individuals, corporations, investors aiming to grow wealth | Businesses, individuals requiring tax efficiency and compliance |

| Compliance | Regulatory adherence related to investments and securities | Tax codes, laws, and jurisdiction-specific regulations |

| Outcome | Optimized financial growth and risk-adjusted returns | Minimized tax liabilities and legal compliance assurance |

Understanding Financial Advisory Services

Financial advisory services encompass comprehensive guidance on investments, retirement planning, estate management, risk assessment, and wealth optimization, aiming to enhance clients' overall financial health. Unlike tax advisory, which primarily focuses on compliance, deductions, and tax-efficient strategies, financial advisory integrates broader objectives including asset allocation, cash flow management, and long-term financial goal setting. Expert financial advisors analyze market trends, personal financial data, and economic indicators to provide tailored plans that maximize returns and mitigate risks.

What Is Tax Advisory?

Tax advisory involves providing expert guidance on tax planning, compliance, and optimization to minimize liabilities and ensure adherence to tax laws and regulations. It encompasses strategies for managing income tax, corporate tax, VAT, and other relevant taxes while considering the latest legislative changes and rulings. Tax advisors help individuals and businesses maximize tax efficiency by leveraging deductions, credits, exemptions, and effective structuring.

Key Differences Between Financial and Tax Advisory

Financial advisory primarily focuses on managing investments, retirement planning, risk assessment, and overall wealth growth, while tax advisory centers on optimizing tax liabilities and ensuring compliance with tax laws. Key differences include financial advisory's broader approach to wealth accumulation and asset management versus tax advisory's specialized expertise in tax code interpretation, filing, and strategic tax planning. Understanding these distinctions helps businesses and individuals choose the right consultancy service for their specific financial goals and obligations.

Roles and Responsibilities in Financial Advisory

Financial Advisory focuses on guiding clients through investment strategies, risk management, and corporate finance decisions to enhance financial growth and stability. Professionals in this field analyze market trends, assess financial statements, and develop tailored solutions to optimize asset allocation and capital structure. Their responsibilities include mergers and acquisitions consulting, fundraising support, and financial planning to drive business performance and investor confidence.

Core Functions of Tax Advisory Professionals

Tax advisory professionals specialize in navigating complex tax regulations to optimize clients' tax liabilities and ensure compliance with local and international tax laws. Their core functions include tax planning, preparing and reviewing tax returns, and advising on tax implications of business transactions and investments. They provide strategic guidance to minimize tax risks and capitalize on tax incentives, tailored to clients' financial goals and regulatory environments.

Required Skills for Financial vs Tax Advisors

Financial advisors require strong analytical skills, proficiency in risk assessment, investment strategies, and comprehensive knowledge of financial markets to guide clients effectively. Tax advisors must possess deep expertise in tax laws, regulatory compliance, detailed problem-solving abilities, and up-to-date knowledge of tax codes to optimize client tax positions. Both roles demand excellent communication skills and attention to detail, but financial advisors focus more on portfolio management while tax advisors emphasize legal frameworks and tax planning.

Industry Demand: Financial vs Tax Advisory

Financial advisory services experience higher industry demand due to businesses seeking strategic investment guidance, risk management, and capital structure optimization to enhance profitability and growth. Tax advisory remains essential for compliance and minimizing tax liabilities, but the complexity of financial markets drives greater need for comprehensive financial planning and advisory solutions. Market trends indicate that dynamic economic conditions and regulatory changes amplify the demand for financial advisors over tax specialists.

Career Growth Opportunities in Both Fields

Financial advisory offers diverse career growth opportunities by focusing on investment strategies, risk management, and wealth planning, enabling professionals to advance into roles such as portfolio manager or financial consultant. Tax advisory provides specialized expertise in tax laws, compliance, and optimization strategies, opening paths to senior tax consultant or tax director positions within corporations or consulting firms. Both fields demand strong analytical skills and continuous learning, but financial advisory typically offers broader market exposure while tax advisory emphasizes regulatory proficiency.

How to Choose Between Financial and Tax Advisory

Choosing between financial advisory and tax advisory depends on your primary needs: financial advisory focuses on investment strategies, wealth management, and retirement planning, while tax advisory specializes in tax compliance, planning, and optimization. Consider whether your priority is long-term financial growth and asset management or minimizing tax liabilities and ensuring regulatory adherence. Evaluating your specific financial goals, current tax situation, and future planning requirements will guide you in selecting the appropriate consultancy service.

Future Trends in Financial and Tax Consultancy

Emerging trends in financial advisory emphasize integrating artificial intelligence and big data analytics to enhance investment strategies and risk management. Tax advisory is increasingly adopting automation and blockchain technology to improve compliance accuracy and streamline reporting processes. Both sectors prioritize sustainability consulting as regulations evolve, driving demand for expertise in environmental, social, and governance (ESG) frameworks.

Financial Advisory vs Tax Advisory Infographic

jobdiv.com

jobdiv.com