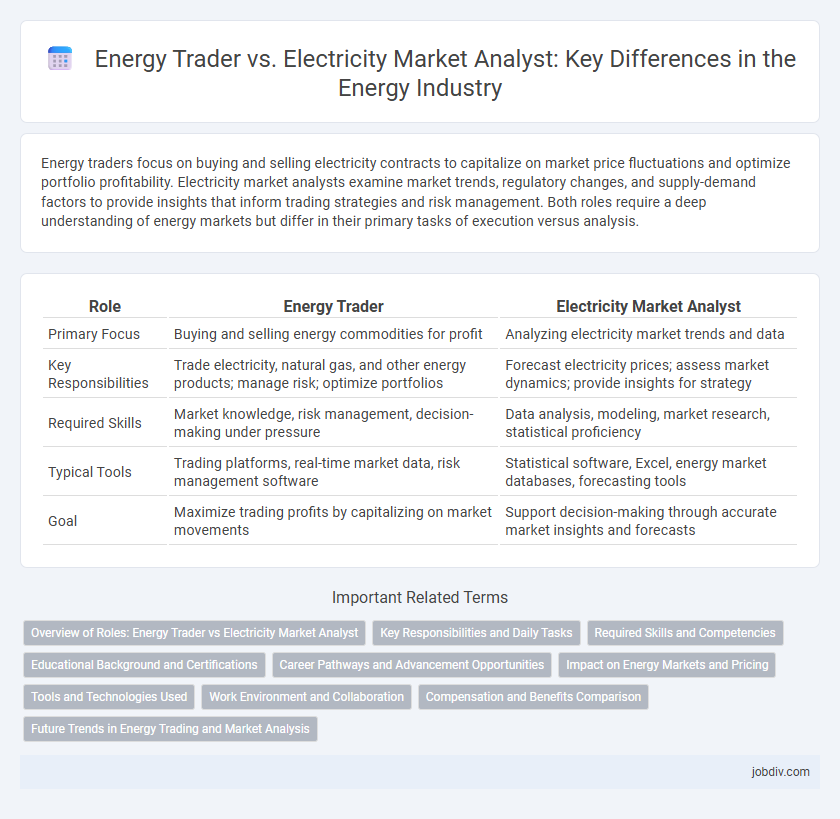

Energy traders focus on buying and selling electricity contracts to capitalize on market price fluctuations and optimize portfolio profitability. Electricity market analysts examine market trends, regulatory changes, and supply-demand factors to provide insights that inform trading strategies and risk management. Both roles require a deep understanding of energy markets but differ in their primary tasks of execution versus analysis.

Table of Comparison

| Role | Energy Trader | Electricity Market Analyst |

|---|---|---|

| Primary Focus | Buying and selling energy commodities for profit | Analyzing electricity market trends and data |

| Key Responsibilities | Trade electricity, natural gas, and other energy products; manage risk; optimize portfolios | Forecast electricity prices; assess market dynamics; provide insights for strategy |

| Required Skills | Market knowledge, risk management, decision-making under pressure | Data analysis, modeling, market research, statistical proficiency |

| Typical Tools | Trading platforms, real-time market data, risk management software | Statistical software, Excel, energy market databases, forecasting tools |

| Goal | Maximize trading profits by capitalizing on market movements | Support decision-making through accurate market insights and forecasts |

Overview of Roles: Energy Trader vs Electricity Market Analyst

Energy traders focus on buying and selling energy commodities such as oil, natural gas, and electricity to maximize profit through market price fluctuations. Electricity market analysts evaluate market trends, regulatory policies, and supply-demand dynamics to provide insights for pricing strategies and risk management. Both roles require strong analytical skills but differ in direct market participation versus strategic market assessment.

Key Responsibilities and Daily Tasks

Energy Traders execute buy and sell orders for electricity contracts, analyze market trends, and manage risk exposure to maximize profits in real-time. Electricity Market Analysts conduct detailed research on market dynamics, forecast price movements, and provide strategic insights to support trading decisions and regulatory compliance. Both roles require strong data analysis skills, but traders focus on transactional execution while analysts emphasize market evaluation and reporting.

Required Skills and Competencies

Energy traders require strong financial acumen, risk management skills, and proficiency in market analysis tools to make real-time trading decisions and optimize energy portfolios. Electricity market analysts must possess deep knowledge of regulatory frameworks, market structures, and data modeling expertise to forecast price trends and assess market dynamics accurately. Both roles demand advanced analytical abilities, strong communication skills, and familiarity with energy commodities and trading platforms.

Educational Background and Certifications

Energy Traders often hold degrees in finance, economics, or engineering, with certifications such as the Chartered Financial Analyst (CFA) or Energy Risk Professional (ERP) enhancing their credentials. Electricity Market Analysts typically possess education in energy economics, environmental science, or data analytics, supported by certifications like the Certified Energy Manager (CEM) or Market Risk Professional (PME). Advanced knowledge in market regulations, statistical modeling, and energy systems is crucial for both roles to navigate the complexities of energy markets effectively.

Career Pathways and Advancement Opportunities

Energy traders typically advance by gaining experience in risk management and leveraging market analysis skills to execute profitable trades, often progressing to senior trader or portfolio manager roles. Electricity market analysts specialize in data interpretation and regulatory trends, with career growth leading to positions such as senior market analyst, regulatory advisor, or energy consultant. Both careers benefit from strong analytical capabilities and industry knowledge, with advancement opportunities tied to mastering market dynamics and policy impacts.

Impact on Energy Markets and Pricing

Energy traders directly influence electricity market pricing through strategic buying and selling, leveraging market volatility to optimize profits and manage risk exposure. Electricity market analysts provide critical insights and forecasting by evaluating market trends, regulatory changes, and supply-demand dynamics, enabling more informed trading decisions and policy development. Both roles significantly impact market efficiency and price stability, with traders driving short-term liquidity and analysts shaping long-term market strategies.

Tools and Technologies Used

Energy traders utilize advanced trading platforms such as Eikon and Openlink to execute real-time transactions and manage risk in volatile electricity markets. Electricity market analysts rely heavily on data analytics software like MATLAB and Python libraries to model market trends, forecast prices, and assess grid stability. Both roles increasingly integrate AI-driven tools and IoT data for enhanced decision-making in energy markets.

Work Environment and Collaboration

Energy traders operate in fast-paced trading floors or digital platforms, making real-time decisions under pressure, often collaborating with market analysts and risk managers to optimize trading strategies. Electricity market analysts typically work in office or research settings, focusing on data analysis and market forecasting, collaborating closely with regulatory bodies and energy producers to inform market behavior. Both roles demand strong teamwork and communication skills to navigate the complexities of energy markets and drive informed decision-making.

Compensation and Benefits Comparison

Energy Traders typically earn higher base salaries and performance-based bonuses reflecting risk-taking and deal closures, while Electricity Market Analysts receive steady compensation with strong benefits tied to data analysis and market forecasting roles. Traders benefit from commission structures and profit-sharing linked to market volatility, whereas analysts often enjoy comprehensive health insurance, retirement plans, and paid training aligned with regulatory compliance and modeling expertise. Both roles may receive stock options or incentive programs, but traders' compensation skews toward variable pay, and analysts' packages emphasize job stability and professional development.

Future Trends in Energy Trading and Market Analysis

Energy traders leverage real-time market data and predictive algorithms to capitalize on price volatility in electricity markets, while electricity market analysts focus on interpreting regulatory changes, supply-demand dynamics, and emerging technologies affecting market behavior. Future trends in energy trading emphasize increased integration of artificial intelligence, blockchain for transaction transparency, and renewable energy certificates, driving more efficient, decentralized trading platforms. Market analysts will play a critical role in forecasting impacts of renewable integration, carbon pricing, and grid modernization on market liquidity and price stability.

Energy Trader vs Electricity Market Analyst Infographic

jobdiv.com

jobdiv.com