Power traders specialize in buying and selling electricity and fuel contracts to maximize profits by analyzing market trends, supply, and demand dynamics. Energy analysts evaluate data on consumption, production costs, and regulatory impacts to provide strategic insights and forecasts that guide investment and operational decisions. While power traders focus on short-term market movements, energy analysts concentrate on long-term energy trends and policy implications.

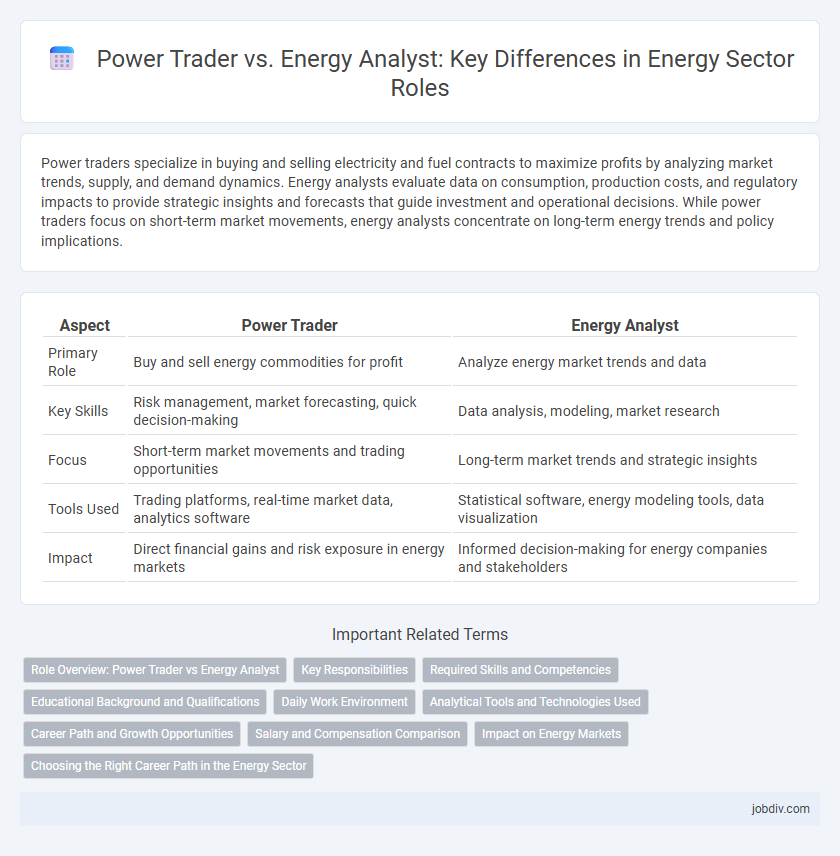

Table of Comparison

| Aspect | Power Trader | Energy Analyst |

|---|---|---|

| Primary Role | Buy and sell energy commodities for profit | Analyze energy market trends and data |

| Key Skills | Risk management, market forecasting, quick decision-making | Data analysis, modeling, market research |

| Focus | Short-term market movements and trading opportunities | Long-term market trends and strategic insights |

| Tools Used | Trading platforms, real-time market data, analytics software | Statistical software, energy modeling tools, data visualization |

| Impact | Direct financial gains and risk exposure in energy markets | Informed decision-making for energy companies and stakeholders |

Role Overview: Power Trader vs Energy Analyst

Power Traders execute real-time buying and selling of electricity to maximize profits, using market trends, pricing models, and risk assessment tools for decision-making. Energy Analysts focus on data evaluation, forecasting demand, and analyzing energy market behavior to support strategic planning and regulatory compliance. Both roles require strong analytical skills but differ in execution, with Traders actively engaging in market transactions and Analysts providing insights for long-term energy management.

Key Responsibilities

Power Traders execute real-time buying and selling of electricity to optimize profit margins, manage market risks, and respond to fluctuating supply and demand conditions. Energy Analysts conduct in-depth data analysis, market forecasting, and performance evaluation to inform strategic decisions and regulatory compliance. Both roles require expertise in energy markets, but Power Traders emphasize transaction execution while Energy Analysts focus on data-driven insights.

Required Skills and Competencies

Power traders require strong quantitative skills, real-time decision-making abilities, and deep knowledge of energy markets to manage risks and optimize trading strategies effectively. Energy analysts need expertise in data analysis, market research, and regulatory frameworks to evaluate energy trends and forecast demand accurately. Both roles demand proficiency in data interpretation and understanding of financial instruments specific to the energy sector.

Educational Background and Qualifications

Power traders typically hold degrees in finance, economics, or engineering with strong quantitative skills, often complemented by certifications such as the Chartered Financial Analyst (CFA) or Energy Risk Professional (ERP). Energy analysts usually possess academic backgrounds in energy management, environmental science, or data analytics, combined with expertise in market trends and regulatory policies, sometimes supported by certifications like Certified Energy Manager (CEM). Both roles demand proficiency in data interpretation and market analysis but diverge in their educational focus, with power traders emphasizing financial acumen and energy analysts prioritizing technical and environmental knowledge.

Daily Work Environment

Power traders operate in high-pressure trading floors, making rapid decisions to buy and sell energy commodities based on real-time market data and price fluctuations. Energy analysts work in more structured office settings, conducting in-depth research, forecasting energy trends, and analyzing market reports to support strategic decision-making. Both roles require strong analytical skills, but traders emphasize fast-paced execution while analysts focus on detailed data interpretation and long-term energy market insights.

Analytical Tools and Technologies Used

Power traders utilize advanced real-time trading platforms like ETRM (Energy Trading and Risk Management) systems, leveraging algorithmic algorithms and market simulation software to execute fast, data-driven trades. Energy analysts rely on sophisticated forecasting models, predictive analytics software such as Python-based tools and specialized energy market databases to interpret consumption trends and price fluctuations. Both roles integrate machine learning algorithms and big data technologies, but power traders prioritize execution speed while energy analysts emphasize in-depth market and regulatory analysis.

Career Path and Growth Opportunities

Power Traders excel in fast-paced environments, specializing in buying and selling electricity or gas to maximize profits, with career growth often leading to senior trading roles or portfolio management. Energy Analysts focus on examining market trends, regulatory impacts, and consumption data to provide strategic insights, with opportunities advancing towards consultancy or energy market analysis leadership. Both career paths benefit from expertise in energy markets, quantitative analysis, and evolving renewable energy sectors, but Power Traders emphasize real-time decision making while Energy Analysts prioritize long-term strategic planning.

Salary and Compensation Comparison

Power traders typically earn higher base salaries than energy analysts, with average compensation ranging from $90,000 to $150,000 annually depending on experience and market conditions. Energy analysts usually have salaries between $70,000 and $110,000, supplemented by bonuses tied to analytical accuracy and project impact. Total compensation for power traders often exceeds that of energy analysts due to performance-based incentives linked to market volatility and trading volume.

Impact on Energy Markets

Power traders influence energy markets by executing buy and sell orders based on price fluctuations and market signals, directly affecting supply-demand dynamics and price volatility. Energy analysts assess market trends, regulatory changes, and consumption patterns to provide strategic insights, shaping long-term investment and policy decisions. Together, their roles drive market efficiency, risk management, and the evolution of energy pricing models.

Choosing the Right Career Path in the Energy Sector

Power traders specialize in buying and selling electricity and energy commodities to maximize profits by analyzing market trends and prices. Energy analysts focus on evaluating energy data, forecasting demand, and assessing policy impacts to support strategic decision-making in the energy sector. Choosing between these careers depends on whether you prefer fast-paced trading environments or detailed analytical research in energy markets.

Power Trader vs Energy Analyst Infographic

jobdiv.com

jobdiv.com