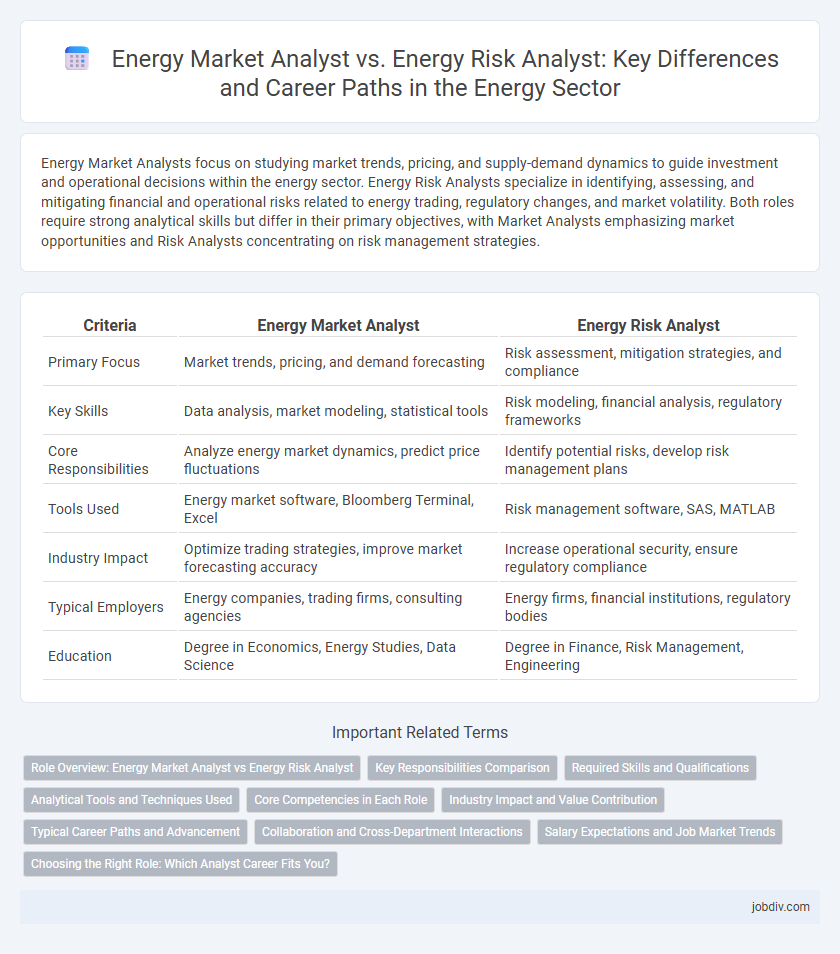

Energy Market Analysts focus on studying market trends, pricing, and supply-demand dynamics to guide investment and operational decisions within the energy sector. Energy Risk Analysts specialize in identifying, assessing, and mitigating financial and operational risks related to energy trading, regulatory changes, and market volatility. Both roles require strong analytical skills but differ in their primary objectives, with Market Analysts emphasizing market opportunities and Risk Analysts concentrating on risk management strategies.

Table of Comparison

| Criteria | Energy Market Analyst | Energy Risk Analyst |

|---|---|---|

| Primary Focus | Market trends, pricing, and demand forecasting | Risk assessment, mitigation strategies, and compliance |

| Key Skills | Data analysis, market modeling, statistical tools | Risk modeling, financial analysis, regulatory frameworks |

| Core Responsibilities | Analyze energy market dynamics, predict price fluctuations | Identify potential risks, develop risk management plans |

| Tools Used | Energy market software, Bloomberg Terminal, Excel | Risk management software, SAS, MATLAB |

| Industry Impact | Optimize trading strategies, improve market forecasting accuracy | Increase operational security, ensure regulatory compliance |

| Typical Employers | Energy companies, trading firms, consulting agencies | Energy firms, financial institutions, regulatory bodies |

| Education | Degree in Economics, Energy Studies, Data Science | Degree in Finance, Risk Management, Engineering |

Role Overview: Energy Market Analyst vs Energy Risk Analyst

Energy Market Analysts specialize in analyzing energy market trends, prices, and supply-demand dynamics to provide forecasts and investment recommendations. Energy Risk Analysts focus on identifying, assessing, and mitigating financial risks related to energy trading, including market volatility and regulatory impacts. Both roles require expertise in energy economics, data modeling, and market intelligence but differ primarily in their emphasis on market opportunities versus risk management strategies.

Key Responsibilities Comparison

Energy Market Analysts assess market trends, supply-demand dynamics, and price fluctuations to provide strategic insights for energy trading and investment decisions. Energy Risk Analysts identify, measure, and mitigate potential risks related to market volatility, regulatory changes, and operational hazards affecting energy portfolios. Both roles require strong analytical skills, but Market Analysts emphasize forecasting and market intelligence, while Risk Analysts focus on risk modeling and compliance management.

Required Skills and Qualifications

Energy Market Analysts require strong analytical skills, proficiency in data modeling, and expertise in market trends, pricing mechanisms, and regulatory frameworks. Energy Risk Analysts need advanced knowledge of risk assessment methodologies, statistical analysis, and compliance standards, often with experience in financial risk management software and scenario analysis. Both roles demand a solid foundation in energy economics, quantitative analysis, and effective communication to interpret complex data for strategic decision-making.

Analytical Tools and Techniques Used

Energy Market Analysts primarily utilize econometric models, market simulation software, and big data analytics to forecast supply, demand, and price trends in energy markets. Energy Risk Analysts rely on risk assessment software, scenario analysis tools, and Value at Risk (VaR) models to evaluate and mitigate potential financial and operational risks in energy portfolios. Both roles leverage advanced statistical analysis and data visualization platforms to enhance decision-making accuracy and strategic planning.

Core Competencies in Each Role

Energy Market Analysts excel in data analysis, market forecasting, and understanding supply-demand dynamics to optimize trading strategies and identify market trends. Energy Risk Analysts specialize in risk assessment, quantitative modeling, and regulatory compliance to mitigate financial exposures associated with energy price volatility and operational hazards. Both roles require proficiency in energy economics, statistical tools, and industry-specific software but differ in focus between market opportunities and risk management.

Industry Impact and Value Contribution

Energy Market Analysts drive industry impact by interpreting market trends, pricing dynamics, and regulatory changes to optimize trading strategies and enhance profitability. Energy Risk Analysts contribute value by identifying, assessing, and mitigating risks related to price volatility, supply disruptions, and regulatory compliance, thereby ensuring financial stability and operational continuity. Both roles are crucial, with Market Analysts focusing on market behavior prediction and Risk Analysts emphasizing risk management frameworks to safeguard investments.

Typical Career Paths and Advancement

Energy Market Analysts typically advance by gaining expertise in market trends, commodity pricing, and regulatory impacts, often moving into senior analyst or portfolio management roles within trading firms or energy consultancies. Energy Risk Analysts progress by specializing in risk assessment methodologies, quantitative modeling, and compliance, frequently transitioning into risk management leadership or chief risk officer positions in energy companies or financial institutions. Both career paths benefit from certifications such as CFA for market analysts and FRM for risk analysts, enhancing opportunities for advancement and cross-functional roles.

Collaboration and Cross-Department Interactions

Energy Market Analysts collaborate closely with trading teams and regulatory departments to interpret market trends and forecast pricing dynamics, ensuring informed decision-making. Energy Risk Analysts engage with compliance, finance, and operations units to assess and mitigate financial and operational risks associated with energy transactions. Both roles interact cross-departmentally to align risk strategies with market intelligence, optimizing overall energy portfolio performance.

Salary Expectations and Job Market Trends

Energy Market Analysts typically command higher salaries due to their expertise in market forecasting, often earning between $70,000 and $120,000 annually, reflecting strong demand in renewable energy sectors. Energy Risk Analysts, with salaries ranging from $65,000 to $110,000, focus on identifying and mitigating financial risks linked to energy commodities, a skill increasingly critical amid market volatility and regulatory changes. Both roles show upward job market trends driven by the global shift towards sustainable energy and the need for sophisticated risk management frameworks.

Choosing the Right Role: Which Analyst Career Fits You?

Energy Market Analysts focus on interpreting market trends, pricing data, and supply-demand dynamics to forecast energy prices and advise trading strategies. Energy Risk Analysts assess potential risks related to market volatility, regulatory changes, and operational hazards, developing risk management frameworks to protect energy assets and investments. Choosing the right role depends on whether you prefer market-driven decision-making and forecasting (Energy Market Analyst) or risk assessment and mitigation within the energy sector (Energy Risk Analyst).

Energy Market Analyst vs Energy Risk Analyst Infographic

jobdiv.com

jobdiv.com