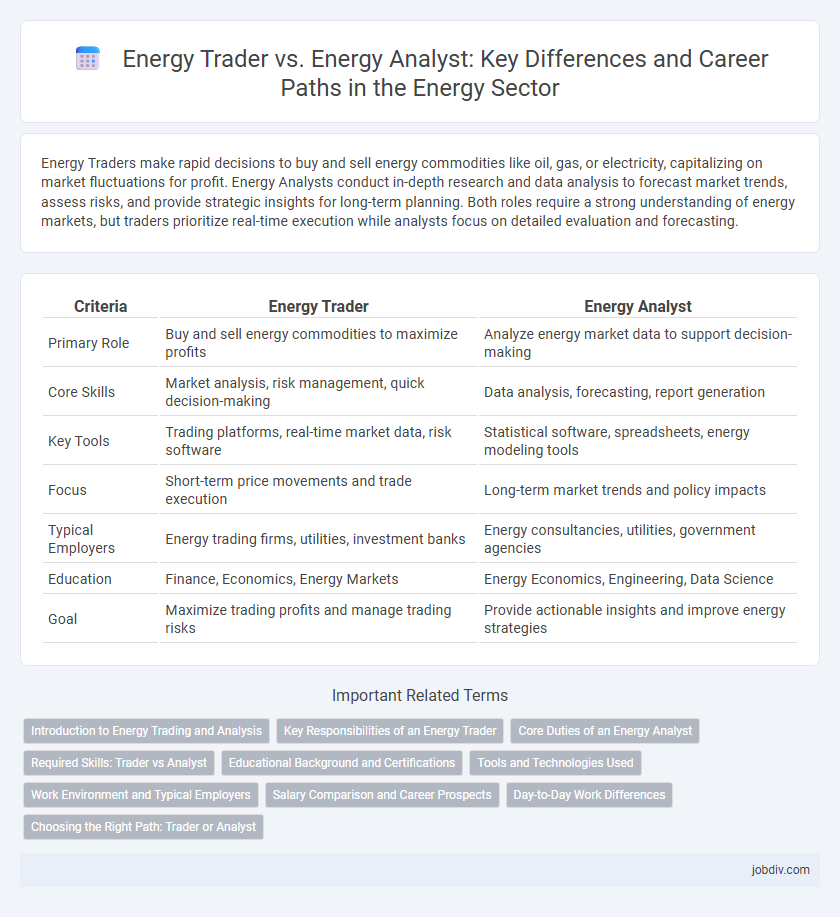

Energy Traders make rapid decisions to buy and sell energy commodities like oil, gas, or electricity, capitalizing on market fluctuations for profit. Energy Analysts conduct in-depth research and data analysis to forecast market trends, assess risks, and provide strategic insights for long-term planning. Both roles require a strong understanding of energy markets, but traders prioritize real-time execution while analysts focus on detailed evaluation and forecasting.

Table of Comparison

| Criteria | Energy Trader | Energy Analyst |

|---|---|---|

| Primary Role | Buy and sell energy commodities to maximize profits | Analyze energy market data to support decision-making |

| Core Skills | Market analysis, risk management, quick decision-making | Data analysis, forecasting, report generation |

| Key Tools | Trading platforms, real-time market data, risk software | Statistical software, spreadsheets, energy modeling tools |

| Focus | Short-term price movements and trade execution | Long-term market trends and policy impacts |

| Typical Employers | Energy trading firms, utilities, investment banks | Energy consultancies, utilities, government agencies |

| Education | Finance, Economics, Energy Markets | Energy Economics, Engineering, Data Science |

| Goal | Maximize trading profits and manage trading risks | Provide actionable insights and improve energy strategies |

Introduction to Energy Trading and Analysis

Energy traders execute buy and sell transactions of energy commodities such as oil, natural gas, and electricity to maximize profits through market fluctuations. Energy analysts evaluate market trends, supply and demand data, and geopolitical factors to provide forecasts and strategic insights supporting trading decisions. Together, trading and analysis roles are essential for navigating volatile energy markets and optimizing investment outcomes.

Key Responsibilities of an Energy Trader

Energy Traders manage the buying and selling of energy commodities such as oil, natural gas, and electricity, leveraging market data to optimize trading strategies and maximize profits. They analyze market trends, negotiate contracts, and execute trades in real-time to capitalize on price fluctuations. Risk management and regulatory compliance are critical components of an Energy Trader's role to ensure profitable and lawful operations within the energy markets.

Core Duties of an Energy Analyst

Energy analysts primarily focus on evaluating market trends, forecasting energy prices, and conducting risk assessments to guide investment decisions. They analyze data from multiple sources, including consumption patterns, regulatory changes, and geopolitical events, to optimize energy procurement strategies. Their insights support stakeholders in making informed decisions related to energy supply, demand, and financial planning.

Required Skills: Trader vs Analyst

Energy traders require strong decision-making skills, risk management expertise, and in-depth knowledge of market dynamics and pricing models to execute timely trades. Energy analysts focus on data analysis, forecasting, and interpreting regulatory and economic trends using advanced statistical tools and energy market software. Both roles demand proficiency in financial modeling, but traders emphasize quick judgment under pressure while analysts prioritize detailed research and reporting.

Educational Background and Certifications

Energy Traders typically hold degrees in finance, economics, or engineering, with certifications such as the Chartered Financial Analyst (CFA) or Series 7 license enhancing their market trading expertise. Energy Analysts often pursue backgrounds in environmental science, petroleum engineering, or data analytics, supported by certifications like the Certified Energy Manager (CEM) or Energy Risk Professional (ERP) to deepen their technical and industry-specific knowledge. Both roles benefit from advanced education and specialized certifications to navigate complex energy markets and regulatory frameworks effectively.

Tools and Technologies Used

Energy traders leverage advanced trading platforms such as Eikon and Openlink to execute real-time transactions and manage risk through algorithmic trading and AI-driven analytics. Energy analysts utilize data visualization tools like Tableau and Power BI alongside statistical software such as MATLAB and Python to interpret market trends and forecast energy prices. Both roles depend on integrated energy management systems (EMS) and big data technologies to enhance decision-making in volatile energy markets.

Work Environment and Typical Employers

Energy traders typically operate in fast-paced trading floors or brokerage firms where real-time market data drives their decision-making, often working for utility companies, investment banks, or commodity trading firms. Energy analysts usually have a more structured office environment, spending time in research departments or consulting firms, analyzing market trends and regulatory impacts for energy producers, policy groups, or financial institutions. Both roles demand strong analytical skills but differ in daily activities, with traders focused on transactions and analysts on data interpretation.

Salary Comparison and Career Prospects

Energy traders typically earn higher salaries than energy analysts, with median annual earnings ranging from $90,000 to $150,000 compared to $60,000 to $100,000 for analysts. Traders often benefit from performance bonuses tied to market activities, while analysts enjoy more stable income and steady career progression in research or consulting roles. Career prospects for energy traders hinge on market volatility and trading performance, whereas analysts have broader opportunities in regulatory bodies, energy firms, and policy organizations.

Day-to-Day Work Differences

Energy traders execute real-time transactions in energy markets, managing risks and capitalizing on price fluctuations in commodities like oil, natural gas, and electricity. Energy analysts focus on data analysis, market trends, and regulatory impacts to provide forecasts and strategic recommendations for optimizing energy asset portfolios. Traders prioritize immediate market movements and liquidity, while analysts emphasize long-term market research and scenario planning.

Choosing the Right Path: Trader or Analyst

Energy traders leverage real-time market data and risk management strategies to buy and sell energy commodities, aiming for profit through short-term price fluctuations. Energy analysts conduct in-depth research on market trends, regulatory impacts, and supply-demand factors to provide accurate forecasts and strategic insights for long-term decision making. Selecting between these roles depends on whether you prefer fast-paced trading environments or analytical, data-driven market evaluation.

Energy Trader vs Energy Analyst Infographic

jobdiv.com

jobdiv.com