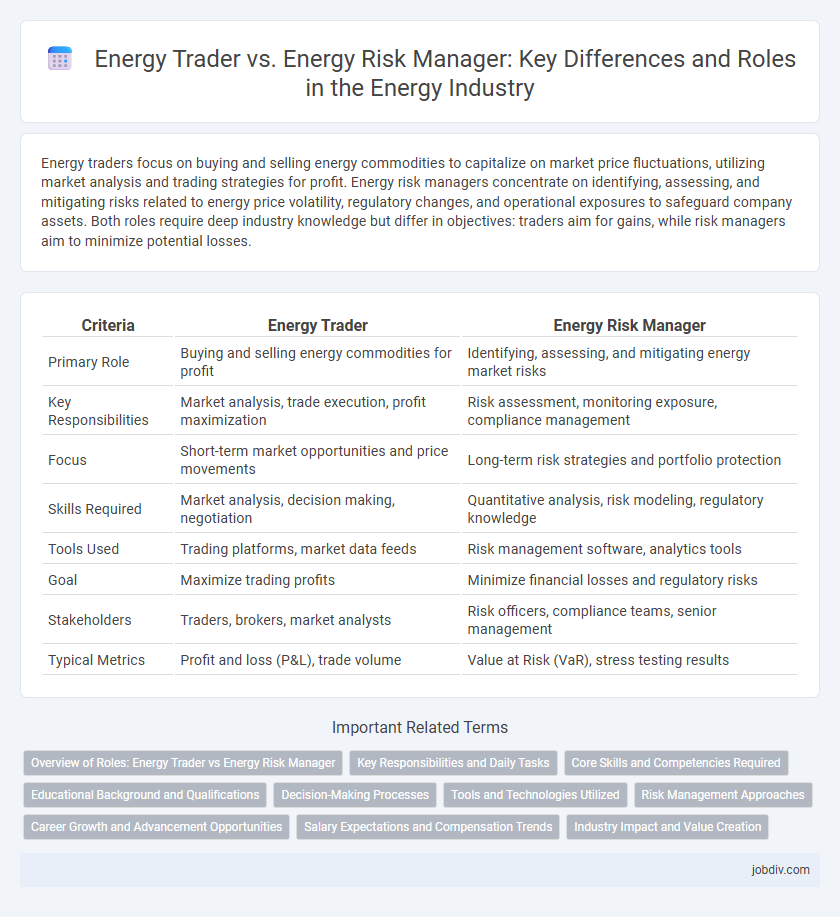

Energy traders focus on buying and selling energy commodities to capitalize on market price fluctuations, utilizing market analysis and trading strategies for profit. Energy risk managers concentrate on identifying, assessing, and mitigating risks related to energy price volatility, regulatory changes, and operational exposures to safeguard company assets. Both roles require deep industry knowledge but differ in objectives: traders aim for gains, while risk managers aim to minimize potential losses.

Table of Comparison

| Criteria | Energy Trader | Energy Risk Manager |

|---|---|---|

| Primary Role | Buying and selling energy commodities for profit | Identifying, assessing, and mitigating energy market risks |

| Key Responsibilities | Market analysis, trade execution, profit maximization | Risk assessment, monitoring exposure, compliance management |

| Focus | Short-term market opportunities and price movements | Long-term risk strategies and portfolio protection |

| Skills Required | Market analysis, decision making, negotiation | Quantitative analysis, risk modeling, regulatory knowledge |

| Tools Used | Trading platforms, market data feeds | Risk management software, analytics tools |

| Goal | Maximize trading profits | Minimize financial losses and regulatory risks |

| Stakeholders | Traders, brokers, market analysts | Risk officers, compliance teams, senior management |

| Typical Metrics | Profit and loss (P&L), trade volume | Value at Risk (VaR), stress testing results |

Overview of Roles: Energy Trader vs Energy Risk Manager

Energy traders focus on buying and selling energy commodities such as oil, natural gas, and electricity to capitalize on market price fluctuations and generate profits. Energy risk managers analyze market trends, identify potential financial risks, and develop strategies to mitigate exposure to price volatility, regulatory changes, and operational uncertainties. Both roles require deep market knowledge, but traders prioritize short-term gains while risk managers emphasize long-term stability and compliance.

Key Responsibilities and Daily Tasks

Energy traders focus on buying and selling energy commodities such as oil, natural gas, and electricity to maximize profits by analyzing market trends and executing trades. Energy risk managers identify, assess, and mitigate financial risks related to price volatility, regulatory changes, and market fluctuations through risk modeling and compliance monitoring. Both roles collaborate to balance profit generation with risk control, ensuring the organization's energy portfolio remains profitable and stable.

Core Skills and Competencies Required

Energy Traders require strong analytical skills, market knowledge, and quick decision-making abilities to optimize trading strategies and maximize profits in dynamic energy markets. Energy Risk Managers focus on expertise in risk assessment, regulatory compliance, and financial modeling to identify, evaluate, and mitigate risks associated with energy portfolios. Both roles demand proficiency in data analysis, energy market fundamentals, and effective communication for strategic collaboration.

Educational Background and Qualifications

Energy traders typically hold degrees in finance, economics, or engineering, with certifications like the Chartered Financial Analyst (CFA) or Energy Risk Professional (ERP) enhancing their market analysis and trading strategy skills. Energy risk managers often possess advanced qualifications in risk management, such as the Financial Risk Manager (FRM) certification, along with degrees in finance, statistics, or environmental science to adeptly assess and mitigate energy market risks. Both roles benefit from strong quantitative skills, but energy risk managers focus more on regulatory compliance and risk assessment frameworks.

Decision-Making Processes

Energy traders execute rapid decision-making based on real-time market data and price fluctuations to optimize short-term profits, relying heavily on technical analysis and market sentiment. Energy risk managers employ a structured, data-driven approach to assess and mitigate risks by evaluating exposure, regulatory impacts, and long-term market trends using quantitative models. While traders prioritize immediate profit maximization, risk managers focus on portfolio stability and compliance, integrating scenario analysis and stress testing into their decision framework.

Tools and Technologies Utilized

Energy traders leverage advanced trading platforms, algorithmic trading software, and real-time market data analytics to execute swift and strategic energy transactions. Energy risk managers utilize sophisticated risk management systems, predictive analytics tools, and scenario modeling software to identify, assess, and mitigate financial risks related to energy markets. Both roles increasingly depend on artificial intelligence, blockchain technology, and cloud-based solutions to enhance operational efficiency and decision-making accuracy.

Risk Management Approaches

Energy traders primarily focus on market risk management by leveraging real-time data and advanced analytics to optimize trading positions and maximize profit margins. Energy risk managers employ comprehensive risk assessment frameworks, integrating credit, operational, and regulatory risks to ensure portfolio stability and compliance. Both roles utilize hedging strategies and scenario analysis, yet risk managers emphasize long-term risk mitigation and capital preservation within volatile energy markets.

Career Growth and Advancement Opportunities

Energy traders often experience rapid career growth by leveraging market analysis, trading strategies, and real-time decision-making skills, with opportunities to advance into senior trading roles or portfolio management. Energy risk managers gain career advancement through expertise in risk assessment, compliance, and mitigation strategies, progressing into chief risk officer positions or strategic advisory roles. Both roles offer strong career trajectories, with energy traders focusing on profit maximization and energy risk managers concentrating on sustainability and regulatory alignment.

Salary Expectations and Compensation Trends

Energy traders typically command higher base salaries with significant performance-based bonuses reflecting profits from trading activities, while energy risk managers receive steadier compensation packages with bonuses tied to risk mitigation success. Market data indicates that energy traders' total compensation can range from $120,000 to over $300,000 annually, depending on experience and trading desk size, whereas energy risk managers generally earn between $90,000 and $180,000, emphasizing stability over high-risk gains. Compensation trends reveal increasing use of equity incentives and long-term performance rewards for both roles, aligning financial interests with company sustainability and risk-adjusted returns.

Industry Impact and Value Creation

Energy Traders drive market liquidity by capitalizing on price fluctuations in commodities such as crude oil, natural gas, and electricity, thereby optimizing portfolio returns and enhancing market efficiency. Energy Risk Managers mitigate exposure to volatile energy prices through strategic hedging and compliance with regulatory frameworks, ensuring financial stability and long-term sustainability for energy companies. Their combined roles foster innovation in trading strategies and risk assessment, ultimately driving value creation and resilience across the global energy industry.

Energy Trader vs Energy Risk Manager Infographic

jobdiv.com

jobdiv.com