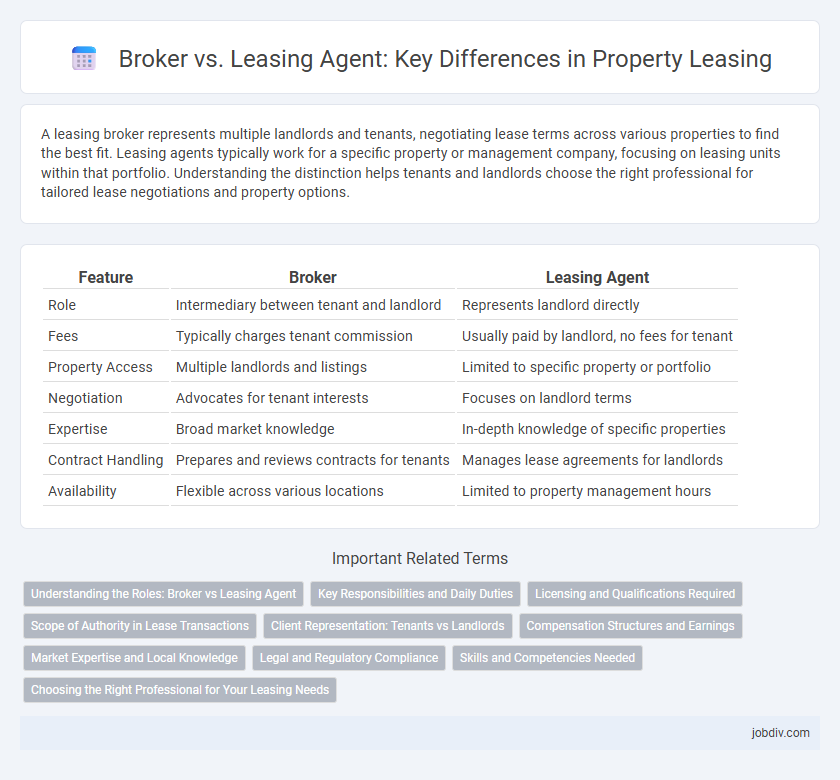

A leasing broker represents multiple landlords and tenants, negotiating lease terms across various properties to find the best fit. Leasing agents typically work for a specific property or management company, focusing on leasing units within that portfolio. Understanding the distinction helps tenants and landlords choose the right professional for tailored lease negotiations and property options.

Table of Comparison

| Feature | Broker | Leasing Agent |

|---|---|---|

| Role | Intermediary between tenant and landlord | Represents landlord directly |

| Fees | Typically charges tenant commission | Usually paid by landlord, no fees for tenant |

| Property Access | Multiple landlords and listings | Limited to specific property or portfolio |

| Negotiation | Advocates for tenant interests | Focuses on landlord terms |

| Expertise | Broad market knowledge | In-depth knowledge of specific properties |

| Contract Handling | Prepares and reviews contracts for tenants | Manages lease agreements for landlords |

| Availability | Flexible across various locations | Limited to property management hours |

Understanding the Roles: Broker vs Leasing Agent

A leasing broker acts as an intermediary between tenants and landlords, offering a broader range of property options across multiple listings and negotiating terms on behalf of clients. Leasing agents typically represent a specific property or landlord, focusing on marketing the property, conducting tours, and handling lease agreements for that single asset. Understanding these distinct roles helps tenants choose the right professional for their needs, whether seeking diverse options or specialized property knowledge.

Key Responsibilities and Daily Duties

Brokers manage client relationships and negotiate lease terms between tenants and landlords, securing favorable deals while ensuring compliance with regulations. Leasing agents conduct property tours, process applications, and handle lease documentation to facilitate tenant move-ins and maintain occupancy rates. Both roles require market knowledge, strong communication skills, and an understanding of legal leasing procedures.

Licensing and Qualifications Required

Brokers in leasing typically require a state-issued real estate license, which involves completing pre-licensing education, passing a licensing exam, and fulfilling continuing education requirements to maintain their credentials. Leasing agents often need to obtain a limited or specialized license, with less stringent educational and examination criteria compared to brokers, depending on state regulations. Both roles demand a thorough understanding of local leasing laws and regulations, but brokers usually possess higher qualifications and broader authority to negotiate and manage property leases.

Scope of Authority in Lease Transactions

A leasing agent typically has a defined scope of authority limited to showing properties, assisting with applications, and facilitating lease signings under the leasing company's guidelines. A broker possesses broader authority, including negotiating lease terms, structuring complex lease agreements, and representing clients in legal and financial aspects of lease transactions. Brokers often hold licenses allowing them to act as intermediaries with fiduciary responsibilities, unlike leasing agents whose roles are more operational and restricted.

Client Representation: Tenants vs Landlords

Leasing brokers typically represent tenants, focusing on finding suitable rental properties that meet client needs and negotiating favorable lease terms. In contrast, leasing agents usually work on behalf of landlords, marketing available units, screening prospective tenants, and managing lease agreements to maximize property occupancy and income. Understanding these distinct roles helps clients choose the right professional to effectively represent their interests in the leasing process.

Compensation Structures and Earnings

Brokers typically earn a commission based on a percentage of the total lease value, often ranging from 3% to 6%, which incentivizes higher-value deal closures and portfolio growth. Leasing agents usually receive a fixed salary complemented by bonuses tied to the number of leases signed or occupancy rates achieved, promoting consistent leasing activity. Commission-based compensation allows brokers to maximize earnings through negotiation skills, while leasing agents benefit from steady income and performance incentives.

Market Expertise and Local Knowledge

Brokers typically possess extensive market expertise, offering a broad view of available leasing options across multiple locations and property types. Leasing agents specialize in specific properties or developments, providing detailed local knowledge that helps tailor leasing options to prospective tenants' needs. Both roles leverage their unique insights to streamline the leasing process, but brokers excel in market-wide analysis while leasing agents focus on hyper-local expertise.

Legal and Regulatory Compliance

Leasing brokers and leasing agents differ significantly in their legal and regulatory compliance requirements, with brokers often needing licensure under state real estate commissions and adherence to stricter fiduciary duties. Leasing agents typically operate under a broker's supervision but must comply with state licensing statutes, fair housing laws, and disclosure obligations to avoid legal penalties. Understanding these distinctions ensures compliance with regulations such as the Real Estate Settlement Procedures Act (RESPA) and anti-discrimination laws during property leasing transactions.

Skills and Competencies Needed

Brokers require strong negotiation skills, market knowledge, and relationship-building competencies to secure optimal leasing terms for clients. Leasing agents must excel in customer service, property marketing, and local leasing regulations to effectively connect tenants with available properties. Both roles benefit from proficiency in communication, contract comprehension, and sales techniques to navigate the leasing process efficiently.

Choosing the Right Professional for Your Leasing Needs

Selecting between a broker and a leasing agent depends on your specific leasing goals and property type. Brokers typically have access to a wider range of listings and can negotiate on behalf of multiple landlords, while leasing agents usually represent one property or property management company, offering detailed local market expertise. Understanding these distinctions ensures you engage the professional best suited to maximize your leasing success and streamline the tenant placement process.

Broker vs Leasing Agent Infographic

jobdiv.com

jobdiv.com