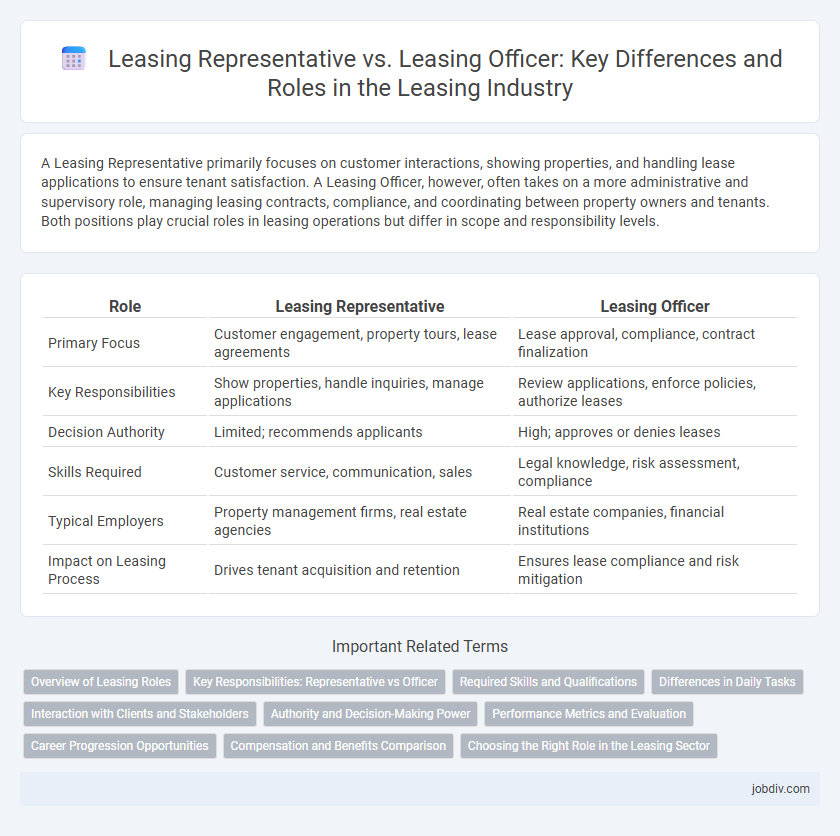

A Leasing Representative primarily focuses on customer interactions, showing properties, and handling lease applications to ensure tenant satisfaction. A Leasing Officer, however, often takes on a more administrative and supervisory role, managing leasing contracts, compliance, and coordinating between property owners and tenants. Both positions play crucial roles in leasing operations but differ in scope and responsibility levels.

Table of Comparison

| Role | Leasing Representative | Leasing Officer |

|---|---|---|

| Primary Focus | Customer engagement, property tours, lease agreements | Lease approval, compliance, contract finalization |

| Key Responsibilities | Show properties, handle inquiries, manage applications | Review applications, enforce policies, authorize leases |

| Decision Authority | Limited; recommends applicants | High; approves or denies leases |

| Skills Required | Customer service, communication, sales | Legal knowledge, risk assessment, compliance |

| Typical Employers | Property management firms, real estate agencies | Real estate companies, financial institutions |

| Impact on Leasing Process | Drives tenant acquisition and retention | Ensures lease compliance and risk mitigation |

Overview of Leasing Roles

Leasing Representatives primarily handle tenant inquiries, property showings, and application processing to facilitate lease agreements. Leasing Officers oversee leasing operations, enforce lease compliance, and manage tenant relations to ensure property management goals are met. Both roles are critical in maintaining occupancy rates and optimizing rental income in commercial and residential properties.

Key Responsibilities: Representative vs Officer

Leasing Representatives primarily handle tenant interactions, property showings, and lease agreement facilitation, ensuring customer satisfaction and occupancy rate optimization. Leasing Officers manage lease documentation, compliance with legal standards, and financial transactions, focusing on contract enforcement and risk mitigation. Representatives emphasize tenant relations and marketing, while Officers concentrate on administrative accuracy and regulatory adherence.

Required Skills and Qualifications

Leasing Representatives must possess strong customer service skills, effective communication abilities, and a basic understanding of leasing agreements to guide prospective tenants through the application process. Leasing Officers require advanced knowledge of property management, contract law, and financial analysis, alongside leadership skills to oversee leasing operations and ensure regulatory compliance. Both roles demand proficiency in CRM software and a detail-oriented approach to managing tenant information and leasing documentation.

Differences in Daily Tasks

Leasing Representatives primarily handle direct tenant interactions, including showing properties, answering inquiries, and processing rental applications, ensuring a smooth client experience. Leasing Officers, on the other hand, focus more on administrative and compliance tasks such as drafting lease agreements, managing lease renewals, and enforcing lease terms. The key difference lies in Leasing Representatives' customer-facing role versus Leasing Officers' emphasis on documentation and lease management.

Interaction with Clients and Stakeholders

Leasing Representatives primarily engage with prospective tenants by conducting property showings, answering inquiries, and facilitating the application process to ensure a positive leasing experience. Leasing Officers interact with a broader range of stakeholders, including property managers, landlords, and legal teams to manage lease agreements, compliance, and contract negotiations. Both roles require strong communication skills, but Leasing Officers focus more on contractual and regulatory aspects while Leasing Representatives emphasize customer service and client relationship-building.

Authority and Decision-Making Power

Leasing Officers hold greater authority and decision-making power compared to Leasing Representatives, often responsible for approving lease agreements and negotiating contract terms. Leasing Representatives primarily handle customer interactions, property showings, and initial application processing with limited autonomy. The distinction in authority impacts their roles in lease approval and financial negotiations within property management.

Performance Metrics and Evaluation

Leasing Representatives are primarily evaluated on customer interaction metrics, including lead conversion rates, response times, and tenant satisfaction scores, reflecting their direct engagement with prospects. Leasing Officers often have broader performance metrics encompassing compliance adherence, lease agreement accuracy, and portfolio management effectiveness, ensuring operational consistency and legal conformity. Both roles rely heavily on occupancy rates and retention figures as key performance indicators to measure success in leasing activities.

Career Progression Opportunities

Leasing Representatives typically handle initial tenant interactions, property tours, and application processing, serving as entry-level roles in real estate leasing. Leasing Officers possess greater responsibilities, including contract negotiations, compliance oversight, and client relationship management, representing a progression in career and expertise. Advancement opportunities often lead from Leasing Representative to Leasing Officer, then to Leasing Manager or Director roles, reflecting increased leadership and strategic decision-making within property management.

Compensation and Benefits Comparison

Leasing Representatives typically earn a base salary between $35,000 and $50,000 annually, with commissions and bonuses based on lease agreements increasing total compensation. Leasing Officers often receive higher base salaries ranging from $45,000 to $65,000 per year, along with enhanced benefits packages including health insurance, retirement plans, and performance bonuses. The compensation structure for Leasing Officers reflects greater responsibilities and decision-making authority, emphasizing stability and long-term incentives compared to the more sales-driven earnings of Leasing Representatives.

Choosing the Right Role in the Leasing Sector

Leasing Representatives primarily focus on client interactions, property showings, and lease agreement facilitation, making them ideal for candidates with strong communication and sales skills. Leasing Officers typically handle more administrative tasks such as contract compliance, rent collection, and reporting, suited for those with attention to detail and a background in property management. Assessing personal strengths and career goals aids in choosing the right role within the leasing sector for optimal job satisfaction and professional growth.

Leasing Representative vs Leasing Officer Infographic

jobdiv.com

jobdiv.com