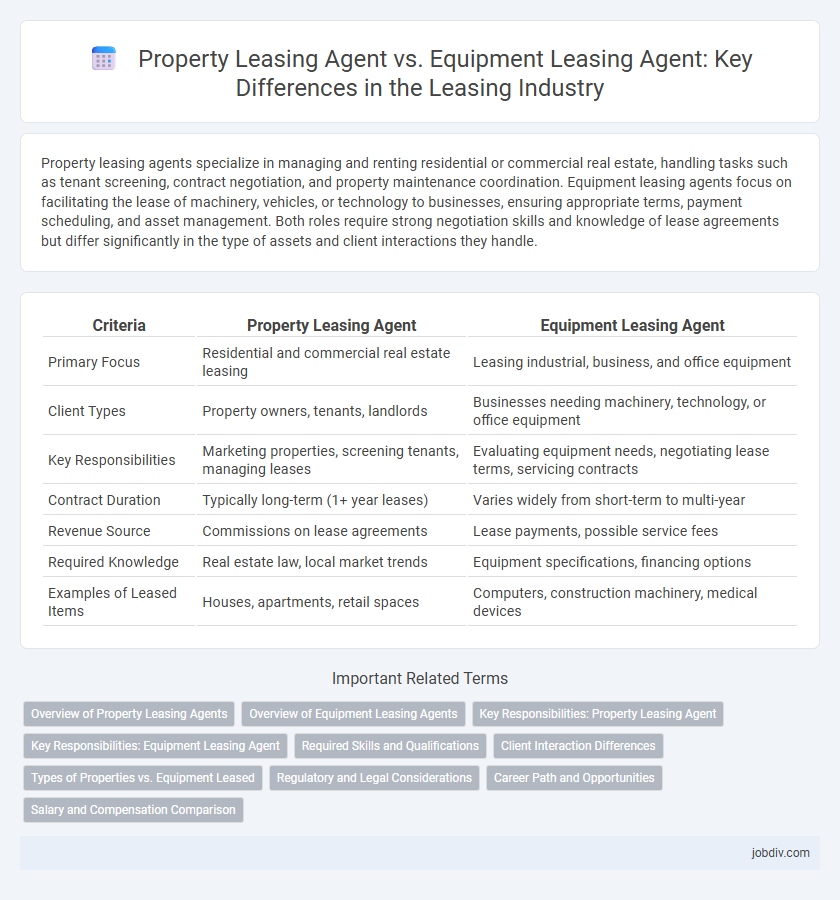

Property leasing agents specialize in managing and renting residential or commercial real estate, handling tasks such as tenant screening, contract negotiation, and property maintenance coordination. Equipment leasing agents focus on facilitating the lease of machinery, vehicles, or technology to businesses, ensuring appropriate terms, payment scheduling, and asset management. Both roles require strong negotiation skills and knowledge of lease agreements but differ significantly in the type of assets and client interactions they handle.

Table of Comparison

| Criteria | Property Leasing Agent | Equipment Leasing Agent |

|---|---|---|

| Primary Focus | Residential and commercial real estate leasing | Leasing industrial, business, and office equipment |

| Client Types | Property owners, tenants, landlords | Businesses needing machinery, technology, or office equipment |

| Key Responsibilities | Marketing properties, screening tenants, managing leases | Evaluating equipment needs, negotiating lease terms, servicing contracts |

| Contract Duration | Typically long-term (1+ year leases) | Varies widely from short-term to multi-year |

| Revenue Source | Commissions on lease agreements | Lease payments, possible service fees |

| Required Knowledge | Real estate law, local market trends | Equipment specifications, financing options |

| Examples of Leased Items | Houses, apartments, retail spaces | Computers, construction machinery, medical devices |

Overview of Property Leasing Agents

Property leasing agents specialize in managing residential, commercial, or industrial spaces, facilitating tenant sourcing, lease negotiations, and property compliance. They conduct market analysis to set competitive rental rates and ensure properties meet regulatory standards, enhancing occupancy rates and client satisfaction. Expertise in local real estate laws and strong interpersonal skills are crucial for property leasing agents to effectively connect landlords with suitable tenants.

Overview of Equipment Leasing Agents

Equipment leasing agents specialize in facilitating agreements for the rental of machinery, vehicles, and technological assets, enabling businesses to access costly equipment without large upfront expenses. They assess clients' financial qualifications, negotiate lease terms, and coordinate with leasing companies to secure favorable contracts. Expertise in understanding asset depreciation, lease structures, and industry-specific equipment demands distinguishes these agents from property leasing professionals.

Key Responsibilities: Property Leasing Agent

Property leasing agents specialize in managing rental agreements, marketing residential or commercial properties, and conducting tenant screenings to ensure optimal occupancy rates. They coordinate property showings, negotiate lease terms, and handle maintenance requests to maintain tenant satisfaction and property value. Their expertise includes understanding local real estate laws, market trends, and effective communication with landlords and tenants for seamless leasing operations.

Key Responsibilities: Equipment Leasing Agent

Equipment leasing agents specialize in evaluating and facilitating lease agreements for machinery, vehicles, and technology assets, ensuring clients acquire necessary equipment without large capital expenditures. They analyze creditworthiness, negotiate lease terms, and coordinate with manufacturers and financial institutions to structure optimal leasing solutions. Their expertise in asset valuation and market trends enables tailored leasing plans that maximize operational efficiency for businesses.

Required Skills and Qualifications

Property leasing agents require strong interpersonal skills, knowledge of real estate laws, and proficiency in marketing residential or commercial properties. Equipment leasing agents must possess technical understanding of equipment specifications, financial analysis skills, and expertise in contract negotiation. Both roles demand effective communication, customer service abilities, and familiarity with leasing regulations.

Client Interaction Differences

Property Leasing Agents primarily engage with tenants and landlords, focusing on residential or commercial real estate needs, lease negotiations, and property management. Equipment Leasing Agents interact with business clients seeking machinery or technology leasing, emphasizing contract terms, equipment specifications, and financing options. The key client interaction difference lies in Property Leasing Agents addressing living or workspace preferences, while Equipment Leasing Agents provide tailored solutions for operational and capital equipment requirements.

Types of Properties vs. Equipment Leased

Property leasing agents specialize in residential, commercial, and industrial real estate, handling leases for apartments, office buildings, retail spaces, and warehouses. Equipment leasing agents focus on tangible assets such as machinery, vehicles, computers, and medical devices, facilitating leasing agreements tailored to business needs. The distinction lies in the asset type managed: real estate properties for property agents versus physical equipment for equipment leasing agents.

Regulatory and Legal Considerations

Property leasing agents navigate complex real estate regulations including zoning laws, tenant rights, and fair housing statutes, requiring compliance with state and local property leasing laws. Equipment leasing agents must adhere to Uniform Commercial Code (UCC) provisions, financial disclosure requirements, and often industry-specific standards governing leased equipment usage and maintenance. Both roles demand rigorous understanding of contract law and regulatory frameworks to mitigate legal risks and ensure enforceable leasing agreements.

Career Path and Opportunities

Property leasing agents specialize in residential and commercial real estate, offering career paths that can lead to roles in property management, real estate sales, or brokerage. Equipment leasing agents focus on leasing machinery and business equipment, with opportunities to advance into financial analysis, sales management, or leasing consultancy within industrial sectors. Both career paths require strong negotiation skills and offer growth potential in specialized niche markets depending on industry demand and economic trends.

Salary and Compensation Comparison

Property leasing agents typically earn a median annual salary of around $50,000, with compensation often including commissions based on lease agreements, driving their total income higher in competitive markets. Equipment leasing agents generally receive a higher base salary, averaging approximately $60,000 per year, supplemented by performance bonuses and commissions tied to the value and volume of leased equipment. Variations in compensation reflect differences in industry demand, complexity of lease transactions, and commission structures between property and equipment leasing sectors.

Property Leasing Agent vs Equipment Leasing Agent Infographic

jobdiv.com

jobdiv.com