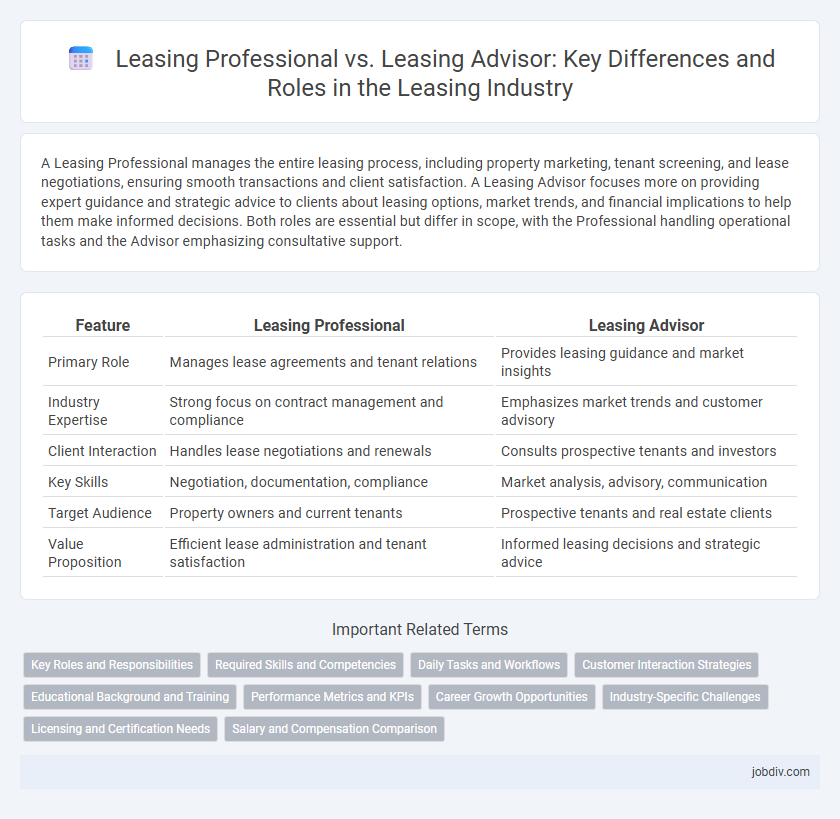

A Leasing Professional manages the entire leasing process, including property marketing, tenant screening, and lease negotiations, ensuring smooth transactions and client satisfaction. A Leasing Advisor focuses more on providing expert guidance and strategic advice to clients about leasing options, market trends, and financial implications to help them make informed decisions. Both roles are essential but differ in scope, with the Professional handling operational tasks and the Advisor emphasizing consultative support.

Table of Comparison

| Feature | Leasing Professional | Leasing Advisor |

|---|---|---|

| Primary Role | Manages lease agreements and tenant relations | Provides leasing guidance and market insights |

| Industry Expertise | Strong focus on contract management and compliance | Emphasizes market trends and customer advisory |

| Client Interaction | Handles lease negotiations and renewals | Consults prospective tenants and investors |

| Key Skills | Negotiation, documentation, compliance | Market analysis, advisory, communication |

| Target Audience | Property owners and current tenants | Prospective tenants and real estate clients |

| Value Proposition | Efficient lease administration and tenant satisfaction | Informed leasing decisions and strategic advice |

Key Roles and Responsibilities

Leasing professionals manage tenant relations, lease negotiations, and property marketing to ensure high occupancy rates and optimal rental income. Leasing advisors primarily focus on guiding prospective tenants through the leasing process, providing detailed property information, and addressing client inquiries to facilitate successful lease agreements. Both roles require strong communication skills and market knowledge but differ in the scope of responsibilities and interaction stages with tenants.

Required Skills and Competencies

Leasing Professionals demonstrate expertise in property management, tenant relations, and contract negotiation, requiring strong communication, organizational, and sales skills. Leasing Advisors focus on client consultation, market analysis, and financial assessment, demanding proficiency in customer service, data interpretation, and persuasive communication. Both roles necessitate knowledge of leasing laws, attention to detail, and ability to handle multiple tasks efficiently within real estate environments.

Daily Tasks and Workflows

Leasing Professionals manage property showings, tenant screenings, and lease agreement preparations to ensure occupancy goals are met efficiently. Leasing Advisors focus on client consultations, addressing inquiries, and providing tailored leasing solutions to enhance customer satisfaction throughout the rental process. Both roles require collaboration with property management teams to streamline workflows and maintain accurate leasing records.

Customer Interaction Strategies

Leasing Professionals emphasize building long-term customer relationships through personalized communication and proactive problem-solving, ensuring tenant satisfaction and retention. Leasing Advisors focus on detailed property knowledge and tailored leasing presentations, guiding prospects with clear, concise information to facilitate informed decisions. Both roles utilize CRM tools and active listening techniques to optimize customer interaction and drive lease conversions.

Educational Background and Training

Leasing Professionals often possess formal education in real estate, finance, or business administration, complemented by industry-recognized certifications such as Certified Leasing Specialist (CLS). Leasing Advisors typically undergo specialized training focused on customer service, property management software, and lease agreement intricacies, emphasizing practical skills over formal education. Both roles require ongoing professional development to stay current with property laws, market trends, and leasing best practices.

Performance Metrics and KPIs

Leasing Professionals typically focus on comprehensive performance metrics such as lease conversion rates, tenant retention rates, and leasing velocity, which directly impact overall portfolio occupancy and revenue growth. Leasing Advisors prioritize personalized KPIs like customer satisfaction scores, inquiry response time, and consultation follow-up rates to enhance tenant experience and relationship management. Both roles leverage data-driven insights to optimize leasing efficiency, but Leasing Professionals emphasize operational outcomes while Leasing Advisors focus on client engagement and advisory effectiveness.

Career Growth Opportunities

Leasing Professionals typically focus on managing tenant relations and ensuring property occupancy, offering a solid foundation for advancing into property management or real estate sales. Leasing Advisors provide strategic consultation on lease agreements and market trends, positioning themselves for roles in commercial leasing or real estate consulting. Career growth in leasing often depends on specialization, with Advisors generally accessing higher-level opportunities due to their analytical and negotiation expertise.

Industry-Specific Challenges

Leasing Professionals often tackle complex contract negotiations and compliance with evolving regulatory standards specific to real estate or automotive sectors. Leasing Advisors specialize in customer-centric strategies, addressing client needs and market trends to enhance tenant retention and satisfaction. Both roles require deep industry knowledge but diverge in focus, with Professionals managing operational and legal challenges while Advisors drive engagement and sales performance.

Licensing and Certification Needs

Leasing professionals typically require a real estate license to legally execute leasing agreements and handle tenant transactions, ensuring compliance with state regulations. Leasing advisors may not always need a formal license but often pursue certifications such as Certified Leasing Specialist (CLS) to enhance their expertise and credibility. Licensing requirements vary by jurisdiction, making it essential for both roles to verify local laws and obtain relevant credentials to maintain professional standards.

Salary and Compensation Comparison

Leasing Professionals typically earn a base salary ranging from $40,000 to $60,000 annually, often supplemented by performance bonuses and commission incentives based on lease agreements closed. Leasing Advisors generally receive a higher overall compensation package, with salaries between $50,000 and $70,000, reflecting their advisory role and direct client interaction, alongside commissions and bonuses tied to tenant retention and occupancy rates. The salary variance is influenced by experience, location, and the complexity of the leasing portfolio managed.

Leasing Professional vs Leasing Advisor Infographic

jobdiv.com

jobdiv.com