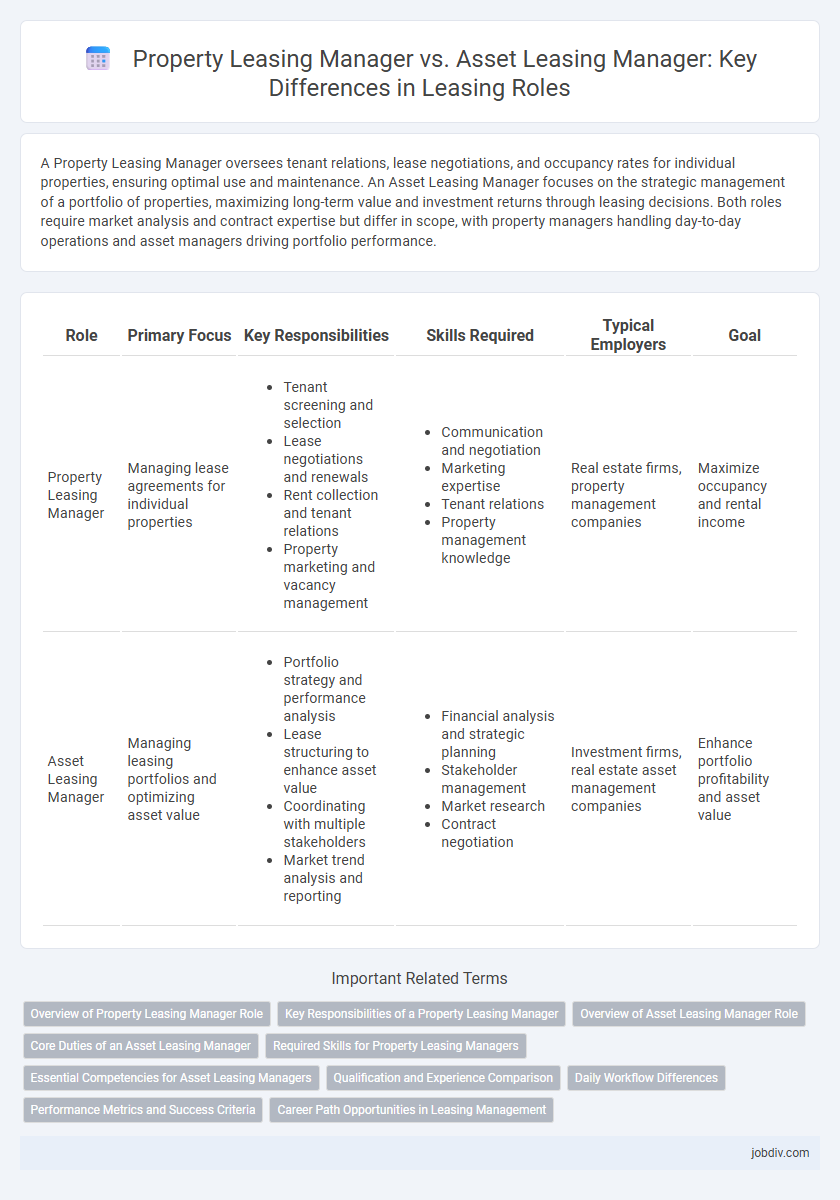

A Property Leasing Manager oversees tenant relations, lease negotiations, and occupancy rates for individual properties, ensuring optimal use and maintenance. An Asset Leasing Manager focuses on the strategic management of a portfolio of properties, maximizing long-term value and investment returns through leasing decisions. Both roles require market analysis and contract expertise but differ in scope, with property managers handling day-to-day operations and asset managers driving portfolio performance.

Table of Comparison

| Role | Primary Focus | Key Responsibilities | Skills Required | Typical Employers | Goal |

|---|---|---|---|---|---|

| Property Leasing Manager | Managing lease agreements for individual properties |

|

|

Real estate firms, property management companies | Maximize occupancy and rental income |

| Asset Leasing Manager | Managing leasing portfolios and optimizing asset value |

|

|

Investment firms, real estate asset management companies | Enhance portfolio profitability and asset value |

Overview of Property Leasing Manager Role

A Property Leasing Manager oversees tenant acquisition, lease negotiations, and property marketing to maximize occupancy and rental income. This role involves managing tenant relationships, coordinating lease documentation, and ensuring compliance with local leasing regulations. Property Leasing Managers focus on individual properties, optimizing their performance and maintaining positive tenant experiences.

Key Responsibilities of a Property Leasing Manager

A Property Leasing Manager oversees tenant relations, lease negotiations, and property marketing to maximize occupancy rates and rental income. They coordinate maintenance requests, enforce lease agreements, and ensure compliance with local regulations to maintain property value and tenant satisfaction. Their responsibilities include conducting property tours, screening prospective tenants, and managing lease renewals to optimize portfolio performance.

Overview of Asset Leasing Manager Role

An Asset Leasing Manager focuses on maximizing the value and performance of a real estate portfolio by strategically managing lease agreements, tenant relationships, and asset utilization. This role involves analyzing market trends, overseeing lease negotiations, and ensuring alignment with long-term investment goals to enhance asset profitability. Expertise in financial metrics, property valuation, and portfolio management is essential to drive sustainable growth and optimize return on investment.

Core Duties of an Asset Leasing Manager

An Asset Leasing Manager primarily oversees the strategic management and optimization of a real estate portfolio to maximize asset value and return on investment. Core duties include analyzing market trends, coordinating lease negotiations, managing tenant relationships, and ensuring compliance with financial and legal requirements. They collaborate closely with finance and asset management teams to align property leasing strategies with broader investment objectives.

Required Skills for Property Leasing Managers

Property Leasing Managers require strong negotiation skills, in-depth knowledge of local real estate markets, and expertise in tenant relationship management to secure leases effectively. Proficiency in contract administration and regulatory compliance ensures smooth leasing transactions and minimizes legal risks. Analytical abilities to assess market trends and financial acumen for budgeting and rent optimization are essential for maximizing property value and occupancy rates.

Essential Competencies for Asset Leasing Managers

Asset Leasing Managers must excel in financial analysis to optimize lease portfolios and maximize returns on investment properties. Strong negotiation skills are essential for structuring favorable lease agreements and managing tenant relationships effectively. Proficiency in market research enables precise evaluation of asset performance and identification of growth opportunities within dynamic real estate markets.

Qualification and Experience Comparison

Property Leasing Managers typically require a background in real estate, property management, or business administration, supported by certifications such as Certified Property Manager (CPM) or Real Property Administrator (RPA). Asset Leasing Managers often possess advanced qualifications in finance, investment, or asset management, with credentials like Chartered Financial Analyst (CFA) or Certified Commercial Investment Member (CCIM) to manage leasing portfolios strategically. Experience for Property Leasing Managers centers on tenant relations, lease negotiations, and property operations, while Asset Leasing Managers focus on financial analysis, portfolio optimization, and long-term asset value enhancement.

Daily Workflow Differences

Property Leasing Managers coordinate tenant relations, manage lease agreements, and oversee property maintenance schedules to ensure occupancy rates remain high. Asset Leasing Managers analyze portfolio performance, strategize lease terms for maximizing asset value, and collaborate with financial teams on investment decisions. The daily workflow for Property Leasing Managers centers on operational tasks and tenant engagement, while Asset Leasing Managers focus on financial analysis and strategic planning.

Performance Metrics and Success Criteria

Property Leasing Managers are evaluated primarily on occupancy rates, tenant retention, lease renewal ratios, and rental income growth within their specific properties. Asset Leasing Managers focus on higher-level performance metrics such as portfolio-wide return on investment (ROI), asset value appreciation, and cash flow optimization across multiple properties. Success criteria for Property Leasing Managers emphasize operational efficiency and tenant satisfaction, while Asset Leasing Managers prioritize strategic asset allocation and long-term financial performance.

Career Path Opportunities in Leasing Management

Property Leasing Managers specialize in tenant relations, lease negotiations, and property marketing, providing a foundation for growth into senior leasing or property management roles. Asset Leasing Managers focus on maximizing portfolio value through strategic lease structuring, financial analysis, and asset optimization, leading to career advancement in asset management or real estate investment. Both paths offer robust opportunities in leasing management, with Property Leasing Managers often progressing toward operational leadership and Asset Leasing Managers advancing into strategic and executive positions.

Property Leasing Manager vs Asset Leasing Manager Infographic

jobdiv.com

jobdiv.com