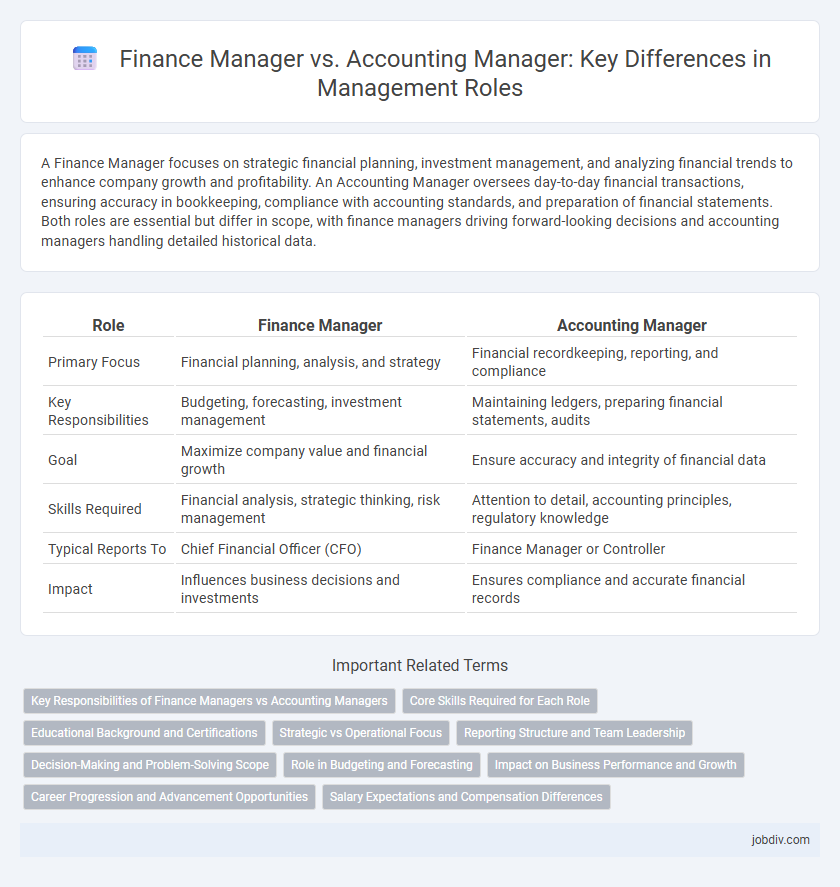

A Finance Manager focuses on strategic financial planning, investment management, and analyzing financial trends to enhance company growth and profitability. An Accounting Manager oversees day-to-day financial transactions, ensuring accuracy in bookkeeping, compliance with accounting standards, and preparation of financial statements. Both roles are essential but differ in scope, with finance managers driving forward-looking decisions and accounting managers handling detailed historical data.

Table of Comparison

| Role | Finance Manager | Accounting Manager |

|---|---|---|

| Primary Focus | Financial planning, analysis, and strategy | Financial recordkeeping, reporting, and compliance |

| Key Responsibilities | Budgeting, forecasting, investment management | Maintaining ledgers, preparing financial statements, audits |

| Goal | Maximize company value and financial growth | Ensure accuracy and integrity of financial data |

| Skills Required | Financial analysis, strategic thinking, risk management | Attention to detail, accounting principles, regulatory knowledge |

| Typical Reports To | Chief Financial Officer (CFO) | Finance Manager or Controller |

| Impact | Influences business decisions and investments | Ensures compliance and accurate financial records |

Key Responsibilities of Finance Managers vs Accounting Managers

Finance Managers oversee budgeting, financial planning, and investment analysis to guide strategic decision-making and optimize company resources. Accounting Managers focus on managing financial records, ensuring regulatory compliance, and supervising daily accounting operations such as ledger maintenance and financial reporting. Both roles collaborate closely to maintain financial accuracy and support organizational financial health.

Core Skills Required for Each Role

Finance Managers require strong analytical skills, proficiency in financial forecasting, and strategic planning expertise to drive business growth and investment decisions. Accounting Managers must possess detailed knowledge of GAAP, expertise in financial reporting, and advanced skills in managing accounting teams and audit processes. Both roles demand proficiency in financial software, but Finance Managers focus more on market trends and investment analysis, while Accounting Managers concentrate on regulatory compliance and accuracy in financial records.

Educational Background and Certifications

Finance Managers typically hold degrees in finance, economics, or business administration and often pursue certifications such as the Chartered Financial Analyst (CFA) or Certified Financial Planner (CFP) to enhance their expertise. Accounting Managers generally have backgrounds in accounting or finance and frequently obtain certifications like the Certified Public Accountant (CPA) or Certified Management Accountant (CMA) to demonstrate proficiency in financial reporting and compliance. Both roles benefit from strong analytical skills but differ in educational focus and professional credentialing aligned with their specific managerial responsibilities.

Strategic vs Operational Focus

Finance Managers prioritize strategic financial planning, investment analysis, and long-term growth initiatives to drive organizational value. Accounting Managers concentrate on operational tasks such as financial reporting, compliance, and maintaining accurate records to ensure regulatory adherence. The Finance Manager's role aligns with forward-looking decision-making, while the Accounting Manager focuses on detailed execution and daily financial operations.

Reporting Structure and Team Leadership

A Finance Manager typically oversees the financial planning, analysis, and strategic reporting directly to the CFO or finance director, managing cross-functional teams including analysts and budget coordinators. An Accounting Manager focuses on the daily accounting operations, ensuring accurate transaction recording and compliance, reporting to the Controller or Finance Manager while leading accounting staff such as accountants and auditors. The Finance Manager's leadership role centers on broader financial strategy and team collaboration, whereas the Accounting Manager emphasizes precision in financial records and operational team supervision.

Decision-Making and Problem-Solving Scope

Finance Managers concentrate on strategic decision-making, analyzing financial data to guide investment, budgeting, and long-term organizational growth. Accounting Managers focus on problem-solving related to accurate financial record-keeping, compliance, and internal controls to ensure data integrity. The Finance Manager's scope emphasizes forward-looking financial strategies, while the Accounting Manager addresses transactional accuracy and regulatory adherence.

Role in Budgeting and Forecasting

Finance Managers play a critical role in budgeting and forecasting by analyzing financial data to develop strategic plans that align with organizational goals and ensure optimal resource allocation. Accounting Managers primarily focus on maintaining accurate financial records and preparing detailed reports that provide the foundation for accurate budget creation and financial forecasts. The collaboration between Finance and Accounting Managers is essential for creating realistic budgets and reliable financial projections that support informed decision-making.

Impact on Business Performance and Growth

A Finance Manager drives business performance by strategically managing investments, budgeting, and financial forecasting, enabling data-driven decisions that promote growth and profitability. An Accounting Manager ensures accurate financial reporting and compliance, which safeguards the company from risks and supports transparent operational management. Together, their roles complement each other to optimize financial health, facilitating sustainable growth and enhanced business outcomes.

Career Progression and Advancement Opportunities

Finance Manager roles typically offer broader career progression opportunities, leading to senior positions such as Finance Director or Chief Financial Officer (CFO), due to their strategic focus on financial planning and analysis. Accounting Managers often advance toward roles like Controller or Chief Accounting Officer (CAO), specializing in compliance, reporting, and internal controls. The Finance Manager path generally provides greater potential for cross-functional leadership and involvement in business growth initiatives, enhancing long-term advancement prospects.

Salary Expectations and Compensation Differences

Finance Managers typically earn higher salaries than Accounting Managers due to their broader strategic responsibilities and impact on organizational growth. Median annual compensation for Finance Managers in the U.S. ranges from $90,000 to $130,000, while Accounting Managers average between $70,000 and $110,000. Variations in bonuses, profit-sharing, and performance incentives also contribute to the compensation gap, reflecting the differing roles in financial planning versus financial reporting.

Finance Manager vs Accounting Manager Infographic

jobdiv.com

jobdiv.com