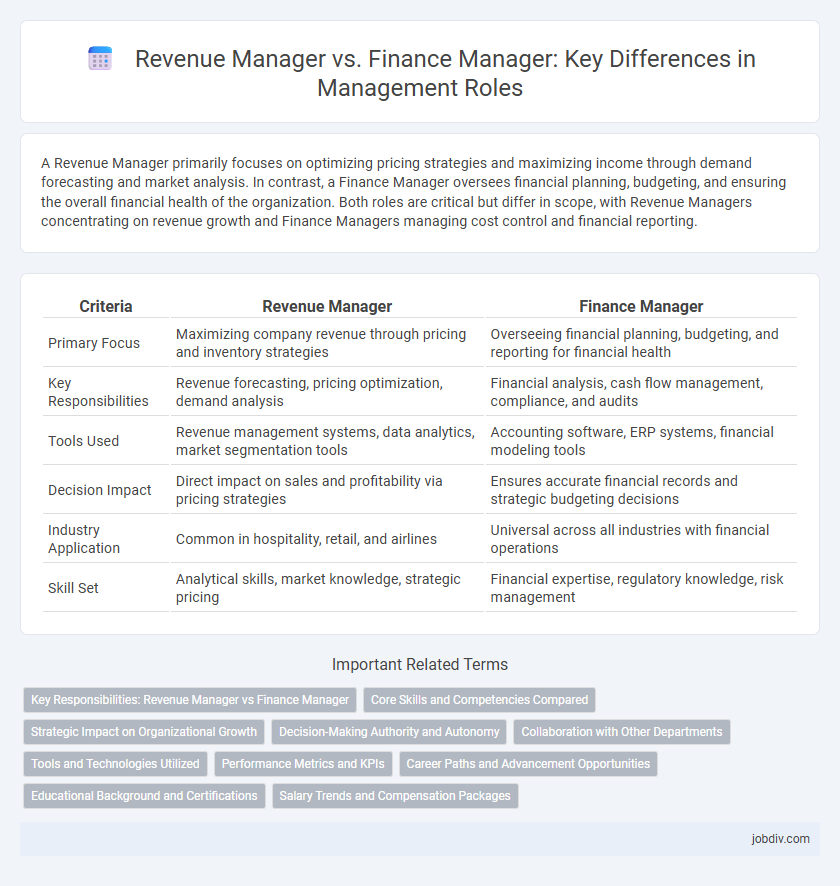

A Revenue Manager primarily focuses on optimizing pricing strategies and maximizing income through demand forecasting and market analysis. In contrast, a Finance Manager oversees financial planning, budgeting, and ensuring the overall financial health of the organization. Both roles are critical but differ in scope, with Revenue Managers concentrating on revenue growth and Finance Managers managing cost control and financial reporting.

Table of Comparison

| Criteria | Revenue Manager | Finance Manager |

|---|---|---|

| Primary Focus | Maximizing company revenue through pricing and inventory strategies | Overseeing financial planning, budgeting, and reporting for financial health |

| Key Responsibilities | Revenue forecasting, pricing optimization, demand analysis | Financial analysis, cash flow management, compliance, and audits |

| Tools Used | Revenue management systems, data analytics, market segmentation tools | Accounting software, ERP systems, financial modeling tools |

| Decision Impact | Direct impact on sales and profitability via pricing strategies | Ensures accurate financial records and strategic budgeting decisions |

| Industry Application | Common in hospitality, retail, and airlines | Universal across all industries with financial operations |

| Skill Set | Analytical skills, market knowledge, strategic pricing | Financial expertise, regulatory knowledge, risk management |

Key Responsibilities: Revenue Manager vs Finance Manager

Revenue Managers focus on optimizing pricing strategies, forecasting revenue streams, and analyzing sales performance to maximize profitability in sectors like hospitality and retail. Finance Managers oversee budgeting, financial reporting, and regulatory compliance, ensuring accurate financial records and strategic allocation of resources across the organization. Both roles require strong analytical skills but differ in their core objectives: revenue growth versus financial stability and control.

Core Skills and Competencies Compared

Revenue Managers specialize in pricing strategies, demand forecasting, and revenue optimization using data analytics and market trends analysis to maximize profitability. Finance Managers focus on financial planning, budgeting, cash flow management, and regulatory compliance, applying expertise in accounting principles and financial reporting. Core competencies for Revenue Managers include strong analytical skills and market insight, whereas Finance Managers require proficiency in financial modeling, strategic planning, and risk management.

Strategic Impact on Organizational Growth

Revenue Managers drive organizational growth by optimizing pricing strategies, forecasting demand, and maximizing sales revenue through data-driven decision-making. Finance Managers contribute by managing budgets, ensuring financial stability, and overseeing capital allocation to support long-term strategic initiatives. Both roles synergize to enhance profitability and sustainable growth, with Revenue Managers focusing on revenue generation and Finance Managers ensuring financial health.

Decision-Making Authority and Autonomy

Revenue Managers primarily focus on pricing strategies, sales forecasting, and optimizing revenue streams with a high degree of autonomy in market-driven decision-making. Finance Managers oversee budgeting, financial reporting, and compliance, exercising authority within regulatory frameworks and aligning decisions with overall corporate financial policies. The scope of decision-making for Revenue Managers is often more tactical and market-responsive, while Finance Managers operate with strategic control over financial resources and risk management.

Collaboration with Other Departments

Revenue Managers collaborate closely with Sales and Marketing teams to optimize pricing strategies and maximize revenue streams, using data analytics to inform demand forecasting. Finance Managers work alongside Accounting and Operations departments to ensure accurate budget planning, financial reporting, and compliance with regulatory standards. Both roles require seamless interdepartmental communication to align financial goals with overall business strategy.

Tools and Technologies Utilized

Revenue Managers primarily utilize advanced revenue management systems (RMS) and pricing optimization software such as IDeaS and RevPAR Guru to analyze market demand and adjust pricing strategies dynamically. Finance Managers rely on enterprise resource planning (ERP) tools like SAP and Oracle Financials to oversee budgeting, financial reporting, and compliance processes with real-time data integration. Both roles increasingly incorporate business intelligence (BI) platforms like Tableau and Power BI to enhance decision-making through data visualization and predictive analytics.

Performance Metrics and KPIs

Revenue Managers focus on optimizing pricing strategies, sales forecasts, and revenue streams using KPIs such as RevPAR (Revenue Per Available Room), ADR (Average Daily Rate), and occupancy rates to drive profitability. Finance Managers prioritize financial health through metrics like net profit margin, cash flow, return on investment (ROI), and budget variance analysis to ensure fiscal stability and compliance. Both roles rely heavily on performance metrics but target distinct financial outcomes: Revenue Managers aim at maximizing income generation, while Finance Managers ensure accurate financial planning and resource allocation.

Career Paths and Advancement Opportunities

Revenue Managers typically advance by deepening expertise in pricing strategies, demand forecasting, and data analytics, often progressing to roles like Director of Revenue Management or Chief Revenue Officer. Finance Managers focus on broader financial oversight including budgeting, reporting, and compliance, with common career advancements leading to Finance Director, Controller, or Chief Financial Officer positions. Both career paths offer leadership opportunities, but Revenue Managers tend to specialize in maximizing income streams, while Finance Managers oversee overall financial health and strategy.

Educational Background and Certifications

Revenue Managers typically hold degrees in business administration, hospitality management, or finance, often obtaining certifications like Certified Revenue Management Executive (CRME) to enhance expertise in pricing strategies and revenue optimization. Finance Managers usually possess degrees in accounting, finance, or economics, with certifications such as Certified Public Accountant (CPA) or Chartered Financial Analyst (CFA), emphasizing skills in financial reporting, budgeting, and fiscal analysis. Both roles require strong analytical skills, but their educational focus and professional credentials align with their specific management responsibilities.

Salary Trends and Compensation Packages

Revenue Managers typically earn between $70,000 and $110,000 annually, often benefiting from performance-based bonuses linked to sales targets and revenue growth. Finance Managers usually command higher base salaries ranging from $90,000 to $130,000, with comprehensive compensation packages including profit-sharing, stock options, and retirement benefits. Salary trends reveal that Finance Managers experience more stable pay increases aligned with organizational financial health, whereas Revenue Manager compensation fluctuates more with market performance and individual achievements.

Revenue Manager vs Finance Manager Infographic

jobdiv.com

jobdiv.com