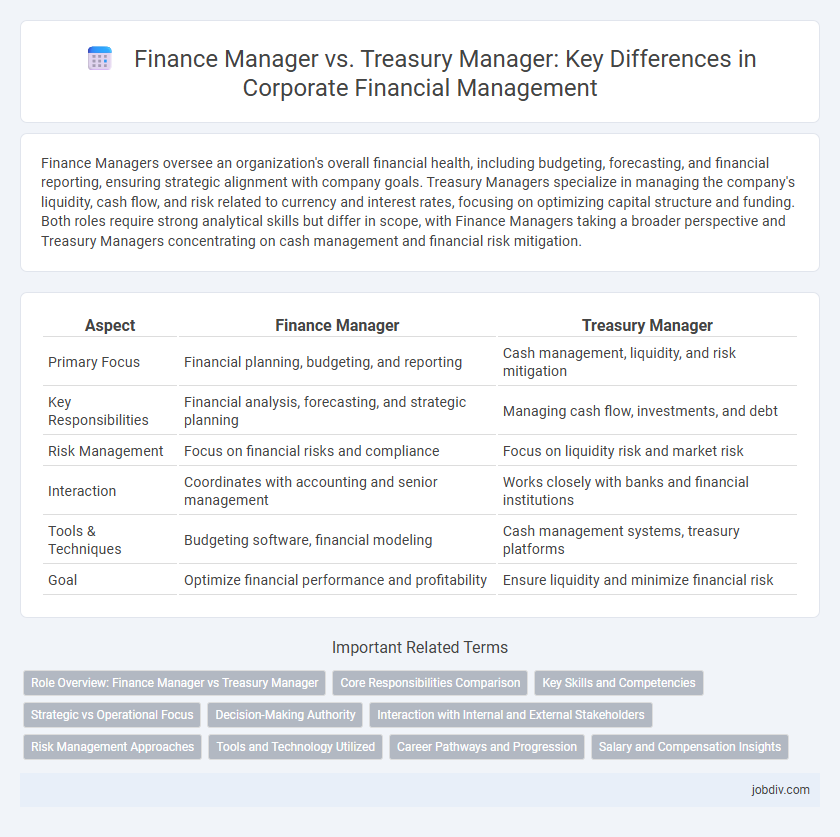

Finance Managers oversee an organization's overall financial health, including budgeting, forecasting, and financial reporting, ensuring strategic alignment with company goals. Treasury Managers specialize in managing the company's liquidity, cash flow, and risk related to currency and interest rates, focusing on optimizing capital structure and funding. Both roles require strong analytical skills but differ in scope, with Finance Managers taking a broader perspective and Treasury Managers concentrating on cash management and financial risk mitigation.

Table of Comparison

| Aspect | Finance Manager | Treasury Manager |

|---|---|---|

| Primary Focus | Financial planning, budgeting, and reporting | Cash management, liquidity, and risk mitigation |

| Key Responsibilities | Financial analysis, forecasting, and strategic planning | Managing cash flow, investments, and debt |

| Risk Management | Focus on financial risks and compliance | Focus on liquidity risk and market risk |

| Interaction | Coordinates with accounting and senior management | Works closely with banks and financial institutions |

| Tools & Techniques | Budgeting software, financial modeling | Cash management systems, treasury platforms |

| Goal | Optimize financial performance and profitability | Ensure liquidity and minimize financial risk |

Role Overview: Finance Manager vs Treasury Manager

Finance Managers oversee budgeting, financial planning, and reporting to ensure organization-wide fiscal health, handling tasks such as forecasting and cost analysis. Treasury Managers concentrate on cash flow management, liquidity optimization, risk assessment, and maintaining banking relationships to safeguard the company's financial assets. Both roles are critical for financial stability but differ in scope, with Finance Managers focusing on overall financial strategy and Treasury Managers on managing liquid resources and funding.

Core Responsibilities Comparison

Finance Managers oversee budgeting, financial reporting, and strategic planning to optimize organizational financial performance, manage risks, and ensure compliance with regulatory standards. Treasury Managers focus on cash flow management, liquidity optimization, investment strategies, and maintaining banking relationships to safeguard the company's financial stability. Both roles require analytical skills and financial expertise, but Finance Managers emphasize long-term financial health while Treasury Managers prioritize day-to-day cash management and funding.

Key Skills and Competencies

Finance Managers excel in financial analysis, budgeting, and strategic planning, with strong skills in risk assessment and regulatory compliance. Treasury Managers specialize in cash flow management, liquidity planning, and investment strategies, demonstrating expertise in risk mitigation and capital structure optimization. Both roles require proficiency in financial software, analytical thinking, and effective communication to support organizational financial health.

Strategic vs Operational Focus

Finance Managers concentrate on strategic financial planning, budgeting, and forecasting to align financial goals with organizational objectives. Treasury Managers focus on operational activities such as cash management, liquidity control, and risk mitigation to ensure effective day-to-day financial operations. The strategic emphasis of Finance Managers supports long-term growth, while Treasury Managers maintain short-term financial stability.

Decision-Making Authority

Finance Managers typically oversee budgeting, financial planning, and analysis, holding decision-making authority related to capital allocation and investment evaluations. Treasury Managers concentrate on cash flow management, liquidity risk, and funding strategies, making critical decisions on short-term financing and banking relationships. Their distinct decision-making scopes ensure effective financial stewardship within an organization.

Interaction with Internal and External Stakeholders

Finance Managers collaborate extensively with internal departments such as accounting, operations, and sales teams to ensure accurate budgeting, forecasting, and financial reporting. Treasury Managers primarily engage with external stakeholders, including banks, investors, and regulatory bodies, to manage liquidity, risk, and capital structure. Both roles require effective communication skills to align organizational financial strategies and maintain compliance with external financial regulations.

Risk Management Approaches

Finance Managers implement comprehensive risk assessment techniques to mitigate financial exposure by analyzing market trends, credit risks, and operational inefficiencies. Treasury Managers specialize in liquidity risk management, currency hedging, and interest rate risk controls to safeguard the firm's cash flow stability. Both roles utilize advanced financial modeling and compliance frameworks to optimize enterprise-wide risk mitigation strategies.

Tools and Technology Utilized

Finance Managers utilize advanced financial planning software such as SAP ERP and Oracle Financials to analyze budgets, forecast financial performance, and generate comprehensive reports. Treasury Managers rely heavily on treasury management systems (TMS) like Kyriba and GTreasury to manage cash flow, liquidity, and risk exposure in real-time. Both roles increasingly incorporate AI-driven analytics and blockchain technology to enhance accuracy, compliance, and operational efficiency.

Career Pathways and Progression

Finance Managers typically advance from roles in accounting or financial analysis, developing expertise in budgeting, forecasting, and financial reporting, often progressing to senior finance leadership such as CFO or Director of Finance. Treasury Managers usually begin with experience in cash management, risk assessment, and investment strategies, moving towards positions like Treasurer or Treasury Director with a focus on optimizing liquidity and managing corporate financial risk. Both career pathways emphasize mastery of financial principles but differ in specialization, with Finance Managers overseeing broader financial performance and Treasury Managers concentrating on capital management and funding strategies.

Salary and Compensation Insights

Finance Managers typically earn a median annual salary ranging from $90,000 to $130,000, with compensation packages often including performance bonuses and stock options. Treasury Managers command slightly higher pay, generally between $100,000 and $140,000 per year, reflecting their specialized expertise in cash management, risk assessment, and liquidity planning. Both roles offer lucrative benefits, but Treasury Managers may receive additional incentives tied to managing financial risk and capital structure optimization.

Finance Manager vs Treasury Manager Infographic

jobdiv.com

jobdiv.com