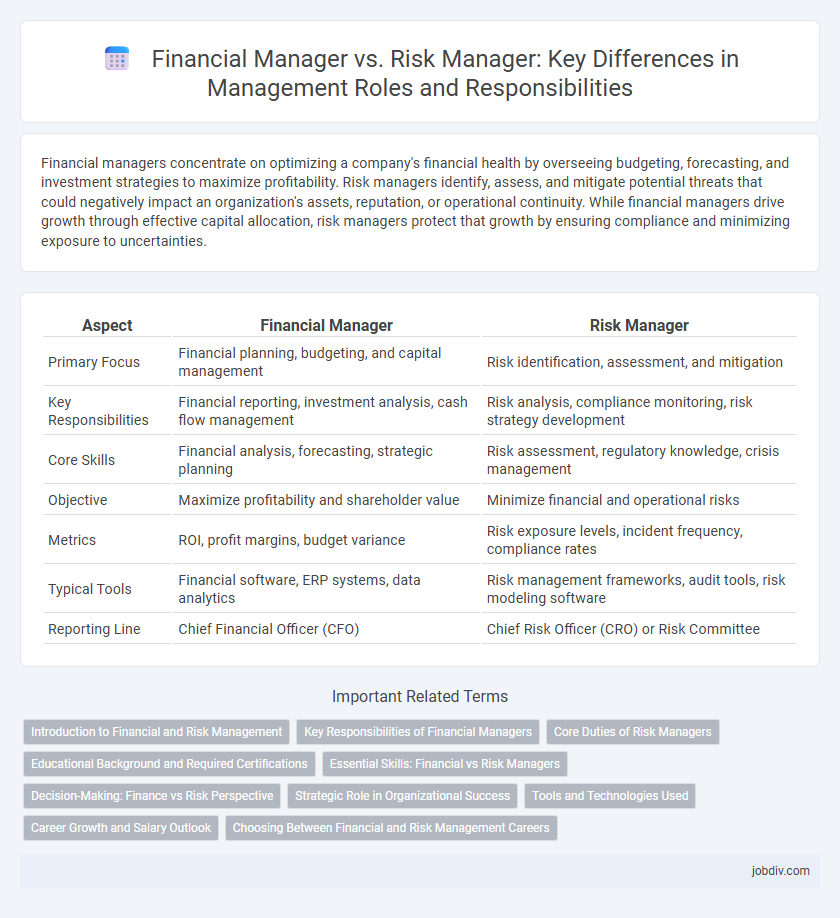

Financial managers concentrate on optimizing a company's financial health by overseeing budgeting, forecasting, and investment strategies to maximize profitability. Risk managers identify, assess, and mitigate potential threats that could negatively impact an organization's assets, reputation, or operational continuity. While financial managers drive growth through effective capital allocation, risk managers protect that growth by ensuring compliance and minimizing exposure to uncertainties.

Table of Comparison

| Aspect | Financial Manager | Risk Manager |

|---|---|---|

| Primary Focus | Financial planning, budgeting, and capital management | Risk identification, assessment, and mitigation |

| Key Responsibilities | Financial reporting, investment analysis, cash flow management | Risk analysis, compliance monitoring, risk strategy development |

| Core Skills | Financial analysis, forecasting, strategic planning | Risk assessment, regulatory knowledge, crisis management |

| Objective | Maximize profitability and shareholder value | Minimize financial and operational risks |

| Metrics | ROI, profit margins, budget variance | Risk exposure levels, incident frequency, compliance rates |

| Typical Tools | Financial software, ERP systems, data analytics | Risk management frameworks, audit tools, risk modeling software |

| Reporting Line | Chief Financial Officer (CFO) | Chief Risk Officer (CRO) or Risk Committee |

Introduction to Financial and Risk Management

Financial managers focus on planning, directing, and overseeing an organization's financial activities, including budgeting, forecasting, and investment decisions to maximize profitability. Risk managers identify, assess, and mitigate potential financial, operational, and strategic risks to safeguard company assets and ensure regulatory compliance. Both roles collaborate to balance growth opportunities with risk exposure, enhancing overall organizational resilience.

Key Responsibilities of Financial Managers

Financial Managers oversee an organization's financial health by planning, organizing, and directing accounting, investing, and budgeting activities. They analyze financial data to guide strategic decision-making, manage cash flow, and ensure compliance with financial regulations. Risk Managers, in contrast, focus primarily on identifying and mitigating financial risks, but Financial Managers hold broader responsibilities that encompass managing overall financial performance and long-term fiscal stability.

Core Duties of Risk Managers

Risk Managers primarily identify, assess, and mitigate potential financial, operational, and strategic risks to protect company assets and ensure regulatory compliance. They develop risk management policies, conduct risk analysis, and implement risk control measures to minimize losses and support business continuity. Unlike Financial Managers who focus on budgeting and financial planning, Risk Managers concentrate on safeguarding the organization from uncertainties and adverse events.

Educational Background and Required Certifications

Financial Managers typically hold a bachelor's degree in finance, accounting, economics, or business administration, with many pursuing advanced degrees such as an MBA to enhance strategic financial planning skills. Risk Managers often have educational backgrounds in finance, risk management, or actuarial science, complemented by specialized certifications like the Financial Risk Manager (FRM) or the Professional Risk Manager (PRM) designation. Both roles benefit from certifications such as the Chartered Financial Analyst (CFA) for Financial Managers and Certified Risk Manager (CRM) credentials for Risk Managers, aligning with industry standards and regulatory requirements.

Essential Skills: Financial vs Risk Managers

Financial managers excel in budgeting, financial analysis, and investment strategies, enabling effective capital allocation and profit maximization. Risk managers specialize in risk assessment, regulatory compliance, and crisis management to minimize potential losses and protect organizational assets. Both roles require strong analytical skills, but financial managers emphasize financial forecasting while risk managers focus on identifying and mitigating threats.

Decision-Making: Finance vs Risk Perspective

Financial managers prioritize decision-making that enhances profitability, capital allocation, and investment returns through rigorous financial analysis and forecasting. Risk managers focus on identifying, assessing, and mitigating potential threats to organizational assets and operations, emphasizing long-term sustainability and regulatory compliance. Both roles require strategic judgment, but financial managers drive value creation, while risk managers ensure stability and resilience.

Strategic Role in Organizational Success

Financial managers drive organizational success by optimizing capital allocation, managing budgeting processes, and ensuring financial stability to support strategic growth initiatives. Risk managers enhance long-term value by identifying potential threats, developing mitigation strategies, and protecting assets from operational, market, and regulatory risks. Both roles collaborate to align financial objectives with risk tolerance, fostering a balanced approach that sustains competitive advantage and maximizes shareholder value.

Tools and Technologies Used

Financial managers rely heavily on advanced financial modeling software such as SAP, Oracle Financials, and Excel for budgeting, forecasting, and reporting accuracy. Risk managers employ specialized risk assessment tools like Palisade @RISK, RiskWatch, and SAS Risk Management to identify, analyze, and mitigate potential threats. Both roles increasingly integrate AI-driven analytics platforms and blockchain technology to enhance decision-making and improve transparency in complex financial environments.

Career Growth and Salary Outlook

Financial Managers typically experience steady career growth driven by their expertise in budgeting, financial analysis, and investment strategies, with median salaries around $131,710 annually as per the U.S. Bureau of Labor Statistics. Risk Managers, specializing in identifying and mitigating financial risks, often see rapid demand growth, reflected in competitive salaries averaging approximately $127,000 per year. Both roles offer robust advancement opportunities in diverse industries, but Financial Managers generally access broader leadership positions while Risk Managers command premium pay in sectors with high regulatory or operational risks.

Choosing Between Financial and Risk Management Careers

Choosing between a financial manager and a risk manager career depends on one's interest in optimizing capital allocation versus identifying and mitigating potential threats to assets and operations. Financial managers primarily focus on budgeting, forecasting, investment analysis, and enhancing shareholder value, while risk managers specialize in assessing financial, operational, and strategic risks to safeguard organizational stability. Professionals seeking analytical roles with an emphasis on asset growth lean towards financial management, whereas those driven by preventive strategies and compliance often prefer risk management careers.

Financial Manager vs Risk Manager Infographic

jobdiv.com

jobdiv.com