A personal banker primarily handles everyday banking needs such as checking accounts, loans, and routine transactions, offering tailored solutions based on your immediate financial situation. In contrast, a financial advisor provides comprehensive investment strategies, retirement planning, and wealth management services designed to grow and protect your long-term financial health. Choosing between the two depends on whether you need help managing daily finances or developing a strategic financial plan for the future.

Table of Comparison

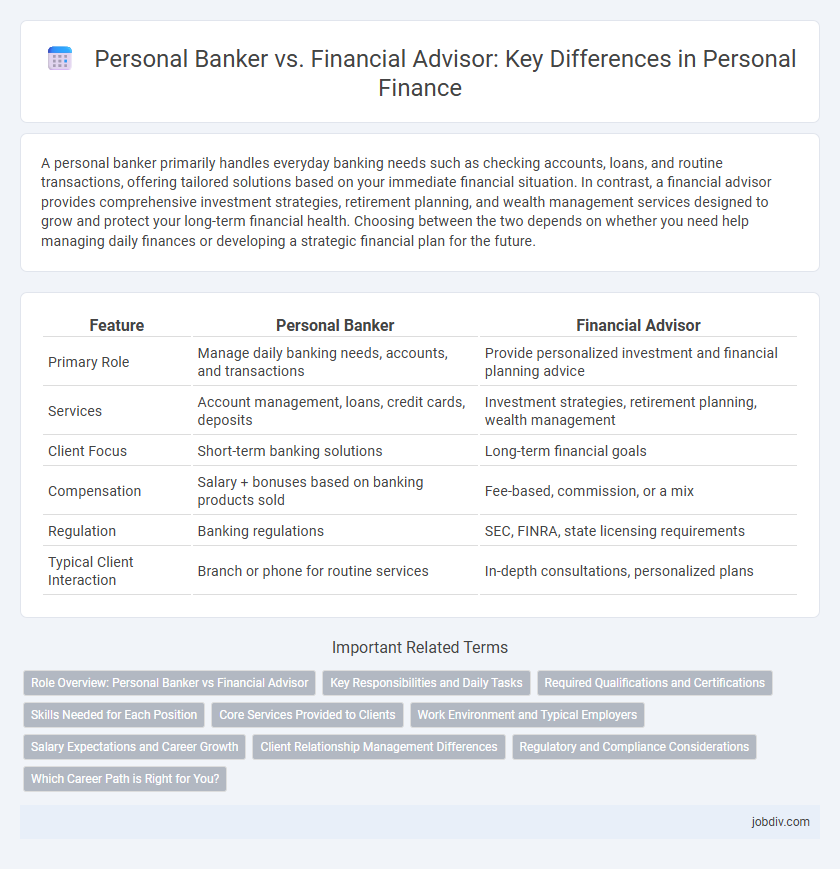

| Feature | Personal Banker | Financial Advisor |

|---|---|---|

| Primary Role | Manage daily banking needs, accounts, and transactions | Provide personalized investment and financial planning advice |

| Services | Account management, loans, credit cards, deposits | Investment strategies, retirement planning, wealth management |

| Client Focus | Short-term banking solutions | Long-term financial goals |

| Compensation | Salary + bonuses based on banking products sold | Fee-based, commission, or a mix |

| Regulation | Banking regulations | SEC, FINRA, state licensing requirements |

| Typical Client Interaction | Branch or phone for routine services | In-depth consultations, personalized plans |

Role Overview: Personal Banker vs Financial Advisor

A Personal Banker primarily manages day-to-day banking needs such as checking and savings accounts, loans, and credit products while providing personalized service at a branch level. A Financial Advisor offers comprehensive financial planning, investment management, retirement strategies, and wealth-building advice tailored to long-term financial goals. Both roles require strong customer relationship skills, but Financial Advisors typically handle more complex financial portfolios compared to the transactional focus of Personal Bankers.

Key Responsibilities and Daily Tasks

A Personal Banker primarily manages daily banking transactions, opens accounts, processes loans, and provides personalized financial products tailored to client needs. Financial Advisors focus on creating long-term investment strategies, retirement planning, and wealth management based on detailed financial analysis and client goals. Both roles require strong client communication but differ in scope, with Personal Bankers handling routine banking services and Financial Advisors offering comprehensive financial planning.

Required Qualifications and Certifications

Personal bankers typically require a high school diploma or associate degree, with some positions favoring a bachelor's degree in finance or business; certifications like the Certified Personal Banker (CPB) enhance credibility. Financial advisors generally need a bachelor's degree in finance, economics, or related fields, with licenses such as the Series 7 and Series 66, and certifications like Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) often required. Both roles demand strong regulatory knowledge and compliance adherence, but financial advisors hold more specialized certifications reflecting advanced expertise in investment strategies and client portfolio management.

Skills Needed for Each Position

Personal bankers require strong interpersonal skills, attention to detail, and expertise in customer service to manage daily banking transactions and provide tailored product recommendations. Financial advisors need advanced analytical abilities, in-depth knowledge of investment strategies, and proficiency in financial planning to develop long-term wealth management solutions for clients. Both roles demand excellent communication skills and a solid understanding of financial regulations.

Core Services Provided to Clients

A Personal Banker primarily assists clients with daily banking needs, such as managing checking and savings accounts, processing loans, and offering credit card services. In contrast, a Financial Advisor provides comprehensive financial planning, including investment strategies, retirement planning, and estate management. Both professionals play crucial roles but serve distinct purposes tailored to clients' immediate banking versus long-term financial goals.

Work Environment and Typical Employers

Personal bankers primarily work in retail bank branches, credit unions, or community banks, providing face-to-face financial services and account management to individual clients. Financial advisors are commonly employed by investment firms, wealth management companies, and financial planning agencies, often operating in office environments or remotely to deliver personalized investment strategies and retirement planning. Both roles require strong client interaction skills but differ significantly in their typical workplace settings and employer types.

Salary Expectations and Career Growth

Personal bankers typically earn an average salary of $45,000 to $65,000 annually, with entry-level positions offering growth through commissions and bonuses, while financial advisors command higher salaries ranging from $60,000 to over $100,000 due to client commissions and asset management fees. Career growth for personal bankers often leads to branch management or specialized banking roles, whereas financial advisors can advance to senior advisory positions, portfolio management, or independent practice. Salary expectations in financial advising generally increase with certifications like CFP and larger client assets under management, highlighting a steeper growth trajectory compared to personal banking.

Client Relationship Management Differences

Personal bankers primarily manage daily banking needs, offering solutions like account services, loans, and credit products with a focus on transactional efficiency. Financial advisors concentrate on long-term financial planning, investment strategies, and wealth management tailored to clients' goals and risk tolerance. The client relationship with personal bankers tends to be more frequent and service-oriented, while financial advisors cultivate deeper, advisory-driven engagements focused on holistic financial well-being.

Regulatory and Compliance Considerations

Personal bankers primarily adhere to banking regulations such as the Bank Secrecy Act and Anti-Money Laundering (AML) requirements while assisting clients with deposit accounts and loans. Financial advisors operate under stringent oversight from the Securities and Exchange Commission (SEC) or state regulators, complying with fiduciary duties and investment advisory laws like the Investment Advisers Act of 1940. Both roles demand strict adherence to privacy laws such as the Gramm-Leach-Bliley Act (GLBA) to protect client information.

Which Career Path is Right for You?

Choosing between a personal banker and a financial advisor depends on your skill set and career goals; personal bankers focus on day-to-day client services and banking products, while financial advisors offer long-term investment strategies and wealth management. Personal bankers typically work in retail banking environments, prioritizing customer service and sales of banking products such as loans and accounts, whereas financial advisors provide tailored financial planning, including retirement, tax, and portfolio management. Assess your interest in client interaction, analytical skills, and desire for advisory versus transactional roles to determine the best fit for your career path.

Personal Banker vs Financial Advisor Infographic

jobdiv.com

jobdiv.com