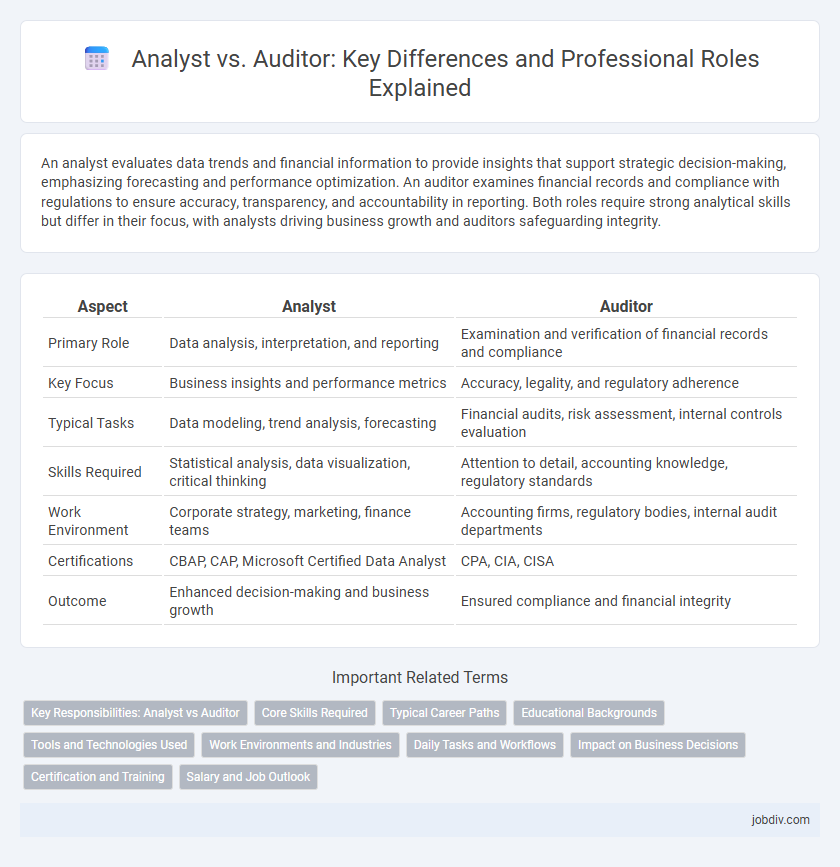

An analyst evaluates data trends and financial information to provide insights that support strategic decision-making, emphasizing forecasting and performance optimization. An auditor examines financial records and compliance with regulations to ensure accuracy, transparency, and accountability in reporting. Both roles require strong analytical skills but differ in their focus, with analysts driving business growth and auditors safeguarding integrity.

Table of Comparison

| Aspect | Analyst | Auditor |

|---|---|---|

| Primary Role | Data analysis, interpretation, and reporting | Examination and verification of financial records and compliance |

| Key Focus | Business insights and performance metrics | Accuracy, legality, and regulatory adherence |

| Typical Tasks | Data modeling, trend analysis, forecasting | Financial audits, risk assessment, internal controls evaluation |

| Skills Required | Statistical analysis, data visualization, critical thinking | Attention to detail, accounting knowledge, regulatory standards |

| Work Environment | Corporate strategy, marketing, finance teams | Accounting firms, regulatory bodies, internal audit departments |

| Certifications | CBAP, CAP, Microsoft Certified Data Analyst | CPA, CIA, CISA |

| Outcome | Enhanced decision-making and business growth | Ensured compliance and financial integrity |

Key Responsibilities: Analyst vs Auditor

Analysts focus on examining data trends, performing financial modeling, and providing insights to support strategic decision-making within an organization. Auditors concentrate on evaluating financial statements, ensuring compliance with regulatory standards, and identifying discrepancies through systematic reviews and testing. Both roles require strong attention to detail, but analysts emphasize forecasting and data interpretation while auditors prioritize accuracy and regulatory adherence.

Core Skills Required

Analysts require strong data interpretation, critical thinking, and proficiency in statistical tools to evaluate business performance and forecast trends. Auditors must possess detailed knowledge of accounting principles, regulatory compliance, and risk assessment to ensure financial accuracy and legal adherence. Both roles demand keen attention to detail and effective communication skills for reporting findings clearly to stakeholders.

Typical Career Paths

Analysts often follow career paths that lead to roles such as Senior Analyst, Data Scientist, or Business Consultant, focusing on data interpretation and strategic decision-making. Auditors typically advance toward positions like Senior Auditor, Audit Manager, or Compliance Officer, emphasizing financial accuracy and regulatory adherence. Both roles offer opportunities for specialization in industries like finance, healthcare, or technology, impacting organizational efficiency and risk management.

Educational Backgrounds

Analysts typically possess degrees in finance, economics, or business administration, emphasizing analytical skills, statistical methods, and data interpretation. Auditors often hold qualifications in accounting or auditing, including certifications such as CPA or ACCA, with a strong foundation in regulatory standards and compliance. Both roles require a thorough understanding of financial principles, but auditors prioritize in-depth knowledge of audit procedures and control frameworks.

Tools and Technologies Used

Analysts typically utilize data visualization software such as Tableau and Power BI alongside statistical tools like Python and R to interpret and model complex datasets. Auditors rely heavily on specialized audit software including ACL Analytics and CaseWare, as well as ERP systems like SAP and Oracle to ensure compliance and accuracy in financial reporting. Both professionals increasingly integrate AI-driven tools and automated analytics platforms to enhance efficiency and precision in their evaluations.

Work Environments and Industries

Analysts typically operate within corporate settings, financial institutions, and consulting firms, focusing on data interpretation to guide strategic decisions across industries such as finance, technology, and healthcare. Auditors commonly work in accounting firms, regulatory agencies, and large corporations, ensuring compliance and accuracy in financial reporting across sectors like manufacturing, banking, and public services. The distinct work environments reflect their core functions: analysts emphasize forecasting and trend analysis, while auditors concentrate on verification and regulatory adherence.

Daily Tasks and Workflows

Analysts focus on data collection, interpreting market trends, and creating detailed reports to support strategic decision-making, employing tools like Excel and business intelligence software daily. Auditors conduct thorough examinations of financial records, ensuring compliance with regulations and internal policies through systematic sampling, testing, and documentation. While analysts prioritize forecasting and risk assessment, auditors emphasize verification and accuracy in financial reporting workflows.

Impact on Business Decisions

An analyst interprets data trends and market conditions to provide actionable insights that drive strategic business decisions and optimize performance. An auditor evaluates financial records and compliance processes, ensuring accuracy and regulatory adherence, which mitigates risks and safeguards stakeholder trust. Both roles contribute significantly to informed decision-making but from distinct perspectives: analysts enhance growth opportunities while auditors protect operational integrity.

Certification and Training

Analysts typically pursue certifications such as Certified Business Analysis Professional (CBAP) or PMI Professional in Business Analysis (PMI-PBA), emphasizing skills in data interpretation and strategic decision-making. Auditors often obtain certifications like Certified Internal Auditor (CIA) or Certified Public Accountant (CPA), focusing on compliance, risk assessment, and financial reporting standards. Continuous training in regulatory frameworks and industry-specific standards is essential for both roles to maintain credibility and proficiency.

Salary and Job Outlook

Analysts earn an average salary ranging from $60,000 to $85,000 annually, while auditors typically command higher compensation, averaging between $65,000 and $90,000 depending on experience and certification status. Job outlook for analysts shows a steady growth rate of around 11% through 2031, driven by demand for data-driven decision making, whereas auditor positions are projected to grow at a slightly faster pace of 12%, influenced by increasing regulatory requirements and corporate compliance standards. Both roles offer competitive benefits and advancement opportunities, with auditors often benefiting from certifications like CPA that enhance salary potential and job stability.

Analyst vs Auditor Infographic

jobdiv.com

jobdiv.com