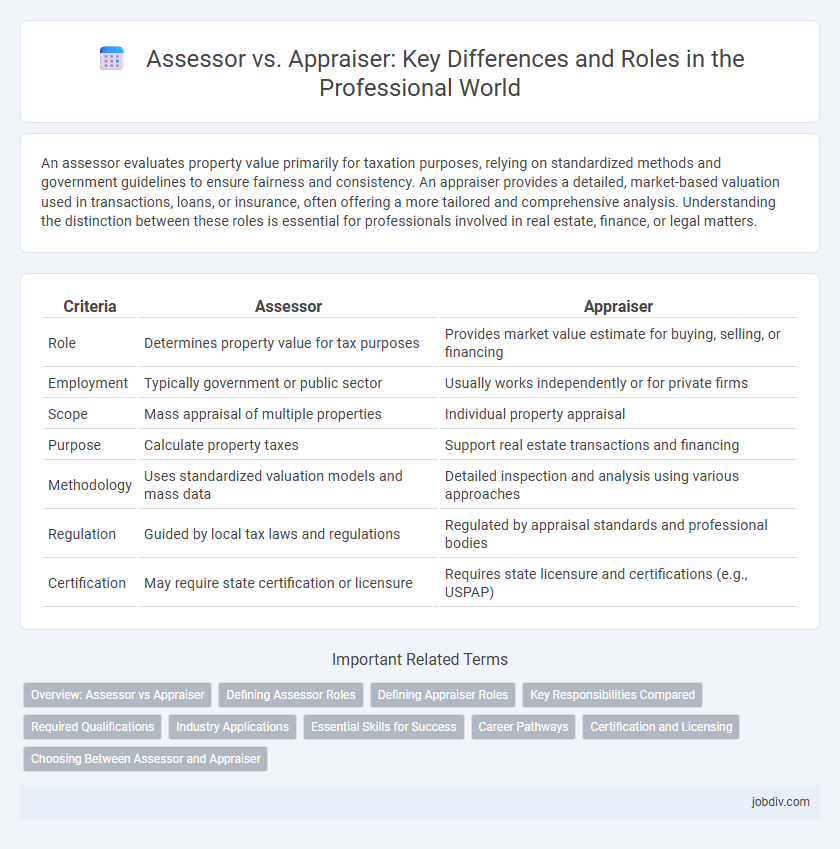

An assessor evaluates property value primarily for taxation purposes, relying on standardized methods and government guidelines to ensure fairness and consistency. An appraiser provides a detailed, market-based valuation used in transactions, loans, or insurance, often offering a more tailored and comprehensive analysis. Understanding the distinction between these roles is essential for professionals involved in real estate, finance, or legal matters.

Table of Comparison

| Criteria | Assessor | Appraiser |

|---|---|---|

| Role | Determines property value for tax purposes | Provides market value estimate for buying, selling, or financing |

| Employment | Typically government or public sector | Usually works independently or for private firms |

| Scope | Mass appraisal of multiple properties | Individual property appraisal |

| Purpose | Calculate property taxes | Support real estate transactions and financing |

| Methodology | Uses standardized valuation models and mass data | Detailed inspection and analysis using various approaches |

| Regulation | Guided by local tax laws and regulations | Regulated by appraisal standards and professional bodies |

| Certification | May require state certification or licensure | Requires state licensure and certifications (e.g., USPAP) |

Overview: Assessor vs Appraiser

An assessor primarily evaluates property values for tax purposes based on established guidelines and mass appraisal techniques, while an appraiser provides detailed, independent valuations for specific transactions such as sales, mortgages, or insurance. Assessors typically work for government agencies or municipalities, establishing assessed values that influence property tax calculations. Appraisers are often licensed professionals who deliver comprehensive reports to lenders, buyers, or sellers, reflecting current market conditions and unique property characteristics.

Defining Assessor Roles

Assessors primarily evaluate property values for tax purposes by examining physical characteristics, market trends, and legal factors to determine fair taxable values. Their role involves adhering to jurisdictional guidelines and ensuring assessments comply with local tax codes and regulations. Unlike appraisers who provide detailed market analyses for transactions, assessors focus on equitable tax value assignments within municipal frameworks.

Defining Appraiser Roles

Appraisers conduct detailed property valuations to determine market value based on factors such as condition, location, and comparable sales, often for real estate transactions or financing. Their role requires certification and adherence to specific industry standards like USPAP (Uniform Standards of Professional Appraisal Practice). Unlike assessors who calculate tax assessments broadly, appraisers provide precise, case-specific evaluations essential for buyer-seller negotiations and loan approvals.

Key Responsibilities Compared

Assessors primarily determine property values for taxation purposes, analyzing market trends, property conditions, and local regulations to ensure accurate tax assessments. Appraisers perform detailed property evaluations to support real estate transactions, insurance claims, or financing, focusing on current market value and property characteristics. Both roles require expertise in property valuation but serve distinct functions within the real estate and financial sectors.

Required Qualifications

Assessors typically require a state certification or license, completion of formal education in real estate or property appraisal, and ongoing continuing education to maintain their credentials. Appraisers must obtain certification through the Appraisal Qualifications Board (AQB) of the Appraisal Foundation, which includes completing specific coursework, passing a state examination, and fulfilling a mandated number of supervised experience hours. Both roles demand adherence to strict ethical standards and regular updates on market regulations to ensure accurate property valuation.

Industry Applications

Assessors primarily evaluate property values for tax purposes, playing a critical role in public sector real estate taxation and municipal revenue generation. Appraisers provide detailed, market-based valuations used in private sector transactions, including mortgage lending, insurance claims, and property sales. The distinct industry applications highlight assessors' influence on public finance and appraisers' impact on investment decisions and risk management.

Essential Skills for Success

Successful assessors and appraisers demonstrate strong analytical skills, attention to detail, and comprehensive knowledge of property valuation standards. Effective communication and negotiation abilities are crucial for accurately conveying valuation results and addressing client inquiries. Mastery of relevant software and staying updated with market trends enhance precision and credibility in property assessment and appraisal tasks.

Career Pathways

A career pathway as an assessor typically involves working for government agencies to evaluate property values for tax purposes, requiring expertise in property law and public administration. In contrast, appraisers often pursue certification through professional organizations like the Appraisal Institute, focusing on market analysis and real estate valuation for private clients, banks, or legal cases. Both career paths offer opportunities for specialization in residential, commercial, or industrial property valuation, with continuing education playing a critical role in career advancement.

Certification and Licensing

Certification for assessors typically requires completion of specialized training programs and passing state or local examinations, ensuring expertise in property tax assessments. Appraisers must obtain licensing through state regulatory boards, which mandates rigorous education, supervised experience, and successful completion of the Uniform Standards of Professional Appraisal Practice (USPAP) exam. Both professions emphasize adherence to regulatory standards, but appraisers face stricter licensing criteria aligned with federal and state appraisal laws.

Choosing Between Assessor and Appraiser

Choosing between an assessor and an appraiser depends on the purpose of property valuation and the level of detail required. Assessors, typically government employees, provide standardized property value estimates for taxation purposes, while appraisers perform detailed, independent evaluations for sales, financing, or legal matters. Understanding the specific requirements of your transaction ensures selecting the appropriate professional for accurate property valuation.

Assessor vs Appraiser Infographic

jobdiv.com

jobdiv.com