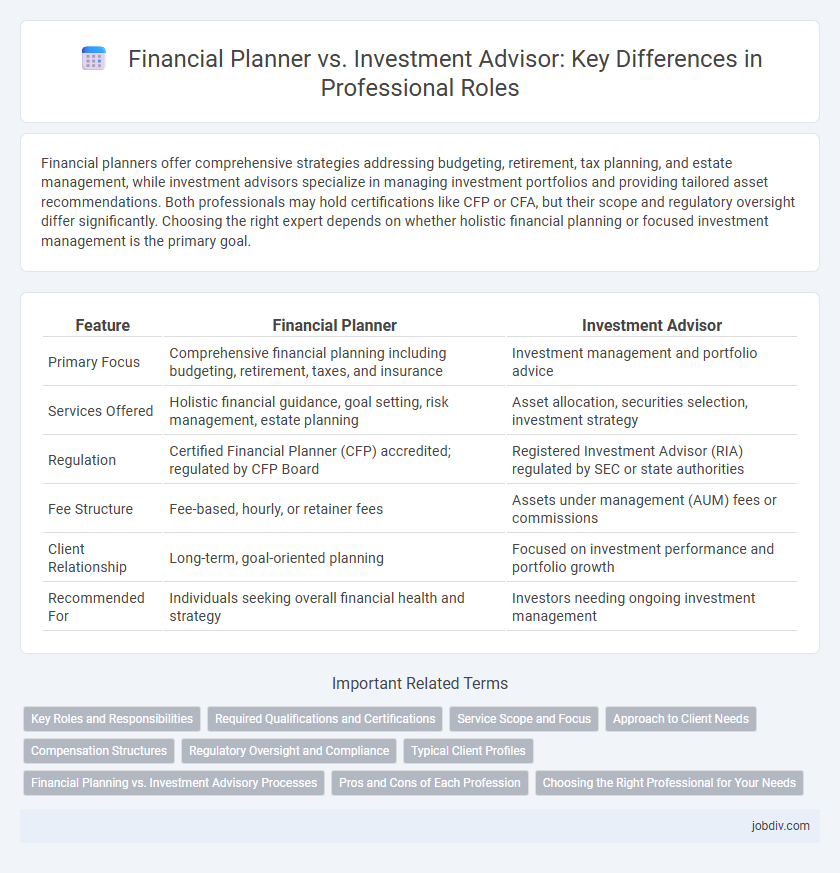

Financial planners offer comprehensive strategies addressing budgeting, retirement, tax planning, and estate management, while investment advisors specialize in managing investment portfolios and providing tailored asset recommendations. Both professionals may hold certifications like CFP or CFA, but their scope and regulatory oversight differ significantly. Choosing the right expert depends on whether holistic financial planning or focused investment management is the primary goal.

Table of Comparison

| Feature | Financial Planner | Investment Advisor |

|---|---|---|

| Primary Focus | Comprehensive financial planning including budgeting, retirement, taxes, and insurance | Investment management and portfolio advice |

| Services Offered | Holistic financial guidance, goal setting, risk management, estate planning | Asset allocation, securities selection, investment strategy |

| Regulation | Certified Financial Planner (CFP) accredited; regulated by CFP Board | Registered Investment Advisor (RIA) regulated by SEC or state authorities |

| Fee Structure | Fee-based, hourly, or retainer fees | Assets under management (AUM) fees or commissions |

| Client Relationship | Long-term, goal-oriented planning | Focused on investment performance and portfolio growth |

| Recommended For | Individuals seeking overall financial health and strategy | Investors needing ongoing investment management |

Key Roles and Responsibilities

A Financial Planner develops comprehensive strategies for managing clients' long-term financial goals, including retirement, estate planning, and risk management. An Investment Advisor primarily focuses on recommending and managing investment portfolios to maximize returns based on client risk tolerance. Both roles require fiduciary responsibility, but Financial Planners offer broader, holistic financial guidance beyond just investment management.

Required Qualifications and Certifications

Financial planners typically require the Certified Financial Planner (CFP) designation, which mandates completing coursework in financial planning, passing a rigorous exam, and adhering to ethical standards. Investment advisors often hold the Chartered Financial Analyst (CFA) credential, emphasizing investment management expertise through extensive exams and practical experience. Both roles may also require state-specific licenses like the Series 65 or 66 for legally providing investment advice.

Service Scope and Focus

A Financial Planner provides comprehensive financial strategies encompassing retirement planning, tax optimization, insurance, and estate planning, addressing overall financial health. An Investment Advisor primarily focuses on investment portfolio management, offering expertise in asset allocation, risk assessment, and securities advisory. Both roles collaborate to enhance client wealth, but Financial Planners adopt a broader approach while Investment Advisors specialize in investment decisions.

Approach to Client Needs

Financial planners adopt a holistic approach by assessing clients' entire financial situation, including budgeting, retirement planning, tax strategies, and estate planning. Investment advisors concentrate primarily on managing clients' investment portfolios to achieve specific financial goals and optimize returns. Both prioritize personalized strategies, but financial planners integrate broader life goals while investment advisors focus on asset growth and risk management.

Compensation Structures

Financial planners typically receive compensation through flat fees, hourly rates, or a percentage of assets under management (AUM), which promotes transparency and aligns their interests with long-term financial goals. Investment advisors often earn commissions or markups on the products they sell, alongside potential fees based on AUM, creating diverse income streams influenced by client investment choices. Understanding these compensation structures is essential for clients to assess potential conflicts of interest and select experts aligned with their financial priorities.

Regulatory Oversight and Compliance

Financial planners are primarily regulated by state insurance departments and financial regulatory agencies such as the SEC or FINRA when offering securities or investment advice, ensuring adherence to fiduciary standards and comprehensive financial planning compliance. Investment advisors fall directly under the jurisdiction of the SEC or state securities regulators, complying with the Investment Advisers Act of 1940, which enforces strict fiduciary duties, registration requirements, and periodic disclosures. Both professionals must navigate complex regulatory frameworks to maintain transparency, protect client interests, and uphold ethical standards in financial management.

Typical Client Profiles

Financial planners typically serve individuals and families seeking comprehensive financial guidance, including retirement planning, tax strategies, and estate planning. Investment advisors focus more on clients with substantial investable assets who require tailored portfolio management and investment advice. Understanding these typical client profiles helps in choosing the right professional based on specific financial goals and needs.

Financial Planning vs. Investment Advisory Processes

Financial planning involves a comprehensive evaluation of an individual's entire financial situation, encompassing budgeting, retirement planning, tax strategies, and risk management to create a personalized financial roadmap. Investment advisory centers on managing clients' investment portfolios by providing tailored asset allocation, security selection, and ongoing portfolio monitoring aligned with their risk tolerance and financial goals. Both processes require regulatory compliance, but financial planners adopt a holistic approach while investment advisors specialize primarily in optimizing investment performance.

Pros and Cons of Each Profession

Financial planners excel in creating comprehensive financial strategies, focusing on budgeting, retirement planning, and insurance needs, but may lack specialized investment expertise. Investment advisors offer expert portfolio management and tailored investment advice, often regulated under strict fiduciary standards, yet they might not address broader financial goals comprehensively. Choosing between the two depends on whether an individual prioritizes holistic financial planning or focused investment guidance.

Choosing the Right Professional for Your Needs

Selecting the right professional depends on your financial goals and needs; a financial planner offers comprehensive strategies including budgeting, retirement planning, and risk management, while an investment advisor primarily focuses on managing and optimizing your investment portfolio. Consider credentials such as Certified Financial Planner (CFP) for broad financial guidance or Chartered Financial Analyst (CFA) for specialized investment advice. Assessing fee structures, fiduciary responsibilities, and personalized service will ensure alignment with your financial objectives.

Financial Planner vs Investment Advisor Infographic

jobdiv.com

jobdiv.com