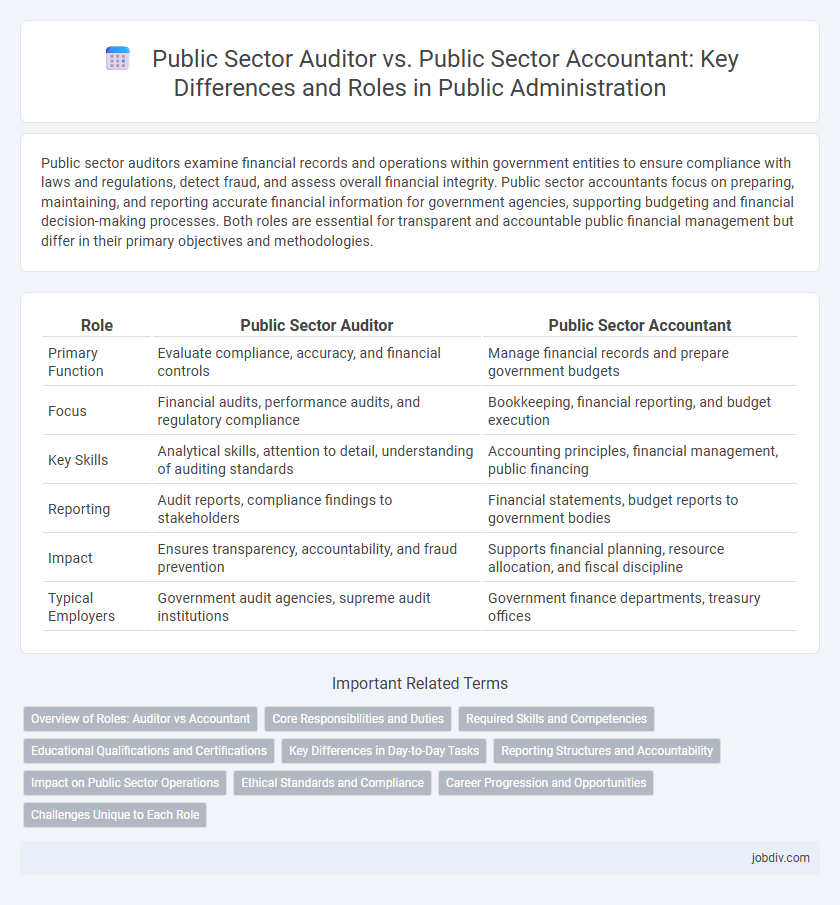

Public sector auditors examine financial records and operations within government entities to ensure compliance with laws and regulations, detect fraud, and assess overall financial integrity. Public sector accountants focus on preparing, maintaining, and reporting accurate financial information for government agencies, supporting budgeting and financial decision-making processes. Both roles are essential for transparent and accountable public financial management but differ in their primary objectives and methodologies.

Table of Comparison

| Role | Public Sector Auditor | Public Sector Accountant |

|---|---|---|

| Primary Function | Evaluate compliance, accuracy, and financial controls | Manage financial records and prepare government budgets |

| Focus | Financial audits, performance audits, and regulatory compliance | Bookkeeping, financial reporting, and budget execution |

| Key Skills | Analytical skills, attention to detail, understanding of auditing standards | Accounting principles, financial management, public financing |

| Reporting | Audit reports, compliance findings to stakeholders | Financial statements, budget reports to government bodies |

| Impact | Ensures transparency, accountability, and fraud prevention | Supports financial planning, resource allocation, and fiscal discipline |

| Typical Employers | Government audit agencies, supreme audit institutions | Government finance departments, treasury offices |

Overview of Roles: Auditor vs Accountant

Public Sector Auditors evaluate government financial statements and compliance with laws, ensuring transparency and accountability through independent assessments. Public Sector Accountants manage budgeting, financial reporting, and record-keeping to support decision-making and efficient resource allocation within government entities. Both roles are essential for maintaining fiscal discipline but differ in their focus on examination versus transaction processing.

Core Responsibilities and Duties

Public Sector Auditors primarily focus on examining financial statements, ensuring compliance with laws, and assessing the effectiveness of internal controls within government agencies. Public Sector Accountants are responsible for preparing financial reports, managing budgets, and maintaining accurate records of public funds. Both roles require strong knowledge of government accounting standards and play critical roles in promoting transparency and accountability in public financial management.

Required Skills and Competencies

Public Sector Auditors require strong analytical skills, knowledge of auditing standards, and proficiency in risk assessment to evaluate compliance and financial integrity within government entities. Public Sector Accountants must excel in financial reporting, budgeting, and regulatory knowledge to effectively manage and document public funds. Both roles demand attention to detail, ethical judgment, and familiarity with government accounting principles and software.

Educational Qualifications and Certifications

Public Sector Auditors typically require a bachelor's degree in accounting, finance, or a related field, often supplemented by certifications like the Certified Internal Auditor (CIA) or Certified Government Auditing Professional (CGAP). Public Sector Accountants generally hold a degree in accounting or finance and may pursue certifications such as the Certified Public Accountant (CPA) to enhance their expertise in government financial reporting and compliance. Both roles emphasize strong knowledge of public sector regulations, but auditors focus more on compliance and risk assessment, while accountants concentrate on financial management and reporting.

Key Differences in Day-to-Day Tasks

Public Sector Auditors primarily focus on examining financial records and ensuring compliance with laws and regulations through systematic audits, while Public Sector Accountants handle the preparation, analysis, and reporting of government financial statements and budgets. Auditors conduct risk assessments, identify discrepancies, and verify accuracy to prevent fraud and inefficiency, whereas accountants manage payroll, fund allocation, and track public expenditures for transparency. The auditor's day-to-day involves investigative reviews and audit report creation, contrasted with the accountant's routine of financial data entry, reconciliation, and regulatory filing.

Reporting Structures and Accountability

Public Sector Auditors typically report to independent oversight bodies or legislative committees to ensure impartial evaluation of financial statements and compliance with laws. Public Sector Accountants generally report within internal government departments, managing financial transactions and preparing reports for departmental heads and regulatory agencies. Auditors maintain accountability through objective assessments, while accountants ensure accuracy and transparency in financial reporting for operational decision-making.

Impact on Public Sector Operations

Public Sector Auditors enhance public sector operations by ensuring transparency, accountability, and compliance with regulations, which strengthens public trust and reduces fraud. Public Sector Accountants contribute by managing and reporting financial resources accurately, enabling effective budgeting and resource allocation for public projects. Both roles are critical for maintaining financial integrity and optimizing operational efficiency within government agencies.

Ethical Standards and Compliance

Public Sector Auditors rigorously evaluate financial records and systems to ensure strict adherence to ethical standards and regulatory compliance, identifying irregularities and recommending corrective actions. Public Sector Accountants maintain accurate financial documentation and uphold integrity by following established accounting principles and government regulations to prevent fraud and mismanagement. Both roles are crucial in fostering transparency, accountability, and trust within public institutions by enforcing compliance with ethical guidelines and statutory requirements.

Career Progression and Opportunities

Public Sector Auditors often advance by gaining specialized expertise in compliance and risk assessment, leading to roles such as Audit Manager or Chief Compliance Officer. Public Sector Accountants progress through mastering governmental accounting standards, moving into positions like Financial Controller or Budget Director. Both careers offer opportunities in policy advising and senior management within government agencies.

Challenges Unique to Each Role

Public sector auditors face challenges such as ensuring compliance with complex regulations, detecting fraud, and maintaining independence during evaluations of government agencies. Public sector accountants struggle with budget constraints, accurate fund allocation, and creating transparent financial reports that align with public accountability standards. Both roles require adapting to evolving government policies and technological advancements impacting financial scrutiny and reporting.

Public Sector Auditor vs Public Sector Accountant Infographic

jobdiv.com

jobdiv.com