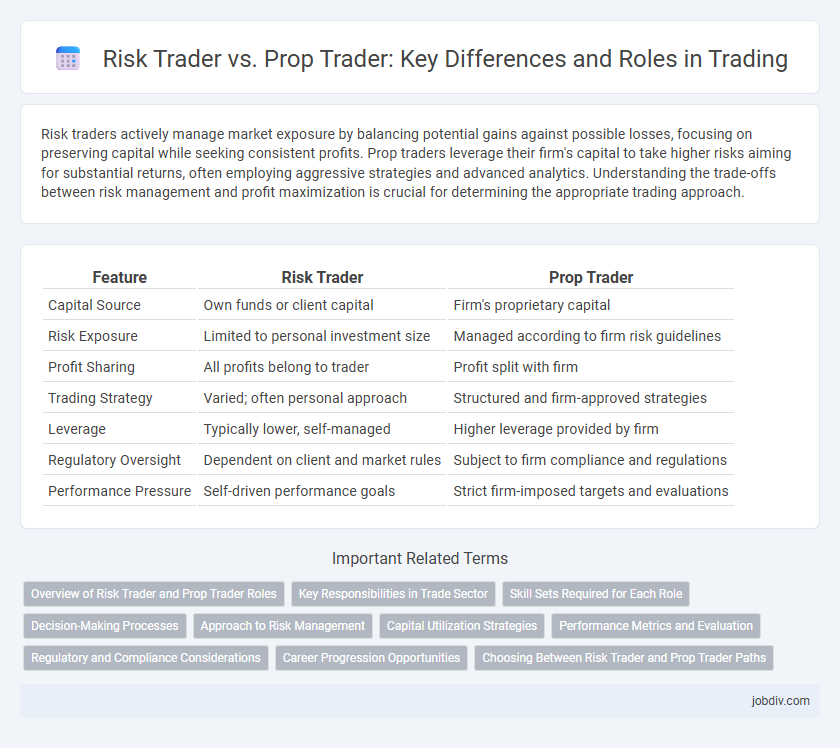

Risk traders actively manage market exposure by balancing potential gains against possible losses, focusing on preserving capital while seeking consistent profits. Prop traders leverage their firm's capital to take higher risks aiming for substantial returns, often employing aggressive strategies and advanced analytics. Understanding the trade-offs between risk management and profit maximization is crucial for determining the appropriate trading approach.

Table of Comparison

| Feature | Risk Trader | Prop Trader |

|---|---|---|

| Capital Source | Own funds or client capital | Firm's proprietary capital |

| Risk Exposure | Limited to personal investment size | Managed according to firm risk guidelines |

| Profit Sharing | All profits belong to trader | Profit split with firm |

| Trading Strategy | Varied; often personal approach | Structured and firm-approved strategies |

| Leverage | Typically lower, self-managed | Higher leverage provided by firm |

| Regulatory Oversight | Dependent on client and market rules | Subject to firm compliance and regulations |

| Performance Pressure | Self-driven performance goals | Strict firm-imposed targets and evaluations |

Overview of Risk Trader and Prop Trader Roles

Risk traders focus on managing and mitigating financial risks by monitoring market positions and ensuring adherence to risk limits while executing trades within those boundaries. Proprietary (prop) traders use the firm's capital to speculate on market movements, aiming to generate direct profits through strategic, high-risk, high-reward trading activities. Both roles require strong market analysis skills, but risk traders prioritize risk control and compliance, whereas prop traders emphasize profit generation and aggressive market exposure.

Key Responsibilities in Trade Sector

Risk traders primarily focus on identifying, measuring, and mitigating financial risks within trading portfolios, using quantitative models to ensure compliance with risk limits and regulatory requirements. Prop traders engage in proprietary trading by deploying firm capital to exploit market opportunities, making high-frequency trades based on market trends and price movements. While risk traders emphasize risk management and portfolio optimization, prop traders prioritize profit generation through speculative trading strategies within established risk guidelines.

Skill Sets Required for Each Role

Risk traders require advanced skills in risk assessment, quantitative analysis, and portfolio management to effectively mitigate losses and optimize returns under varying market conditions. Prop traders must excel in market research, technical analysis, and rapid decision-making to capitalize on short-term price movements and generate profits using proprietary capital. Both roles demand strong analytical abilities, discipline, and a deep understanding of financial instruments, but the emphasis differs with risk traders focusing on risk control and prop traders prioritizing aggressive trading strategies.

Decision-Making Processes

Risk traders evaluate market risks by analyzing volatility, liquidity, and potential portfolio exposure to make conservative trading decisions aimed at minimizing losses. Prop traders focus on exploiting market inefficiencies and price discrepancies through aggressive, high-conviction bets based on proprietary models and real-time data analysis. Decision-making for risk traders involves strict adherence to risk limits and regulatory compliance, whereas prop traders prioritize maximizing returns by tolerating higher risk levels and employing rapid, autonomous trade execution strategies.

Approach to Risk Management

Risk traders prioritize minimizing losses by closely monitoring market volatility and employing conservative stop-loss strategies to protect capital. Prop traders adopt a more aggressive risk management style, leveraging higher risk tolerance and sophisticated algorithms to capitalize on short-term market inefficiencies. Both approaches require continuous position sizing adjustments and rigorous stress testing to align with different trading objectives and risk appetites.

Capital Utilization Strategies

Risk traders employ capital utilization strategies focused on mitigating potential losses by diversifying portfolios and setting tight stop-loss limits to preserve assets. Prop traders maximize capital efficiency by leveraging firm capital to take larger, higher-risk positions aiming for significant returns, often using advanced algorithms and real-time market data analysis. Both strategies require dynamic risk assessment, but prop trading emphasizes aggressive capital deployment while risk trading prioritizes capital preservation.

Performance Metrics and Evaluation

Risk traders are evaluated based on their ability to manage and mitigate financial risks while maintaining portfolio stability, with key performance metrics including Value at Risk (VaR), drawdowns, and Sharpe ratios. Prop traders focus on maximizing returns through proprietary capital deployment, emphasizing metrics such as return on equity (ROE), profit per trade, and win-loss ratios. Performance evaluation for both roles involves assessing risk-adjusted returns, with risk traders prioritizing downside protection and prop traders targeting aggressive growth strategies.

Regulatory and Compliance Considerations

Risk traders must adhere strictly to regulatory frameworks such as Dodd-Frank in the U.S. and MiFID II in Europe, ensuring transparent reporting and compliance with risk limits imposed by their firms and authorities. Proprietary traders often face distinct regulatory scrutiny focused on capital requirements and market conduct rules, as they trade the firm's own capital rather than client funds. Both roles require rigorous compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations to mitigate operational and legal risks.

Career Progression Opportunities

Risk traders typically advance by mastering risk management techniques and gaining expertise in regulatory compliance, often progressing toward senior risk officer roles or portfolio manager positions. Prop traders focus on developing proprietary strategies and generating consistent profits, which can lead to opportunities as senior traders, trading desk heads, or even starting their own trading firms. Career progression for risk traders emphasizes stability and risk control, while prop traders advance through performance-driven recognition and entrepreneurial growth within financial institutions.

Choosing Between Risk Trader and Prop Trader Paths

Choosing between a risk trader and a prop trader path depends on risk tolerance and capital allocation preferences. Risk traders manage client funds or institutional capital with strict risk limits and regulatory compliance, emphasizing risk-adjusted returns. Prop traders use firm capital to take proprietary positions, often allowing greater flexibility, higher potential profits, but increased exposure to market volatility.

Risk Trader vs Prop Trader Infographic

jobdiv.com

jobdiv.com